Answered step by step

Verified Expert Solution

Question

1 Approved Answer

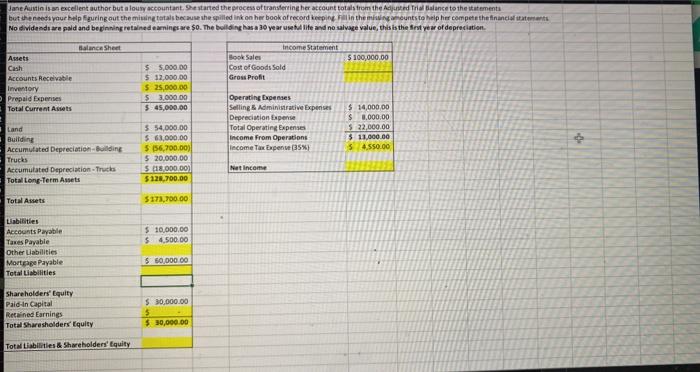

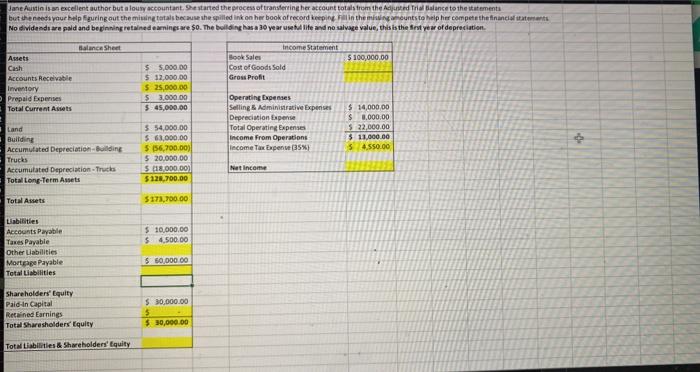

Jane Austin is an excellent author but alousy accountant. Se started the process of transferring her account totals from the Adjusted Trial Balance to the

Jane Austin is an excellent author but alousy accountant. Se started the process of transferring her account totals from the Adjusted Trial Balance to the statements but the needs your help figuring out the missing total because she spilled ink on her book of record keeping in the main amounts to help her compete the financial statement No dividends are paid and beginning retained earnings are $0. The building has a 30 year useful life and no salvage value, this is the first year of depreciation Balance Sheet Income Statement Book Sales $ 100,000.00 Cost of Goods Sold Gross Profit Amets Cash Accounts Receivable Inventory Prepaid Expenses Total Current Assets $ 5.000.00 $ 12,000.00 $ 25,000.00 53.000.00 $ 45,000.00 Operating Expenses Selling & Administrative Expenses Depreciation Expense Total Operating Expenses Income From Operations Income Tax bene! $ 14,000.00 $ 8.000.00 $ 22,000.00 $ 11,000.00 54.550.00 Land Building Accumulated Depreciation Building Trucks Accumulated Depreciation Trucks Total Long Term Assets 5.54,000.00 $ 63,000.00 5 156,700.00) $ 20,000.00 5.418 000.00) $128.700.00 Net Income Total Assets 5173,700.00 $ 10,000.00 $ 4.500.00 Liabilities Accounts Payable Taves Payable Other Liabilities Mortgage Payable Total Liabilities $ 50.000.00 Shareholders' Equity Pald-in Capital Retained Earnings Total Sharesholders Equity $ 30,000.00 5 $ 30,000.00 Tot Liabilities & Shweholders' Equity

Jane Austin is an excellent author but alousy accountant. Se started the process of transferring her account totals from the Adjusted Trial Balance to the statements but the needs your help figuring out the missing total because she spilled ink on her book of record keeping in the main amounts to help her compete the financial statement No dividends are paid and beginning retained earnings are $0. The building has a 30 year useful life and no salvage value, this is the first year of depreciation Balance Sheet Income Statement Book Sales $ 100,000.00 Cost of Goods Sold Gross Profit Amets Cash Accounts Receivable Inventory Prepaid Expenses Total Current Assets $ 5.000.00 $ 12,000.00 $ 25,000.00 53.000.00 $ 45,000.00 Operating Expenses Selling & Administrative Expenses Depreciation Expense Total Operating Expenses Income From Operations Income Tax bene! $ 14,000.00 $ 8.000.00 $ 22,000.00 $ 11,000.00 54.550.00 Land Building Accumulated Depreciation Building Trucks Accumulated Depreciation Trucks Total Long Term Assets 5.54,000.00 $ 63,000.00 5 156,700.00) $ 20,000.00 5.418 000.00) $128.700.00 Net Income Total Assets 5173,700.00 $ 10,000.00 $ 4.500.00 Liabilities Accounts Payable Taves Payable Other Liabilities Mortgage Payable Total Liabilities $ 50.000.00 Shareholders' Equity Pald-in Capital Retained Earnings Total Sharesholders Equity $ 30,000.00 5 $ 30,000.00 Tot Liabilities & Shweholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started