Question

Jane and Drew are concerned about their family debt load. They are both 35 years old with young children. They have no money left at

Jane and Drew are concerned about their family debt load. They are both 35 years old with young children. They have no money left at the end of each month. In fact, some months they have to borrow to make ends meet. They would like to reduce the burden of their debt but they do not want to reduce their standard of living.

Jane and Drew are concerned about their family debt load. They are both 35 years old with young children. They have no money left at the end of each month. In fact, some months they have to borrow to make ends meet. They would like to reduce the burden of their debt but they do not want to reduce their standard of living.

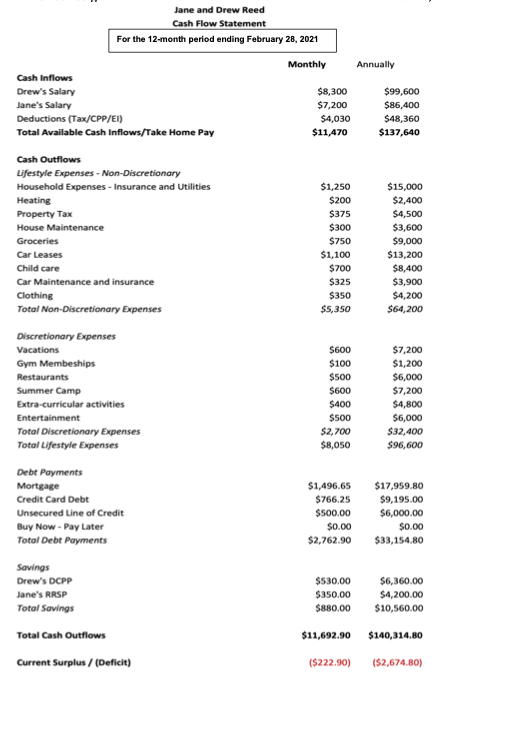

Jane is a Manager at a communications firm recently engaged by the Ontario government in its communications initiatives associated with the current Covid-19 vaccinations. She is able to work from home and earns $86,400 per year. She does not have a pension plan with her employer but they do provide her with health benefits for her and the family. Drew is a sales rep for a food company (and is continuing to work during COVID-19 as his company has been deemed an essential service). He earns $99,600 per year and his company has a Group Registered Retirement Savings Plan.

