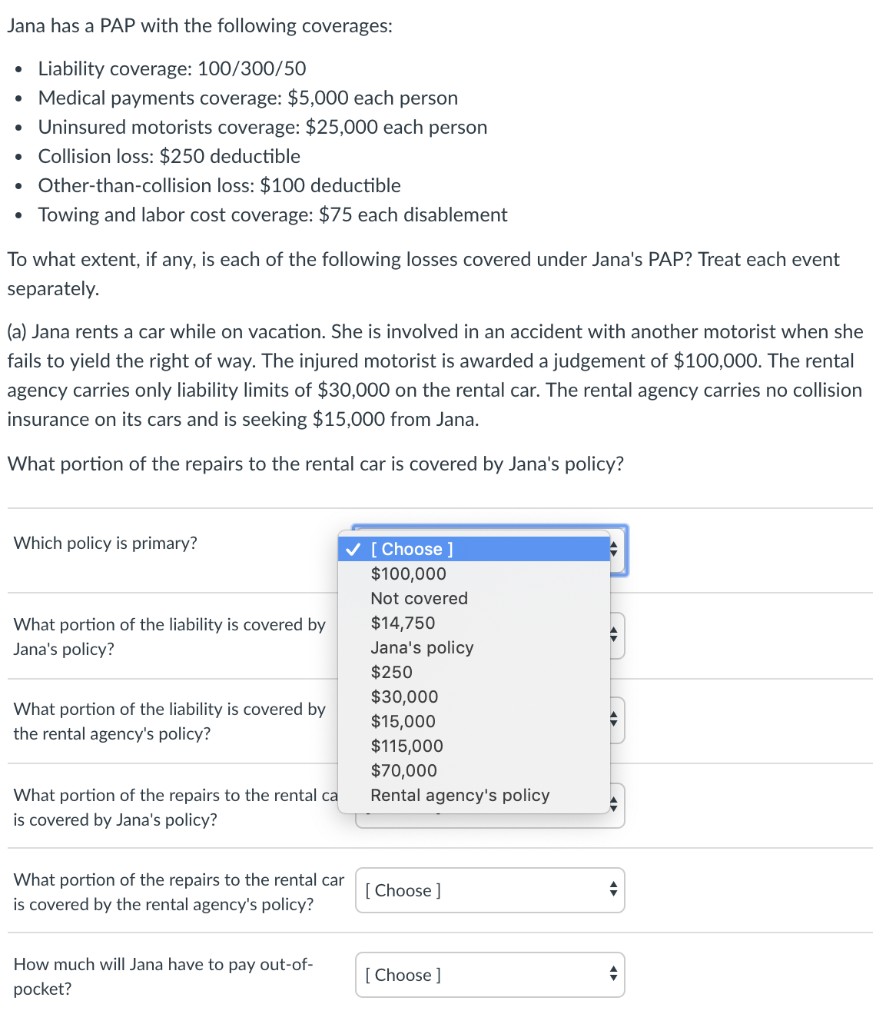

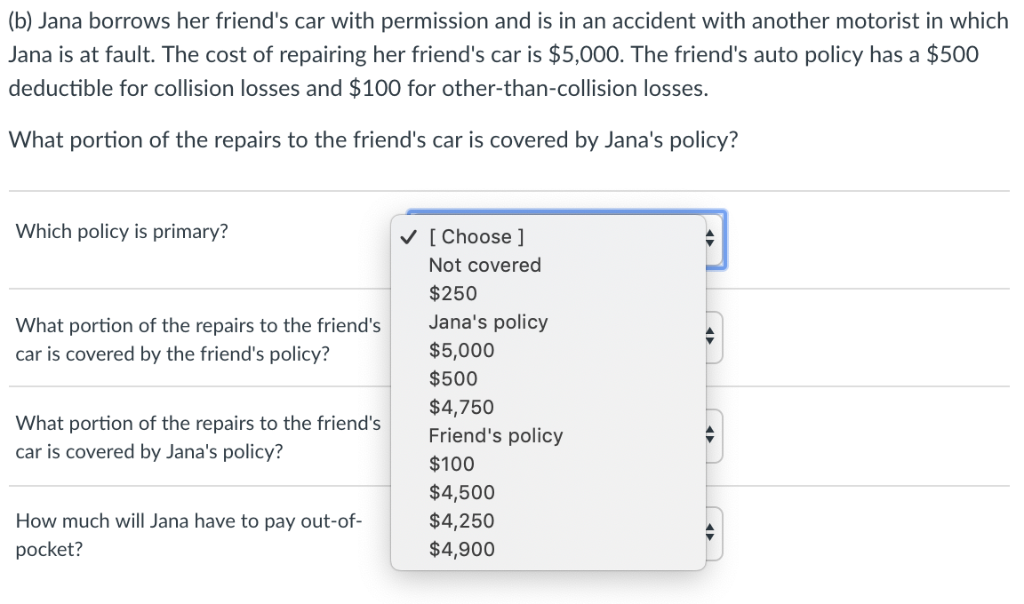

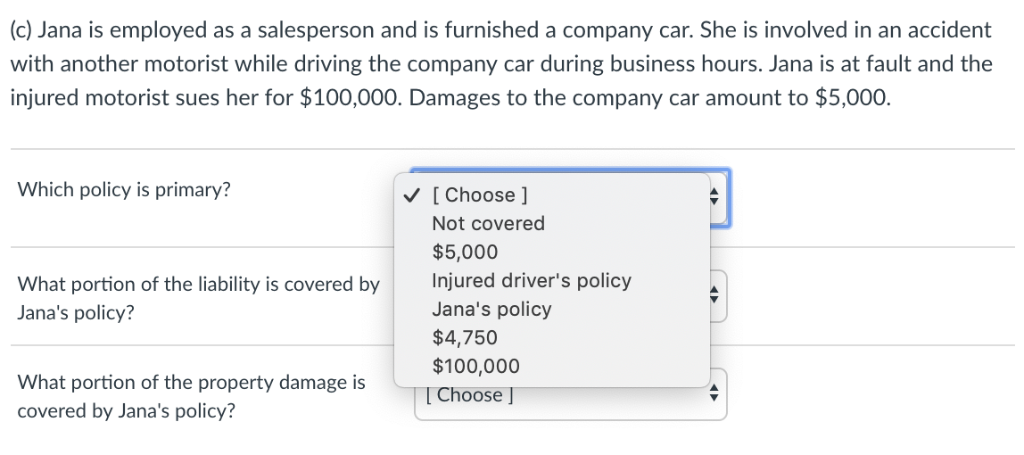

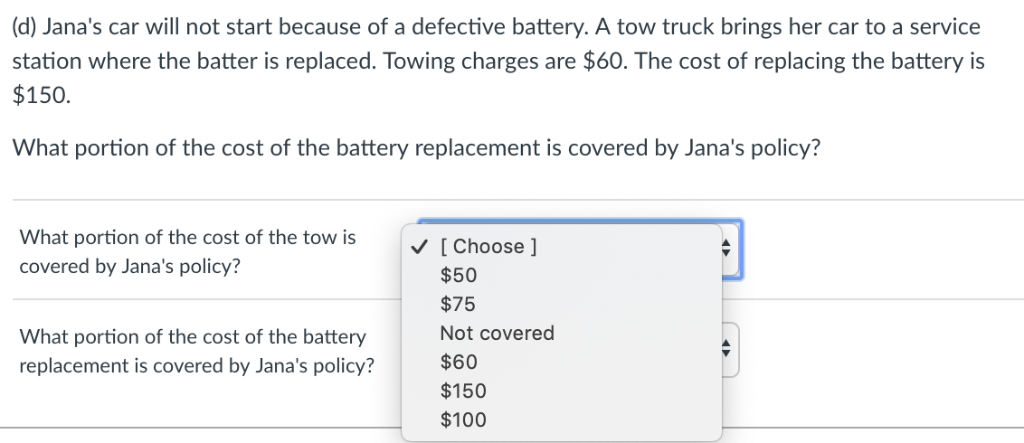

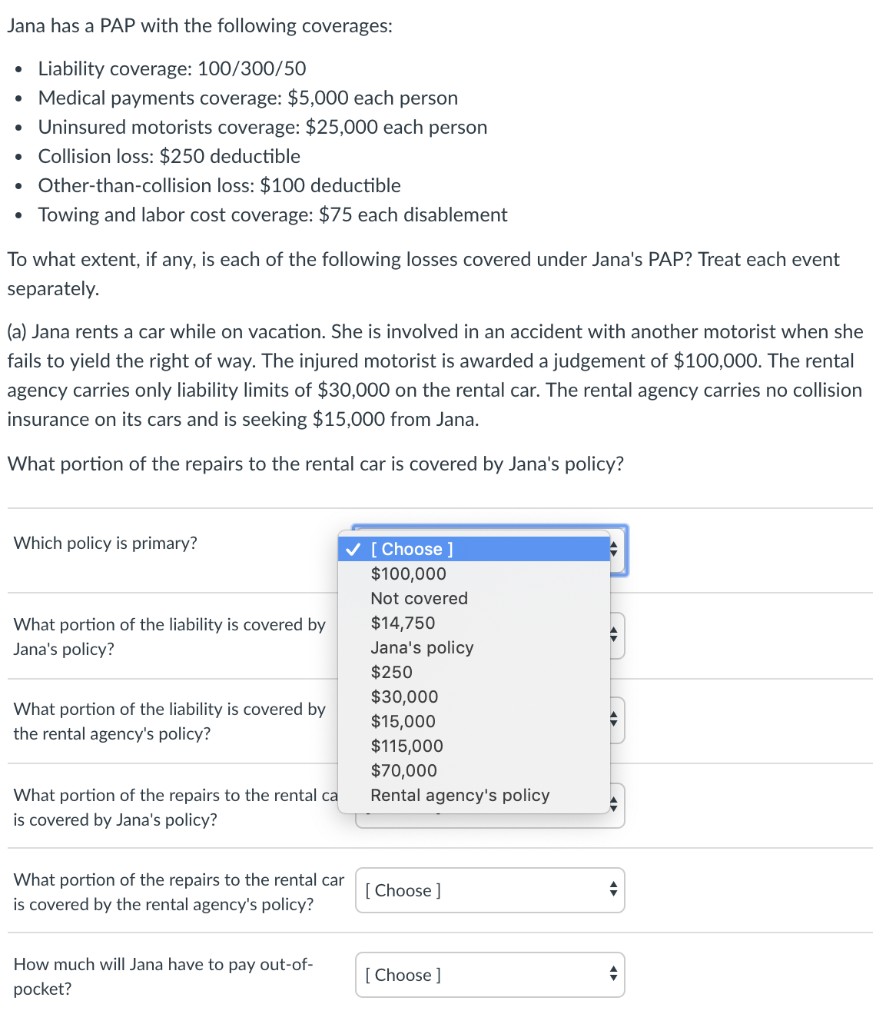

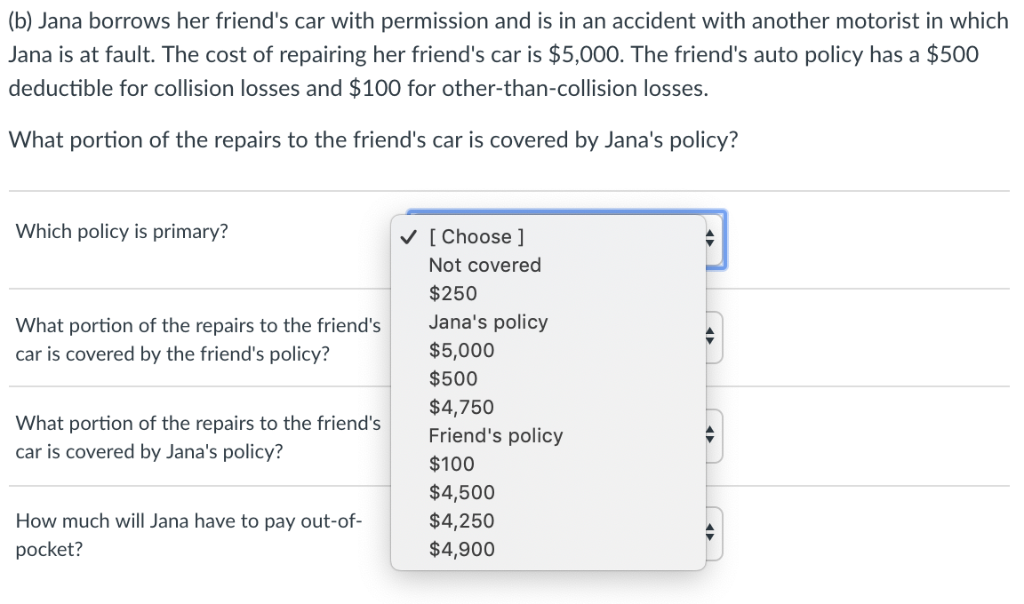

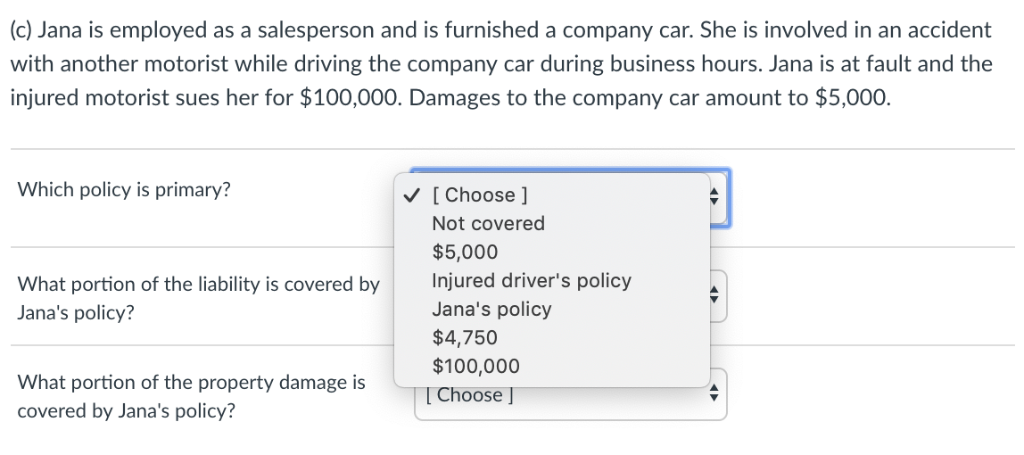

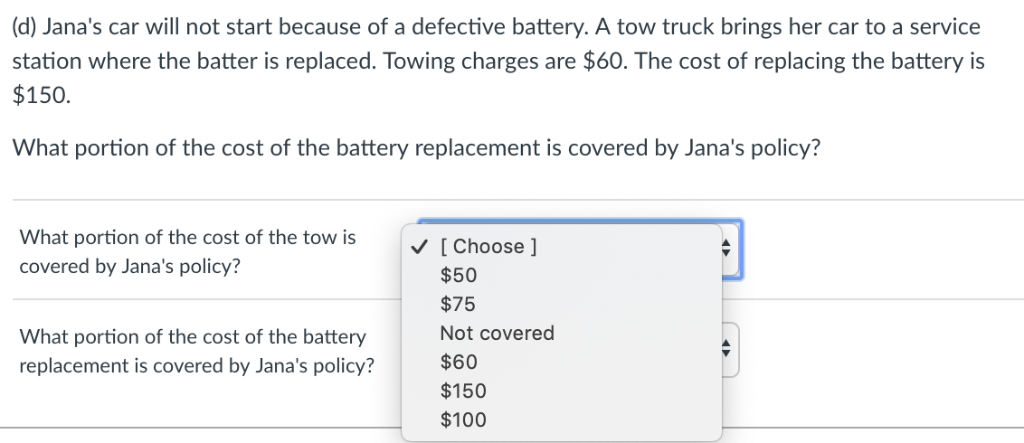

Jana has a PAP with the following coverages Liability coverage: 100/300/50 Medical payments coverage: $5,000 each person Uninsured motorists coverage: $25,000 each person Collision loss: $250 deductible Other-than-collision loss: $100 deductible Towing and labor cost coverage: $75 each disablement To what extent, if any, is each of the following losses covered under Jana's PAP? Treat each event separately (a) Jana rents a car while on vacation. She is involved in an accident with another motorist when she fails to yield the right of way. The injured motorist is awarded a judgement of $100,000. The rental agency carries only liability limits of $30,000 on the rental