Question

Jane and Ben are married and usually file a joint return. They live in a separate property state (rather than a community property state). Jane

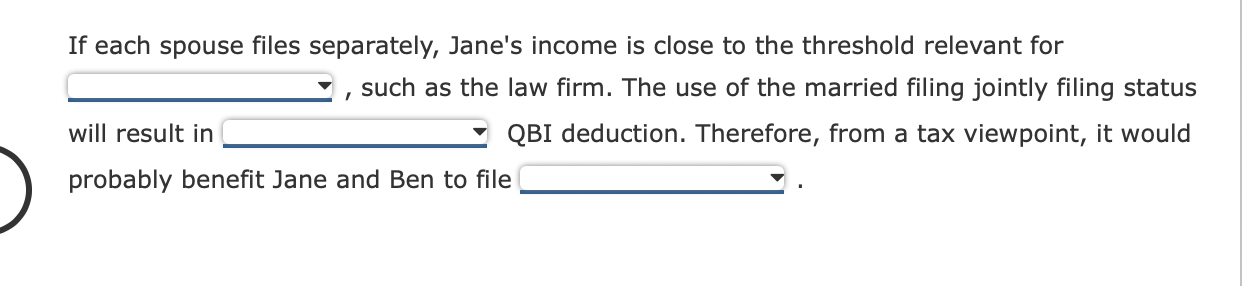

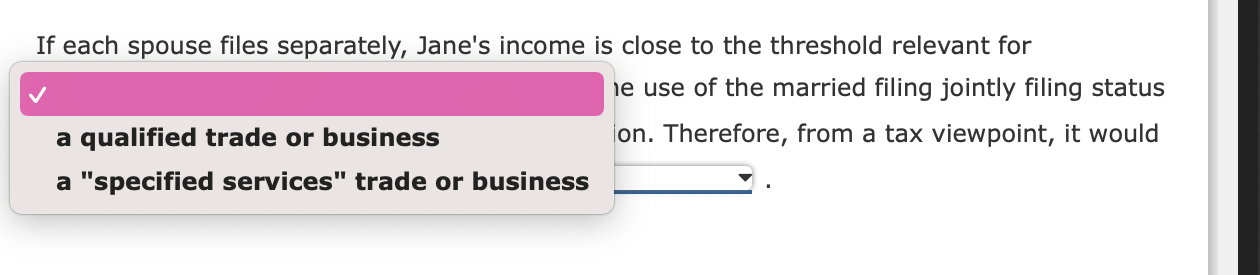

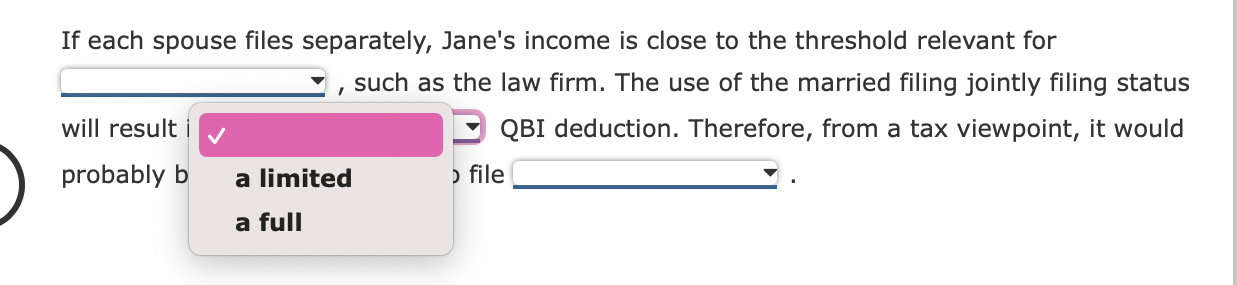

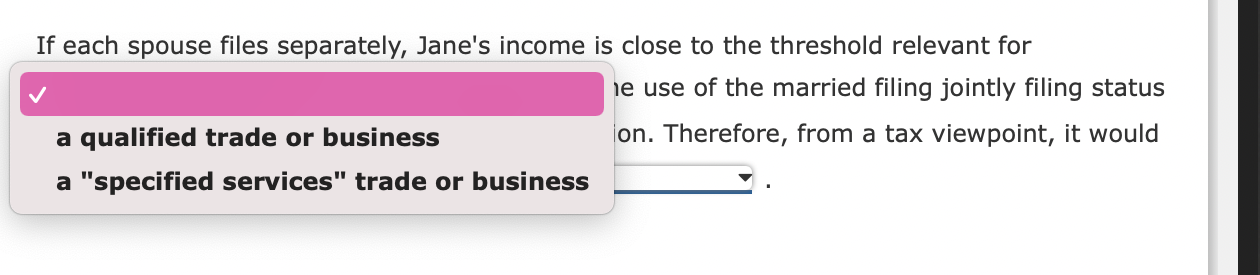

Jane and Ben are married and usually file a joint return. They live in a separate property state (rather than a community property state). Jane is a partner in a law firm and typically generates income of $162,000. Ben is a grade school teacher with wage income of $75,000. The couple has investment income that is less than their standard deduction. With enactment of the deduction for qualified business income, the couple is wondering if they should continue to file as married filing jointly or instead use the married filing separately status.

Why do they wonder this, and what advice would you offer them and why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started