Answered step by step

Verified Expert Solution

Question

1 Approved Answer

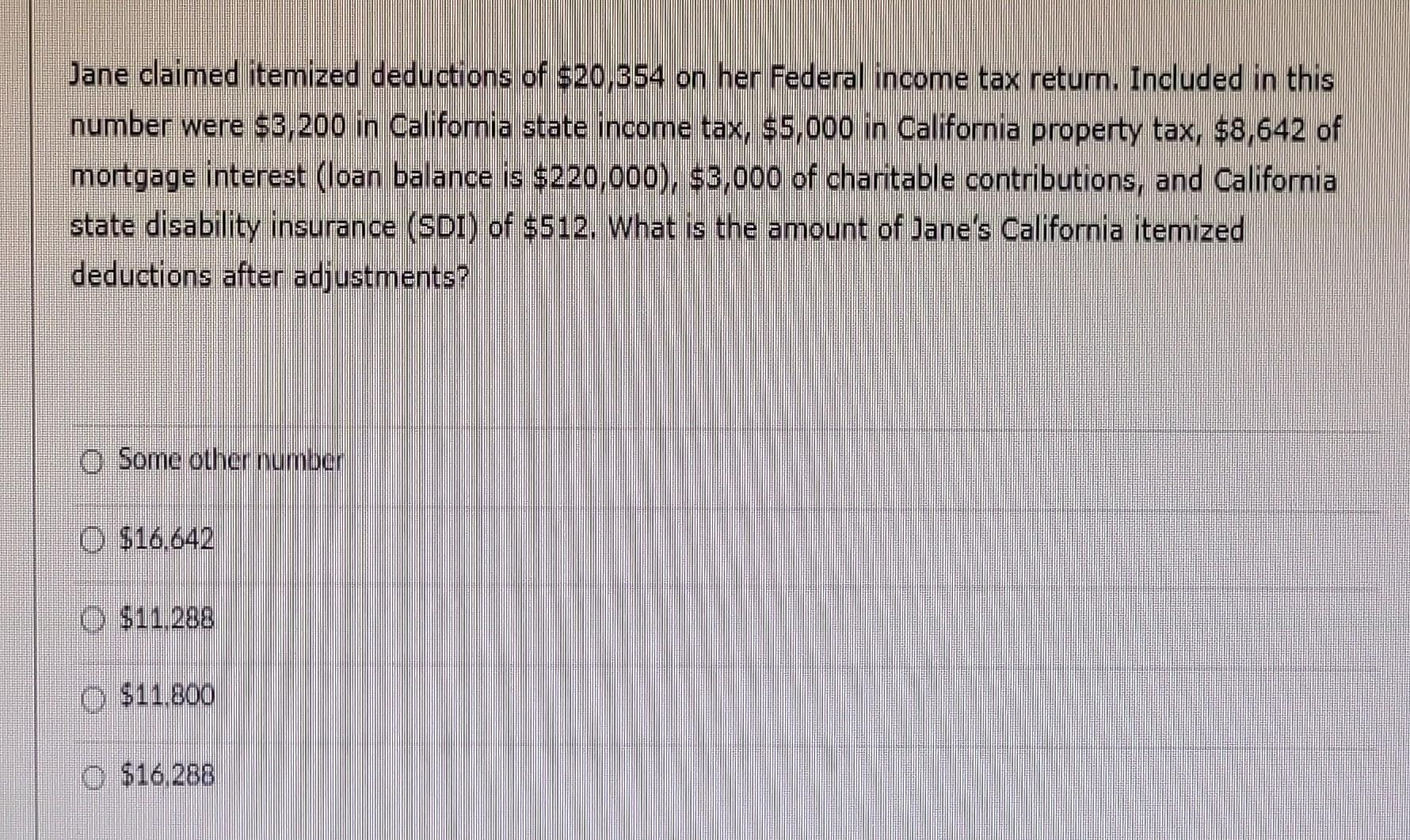

Jane claimed itemized deductions of $20,354 on her Federal income tax return. Included in this number were $3,200 in California state income tax, $5,000 in

