Answered step by step

Verified Expert Solution

Question

1 Approved Answer

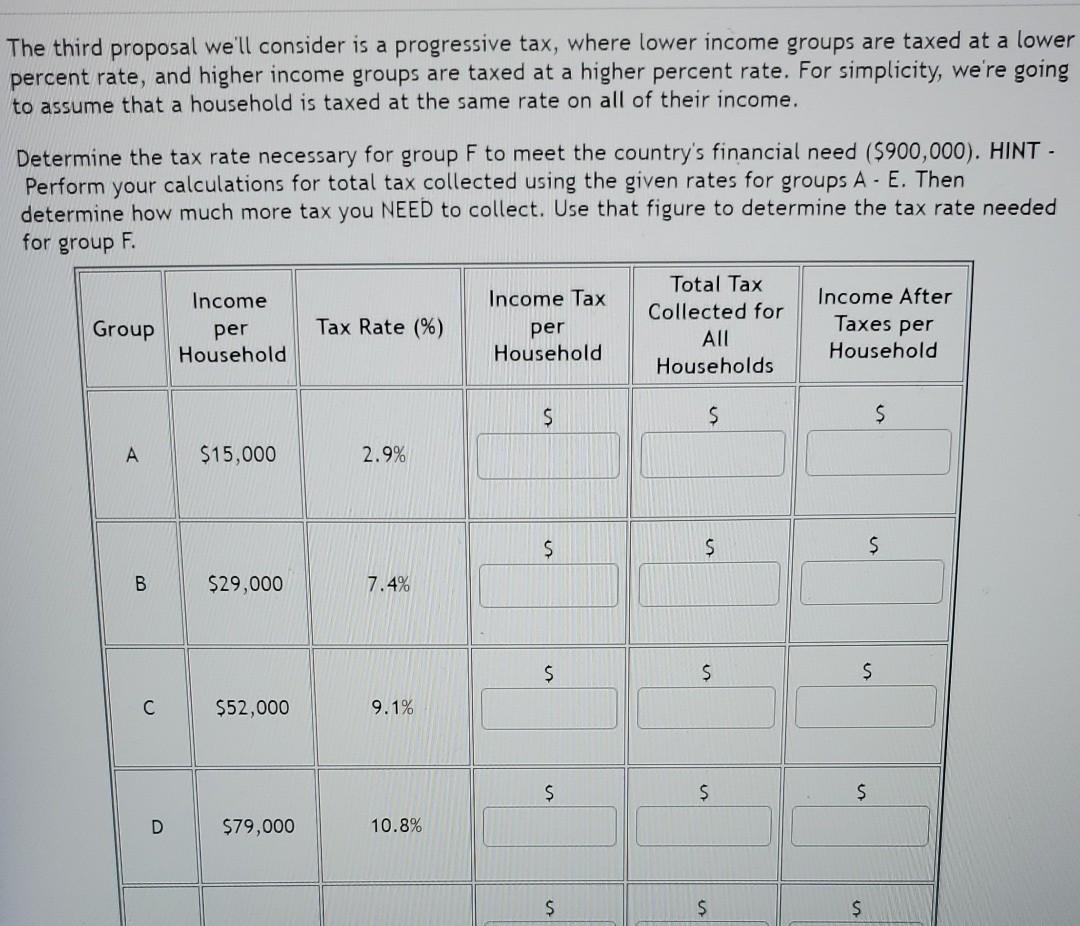

The third proposal we'll consider is a progressive tax, where lower income groups are taxed at a lower percent rate, and higher income groups are

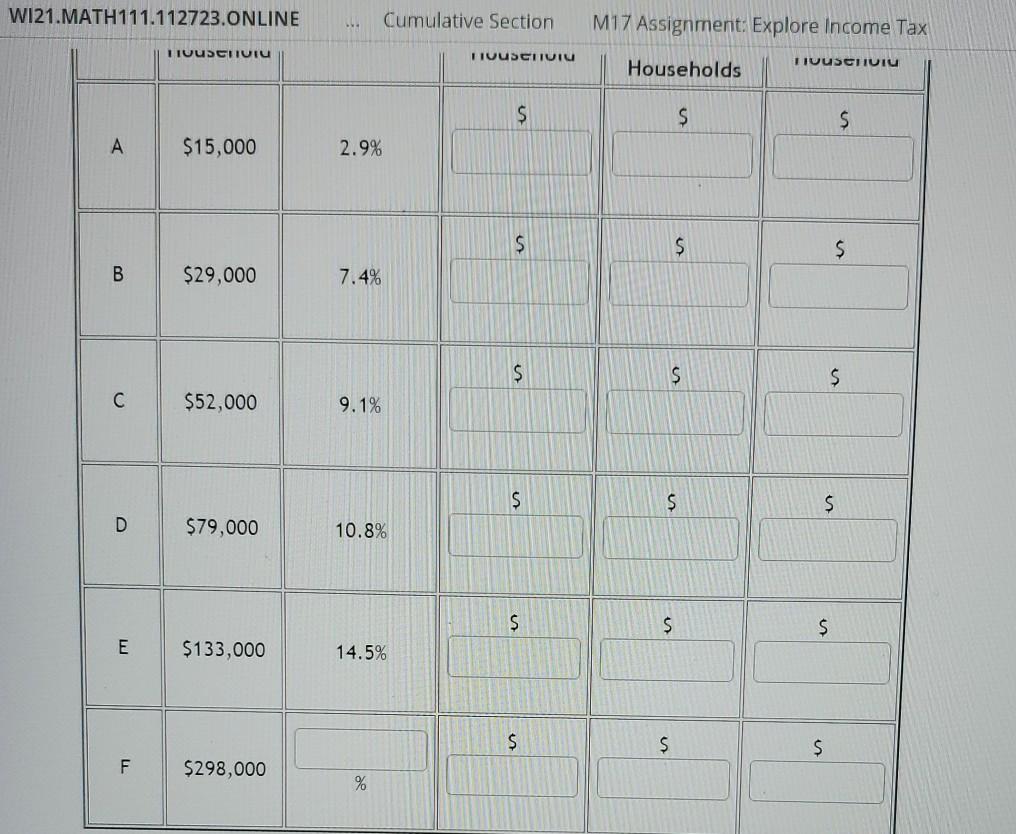

The third proposal we'll consider is a progressive tax, where lower income groups are taxed at a lower percent rate, and higher income groups are taxed at a higher percent rate. For simplicity, we're going to assume that a household is taxed at the same rate on all of their income. Determine the tax rate necessary for group F to meet the country's financial need ($900,000). HINT- Perform your calculations for total tax collected using the given rates for groups A - E. Then determine how much more tax you NEED to collect. Use that figure to determine the tax rate needed for group F. Income After Group Income per Household Tax Rate (%) Income Tax per Household Total Tax Collected for All Households Taxes per Household $ $ $ $15,000 2.9% $ $ $ B $29,000 7.4% $ $ $ $52,000 9.1% $ $ $ D $79,000 10.8% $ $ $ W121.MATH111.112723.ONLINE Cumulative Section M17 Assignment: Explore Income Tax HIUUSCHIUIU HTUUSCHIU Households HIVUSCIUTU $ $ $ A $15,000 2.9% $ $ $ B $29,000 7.4% $ $ $ $52,000 9.1% $ $ $ D $79,000 10.8% $ $ $ E $133,000 14.5% $ $ $ F $298,000 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started