car. The rental agency carries no collision insurance on its cars and is seeking $15,000 from Jana. What portion of the repairs to the rental car is covered by Jana's policy? Which policy is primary? [Choose ] $100,000 Not covered $14,750 Jana's policy $250 $30,000 $15,000 $115,000 $70,000 Rental agency's policy What portion of the liability is covered by Jana's policy? What portion of the liability is covered by the rental agency's policy? What portion of the repairs to the rental ca is covered by Jana's policy? What portion of the repairs to the rental car is covered by the rental agency's policy? car [Choose How much will Jana have to pay out-of- pocket? Choose ] (c) Jana is employed as a salesperson and is furnished a company car. She is involved in an accident with another motorist while driving the company car during business hours. Jana is at fault and the injured motorist sues her for $100,000. Damages to the company car amount to $5,000. Which policy is primary? [ Choose] Not covered $5,000 Injured driver's policy Jana's policy $4,750 $100,000 lChoose ] What portion of the liability is covered by Jana's policy? What portion of the property damage is covered by Jana's policy? (d) Jana's car will not start because of a defective battery. A tow truck brings her car to a service station where the batter is replaced. Towing charges are $60. The cost of replacing the battery is $150. What portion of the cost of the battery replacement is covered by Jana's policy? What portion of the cost of the tow is covered by Jana's policy? V [Choose ] $50 $75 Not covered $60 $150 $100 What portion of the cost of the battery replacement is covered by Jana's policy? Jana has a PAP with the following coverages Liability coverage: 100/300/50 Medical payments coverage: $5,000 each person Uninsured motorists coverage: $25,000 each person Collision loss: $250 deductible Other-than-collision loss: $100 deductible Towing and labor cost coverage: $75 each disablement To what extent, if any, is each of