Answered step by step

Verified Expert Solution

Question

1 Approved Answer

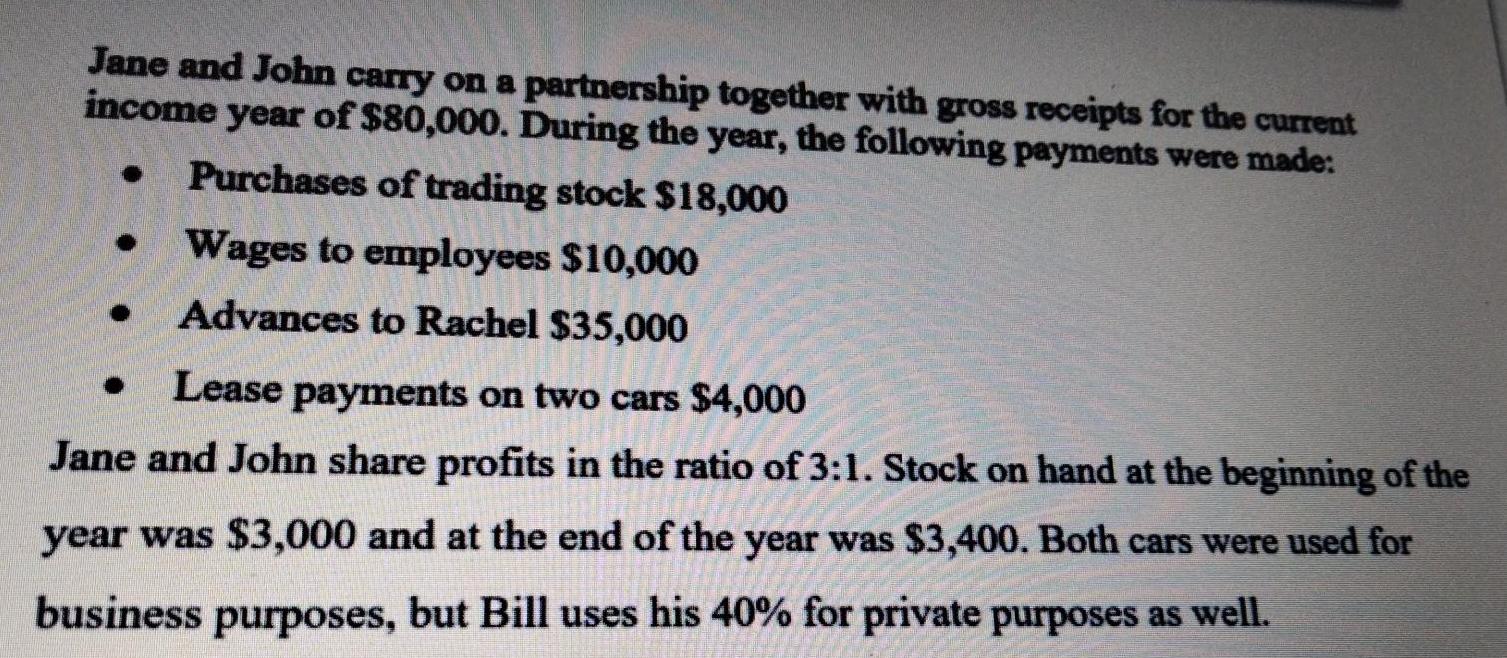

Jane and John carry on a partnership together with gross receipts for the current income year of $80,000. During the year, the following payments

Jane and John carry on a partnership together with gross receipts for the current income year of $80,000. During the year, the following payments were made: Purchases of trading stock $18,000 Wages to employees $10,000 Advances to Rachel $35,000 Lease payments on two cars $4,000 Jane and John share profits in the ratio of 3:1. Stock on hand at the beginning of the year was $3,000 and at the end of the year was $3,400. Both cars were used for business purposes, but Bill uses his 40% for private purposes as well. th cars were business purposes, but Bill uses his 40% for private purposes as well. 024 Calculate the net income of the partnership and the assessable income of the partners. (10 marks) H E B i A- X, X

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Pl Alc Crvoss receipts 80000 Beginning stoake 3000 3400 Endin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started