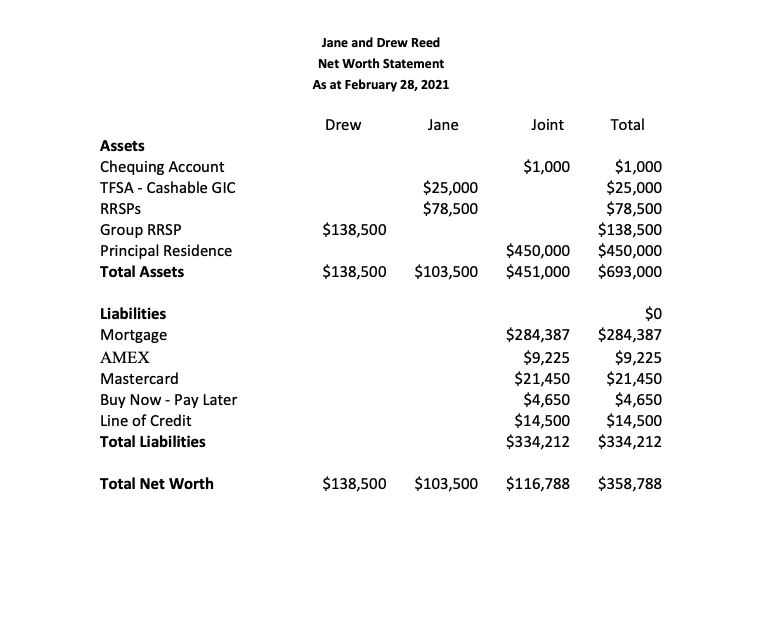

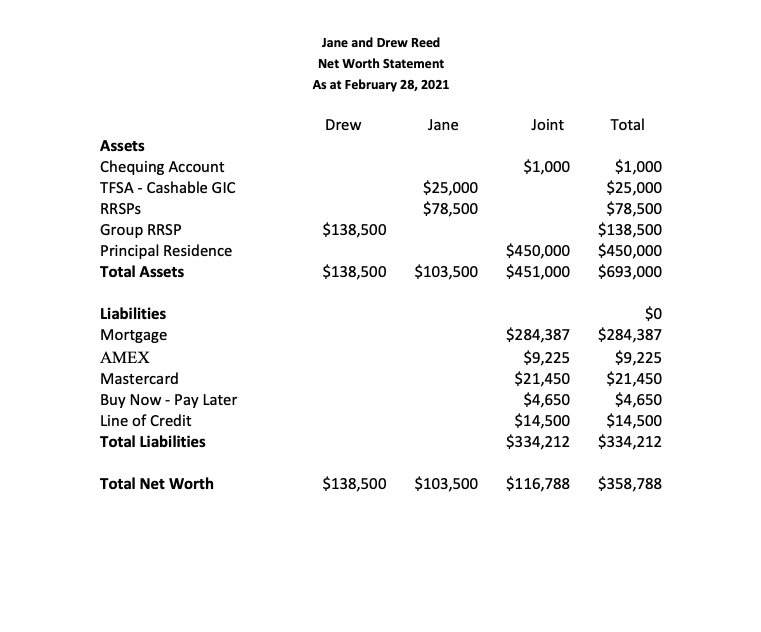

Jane and Drew have a chequing account with $1,000 in it and Jane has $25,000 in a TFSA account invested in a cashable GIC. This investment earns an annual interest of 1%. They use this as an emergency fund.

Their mortgage on the house is their largest debt, at $284,387. They make bi-weekly payments of $690.76. They purchased the house two years ago for $400,000 and their mortgage at that time was $300,000. They amortized this loan over 25 years. At that time, they took on a 3-year closed mortgage at 3.5%. They believed that interest rates were going to fall over the short term and did not want to lock into a rate for longer. Currently, a 5-year closed fixed-rate mortgage is 3.1% and a 5-year closed variable rate mortgage is 2.9%. An unsecured loan can be obtained with a fixed rate of 8%.

Jane and Drew's other Debts:

- An unsecured line of credit at a rate of 7% per year, which they used to cover expenses as needed. The current balance is $14,500. They are currently paying $500 per month on average against this debt. They are frustrated because every time they pay down some of this debt, another expense comes up and then the balance creeps back up. The credit limit on this line of credit is $15,000.

- AMEX balance of $9,225 at an annual interest rate of 19%. They are currently making minimum payments of $230 on average each month. The AMEX card has a limit of $10,000.

- Scotiabank Mastercard balance of $21,450. The credit limit is $24,000 and the annual rate of interest is 19.99%. They have been making minimum payments of $536.25 on average each month.

- They have two car leases that will be expiring next year. They pay a total of $1,100 per month for the two leases. They like leasing because they enjoy having a new car every 3 years. They believe that this is the best strategy as their vehicles are always covered by warranty and they don't have to pay for any maintenance.

- Leon's Buy Now - Pay Later loan that was used to purchase new furniture 18 months ago. The balance of $4,650 is due in 6-months from today. If the loan is not repaid by the due date, the financing terms will result in the application of interest charges retroactively to the loan date at an annual rate of 24%.

Needs to be done:

Step 1: Prepare all of the financial ratios AND comment

Step 2: Calculate the Clients' Total Debt including AND excluding the mortgage (i.e. 2 calculations)

Step 3: Methods of saving money/interest by either debt consolidation or a fixed-rate loan:

a) Debt Consolidation

- - Consider equity in the home

- - Penalties for refinancing before end of term

- - Total Mortgage amount needed to effect savings

- b) Compare new and old mortgage payments

c) Compare savings/costs of debt consolidation to a fixed-rate loan

Step 4: Identify the Benefits and Drawbacks of your recommended approach to debt

management (e.g. consolidation through a new mortgage or fixed-rate loan).

Step 5: Identify any other options that may be available to Drew and Jane.

Please see the picture also.