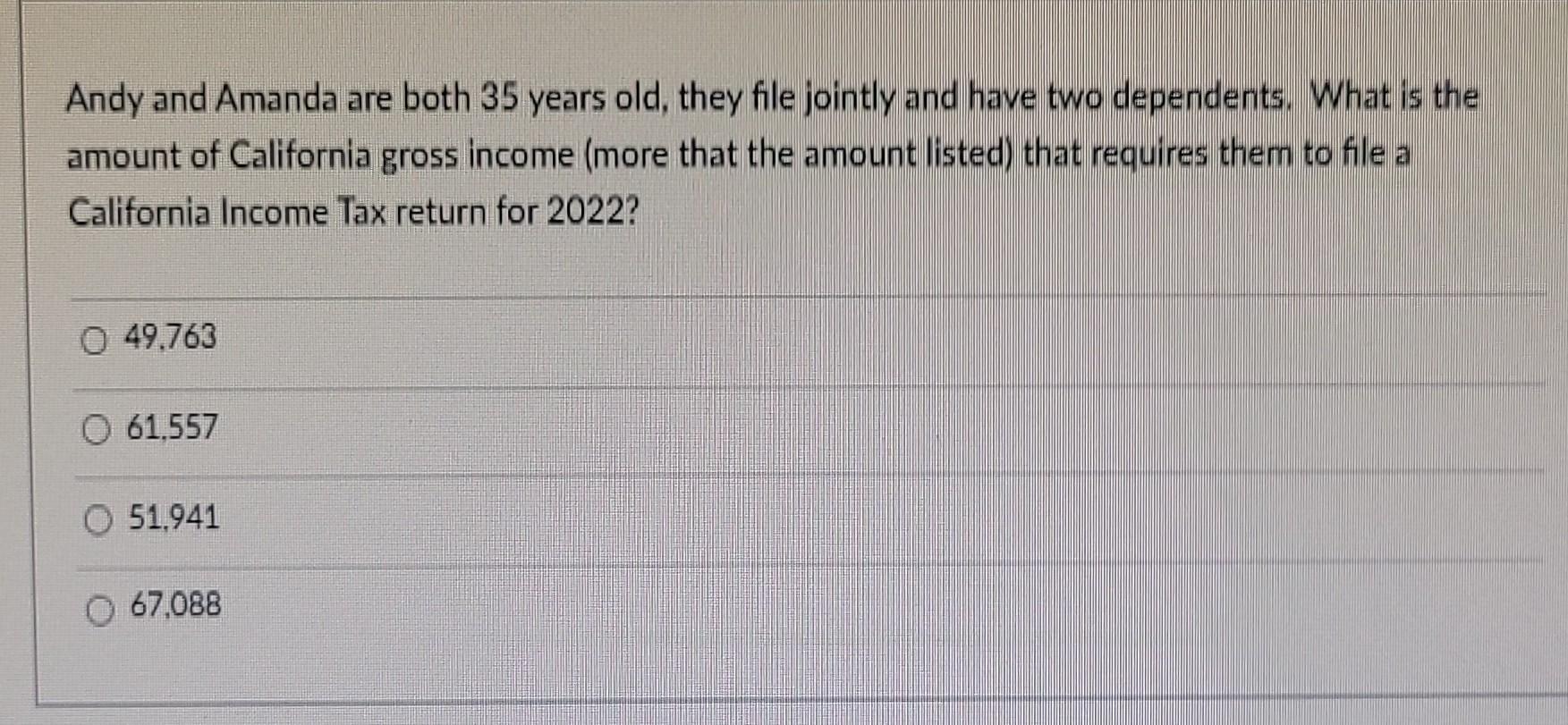

Jane claimed itemized deductions of $20,354 on her Federal income tax return. Included in this number were $3,200 in California state income tax, $5,000 in California property tax, $8,642 of mortgage interest (loan balance is $220,000 ), $3,000 of charitable contributions, and California state disability insurance (SDI) of \$512, What is the amount of Jane's California itemized deductions after adjustments? Some other number $16,642 $11,288 $11,800 $16.288 Andy and Amanda are both 35 years old, they file jointly and have two dependents. What is the amount of California gross income (more that the amount listed) that requires them to file a California Income Tax return for 2022 ? 49,763 61,557 51,941 67,088 Jane claimed itemized deductions of $20,354 on her Federal income tax return. Included in this number were $3,200 in California state income tax, $5,000 in California property tax, $8,642 of mortgage interest (loan balance is $220,000 ), $3,000 of charitable contributions, and California state disability insurance (SDI) of \$512, What is the amount of Jane's California itemized deductions after adjustments? Some other number $16,642 $11,288 $11,800 $16.288 Andy and Amanda are both 35 years old, they file jointly and have two dependents. What is the amount of California gross income (more that the amount listed) that requires them to file a California Income Tax return for 2022 ? 49,763 61,557 51,941 67,088

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started