the following losses covered under Jana's PAP? Treat each event separately (a) Jana rents a car while on vacation. She is involved in an accident with another motorist when she fails to yield the right of way. The injured motorist is awarded a judgement of $100,000. The rental agency carries only liability limits of $30,000 on the rental car. The rental agency carries no collision insurance on its cars and is seeking $15,000 from Jana. What portion of the repairs to the rental car is covered by Jana's policy? Which policy is primary? [Choose ] $100,000 Not covered $14,750 Jana's policy $250 $30,000 $15,000 $115,000 $70,000 Rental agency's policy What portion of the liability is covered by Jana's policy? What portion of the liability is covered by the rental agency's policy? What portion of the repairs to the rental ca is covered by Jana's policy? What portion of the repairs to the rental car is covered by the rental agency's policy? car [Choose How much will Jana have to pay out-of- pocket? Choose ] (c) Jana is employed as a salesperson and is furnished a company car. She is involved in an accident with another motorist while driving the company car during business hours. Jana is at fault and the injured motorist sues her for $100,000. Damages to the company car amount to $5,000. Which policy is primary? [ Choose] Not covered $5,000 Injured driver's policy Jana's policy $4,750 $100,000 lChoose ] What portion of the liability is covered by Jana's policy? What portion of the property damage is covered by Jana's policy? (d) Jana's car will not start because of a defective battery. A tow truck brings her car to a service station where the batter is replaced. Towing charges are $60. The cost of replacing the battery is $150. What portion of the cost of the battery replacement is covered by Jana's policy? What portion of the cost of the tow is covered by Jana's policy? V [Choose ] $50 $75 Not covered $60 $150 $100 What portion of the cost of the battery replacement is covered by Jana's policy