Jane and Drew Reed Net Worth Statement As at February 28, 2021 Drew Jane Joint Total $1,000 Assets Chequing Account TESA - Cashable GIC RRSPS Group RRSP Principal Residence Total Assets $25,000 $78,500 $1,000 $25,000 $78,500 $138,500 $450,000 $693,000 $138,500 $450,000 $451,000 $138,500 $103,500 Liabilities Mortgage AMEX Mastercard Buy Now - Pay Later Line of Credit Total Liabilities $284,387 $9,225 $21,450 $4,650 $14,500 $334,212 $0 $284,387 $9,225 $21,450 $4,650 $14,500 $334,212 Total Net Worth $138,500 $103,500 $116,788 $358,788 Jane and Drew Reed Net Worth Statement As at February 28, 2021 Drew Jane Joint Total $1,000 Assets Chequing Account TESA - Cashable GIC RRSPS Group RRSP Principal Residence Total Assets $25,000 $78,500 $1,000 $25,000 $78,500 $138,500 $450,000 $693,000 $138,500 $450,000 $451,000 $138,500 $103,500 Liabilities Mortgage AMEX Mastercard Buy Now - Pay Later Line of Credit Total Liabilities $284,387 $9,225 $21,450 $4,650 $14,500 $334,212 $0 $284,387 $9,225 $21,450 $4,650 $14,500 $334,212 Total Net Worth $138,500 $103,500 $116,788 $358,788 Annually Jane and Drew Reed Cash Flow Statement For the 12-month period ending February 28, 2021 Monthly Cash Inflows Drew's Salary $8,300 Jane's Salary $7,200 Deductions (Tax/CPP/EI) $4,030 Total Available Cash Inflows/Take Home Pay $11,470 $99,600 $86,400 $48,360 $137,640 $1,250 $200 $375 $300 $750 $1,100 $700 $325 $350 $5,350 $15,000 $2,400 $4,500 $3,600 $9,000 $13,200 $8,400 $3,900 $4,200 $64,200 Cash Outflows Lifestyle Expenses - Non-Discretionary Household Expenses - Insurance and Utilities Heating Property Tax House Maintenance Groceries Car Leases Child care Car Maintenance and insurance Clothing Total Non-Discretionary Expenses Discretionary Expenses Vacations Gym Membeships Restaurants Summer Camp Extra-curricular activities Entertainment Total Discretionary Expenses Total Lifestyle Expenses Debt Payments Mortgage Credit Card Debt Unsecured Line of Credit Buy Now - Pay Later Total Debt Payments $600 $100 $500 $600 $400 $500 $2,700 $8,050 $7,200 $1,200 $6,000 $7,200 $4,800 $6,000 $32,400 $96,600 $1,496.65 $766.25 $500.00 $0.00 $2,762.90 $17,959.80 $9,195.00 $6,000.00 $0.00 $33,154.80 $530.00 $350.00 $880.00 $6,360.00 $4,200.00 $10,560.00 Savings Drew's DCPP Jane's RRSP Total Savings Total Cash Outflows Current Surplus / (Deficit) $11,692.90 $140,314.80 ($222.90) ($2,674.80) Jane and Drew Reed Net Worth Statement As at February 28, 2021 Drew Jane Joint Total $1,000 Assets Chequing Account TESA - Cashable GIC RRSPS Group RRSP Principal Residence Total Assets $25,000 $78,500 $1,000 $25,000 $78,500 $138,500 $450,000 $693,000 $138,500 $450,000 $451,000 $138,500 $103,500 Liabilities Mortgage AMEX Mastercard Buy Now - Pay Later Line of Credit Total Liabilities $284,387 $9,225 $21,450 $4,650 $14,500 $334,212 $0 $284,387 $9,225 $21,450 $4,650 $14,500 $334,212 Total Net Worth $138,500 $103,500 $116,788 $358,788 Jane and Drew Reed Net Worth Statement As at February 28, 2021 Drew Jane Joint Total $1,000 Assets Chequing Account TESA - Cashable GIC RRSPS Group RRSP Principal Residence Total Assets $25,000 $78,500 $1,000 $25,000 $78,500 $138,500 $450,000 $693,000 $138,500 $450,000 $451,000 $138,500 $103,500 Liabilities Mortgage AMEX Mastercard Buy Now - Pay Later Line of Credit Total Liabilities $284,387 $9,225 $21,450 $4,650 $14,500 $334,212 $0 $284,387 $9,225 $21,450 $4,650 $14,500 $334,212 Total Net Worth $138,500 $103,500 $116,788 $358,788 Annually Jane and Drew Reed Cash Flow Statement For the 12-month period ending February 28, 2021 Monthly Cash Inflows Drew's Salary $8,300 Jane's Salary $7,200 Deductions (Tax/CPP/EI) $4,030 Total Available Cash Inflows/Take Home Pay $11,470 $99,600 $86,400 $48,360 $137,640 $1,250 $200 $375 $300 $750 $1,100 $700 $325 $350 $5,350 $15,000 $2,400 $4,500 $3,600 $9,000 $13,200 $8,400 $3,900 $4,200 $64,200 Cash Outflows Lifestyle Expenses - Non-Discretionary Household Expenses - Insurance and Utilities Heating Property Tax House Maintenance Groceries Car Leases Child care Car Maintenance and insurance Clothing Total Non-Discretionary Expenses Discretionary Expenses Vacations Gym Membeships Restaurants Summer Camp Extra-curricular activities Entertainment Total Discretionary Expenses Total Lifestyle Expenses Debt Payments Mortgage Credit Card Debt Unsecured Line of Credit Buy Now - Pay Later Total Debt Payments $600 $100 $500 $600 $400 $500 $2,700 $8,050 $7,200 $1,200 $6,000 $7,200 $4,800 $6,000 $32,400 $96,600 $1,496.65 $766.25 $500.00 $0.00 $2,762.90 $17,959.80 $9,195.00 $6,000.00 $0.00 $33,154.80 $530.00 $350.00 $880.00 $6,360.00 $4,200.00 $10,560.00 Savings Drew's DCPP Jane's RRSP Total Savings Total Cash Outflows Current Surplus / (Deficit) $11,692.90 $140,314.80 ($222.90) ($2,674.80)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started