Answered step by step

Verified Expert Solution

Question

1 Approved Answer

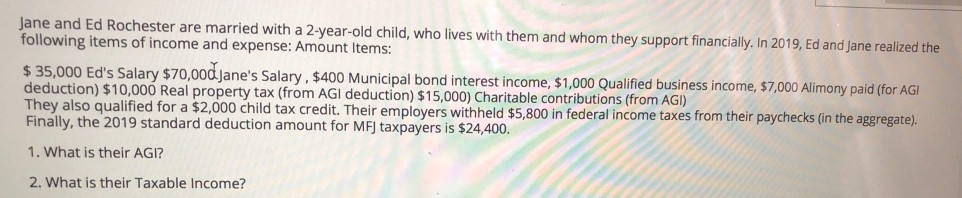

Jane and Ed Rochester are married with a 2-year-old child, who lives with them and whom they support financially. In 2019, Ed and Jane realized

Jane and Ed Rochester are married with a 2-year-old child, who lives with them and whom they support financially. In 2019, Ed and Jane realized the following items of income and expense: Amount Items: $ 35,000 Ed's Salary $70,000 Jane's Salary, $400 Municipal bond interest income, $1,000 Qualified business income, $7,000 Alimony paid (for AGI deduction) $10,000 Real property tax (from AGI deduction) $15,000) Charitable contributions (from AGI) They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2019 standard deduction amount for MFJ taxpayers is $24,400. 1. What is their AGI? 2. What is their Taxable income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started