Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jane Doe has always lived in Quebec and just graduated from Universite de Montreal in December 2022 and started her full-time employment as of January

Jane Doe has always lived in Quebec and just graduated from Universite de Montreal in December 2022 and started her full-time employment as of January 1, 2023. Prior to this, she only held part-time jobs as an intern.

Facts for 2023 for Barb:

- Gross annual salary of $71,000

- Interest income of $500

- Unused tuition carry over from 2022: $7,000

- Made Registered Retirement Savings Plan (RRSP) contribution of $3,000

- Registered Retirement Savings Plan (RRSP) contribution room of $10,000

- Made Tax-Free Savings Account (TFSA) contribution of $2,000

- Tax-Free Savings Account (TFSA) contribution room of $18,500

- Sold 50 shares in Intact Financial at $193 per share on July 10, 2023 (paid a total of $7,700 for 70 shares when she purchased them in 2020)

- Net capital loss from previous years of $400

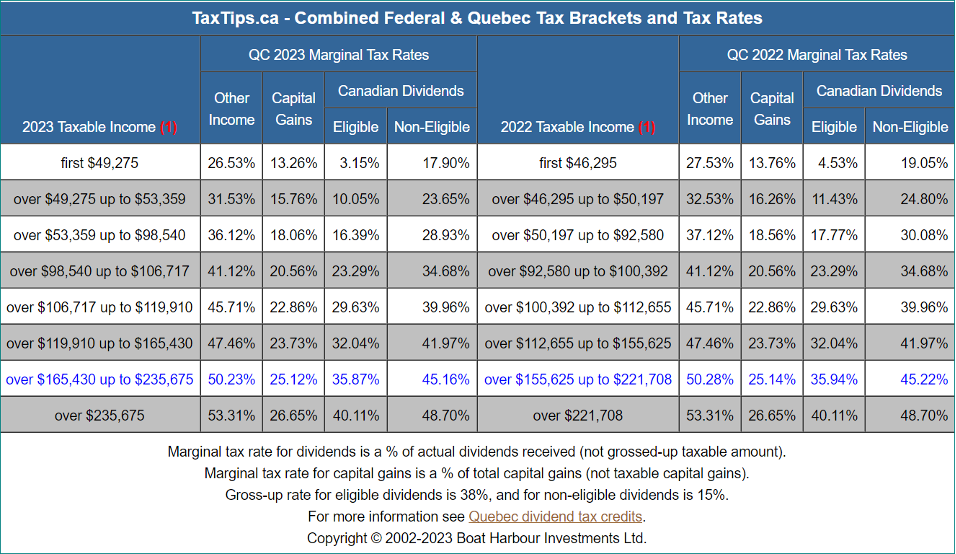

- Using Table A, calculate Jane Doe's taxes payable (ignore non-refundable tax credits for this problem). (2 marks)

Show Calculations

2. Calculate Jane Doe's average tax rate and marginal tax rate for 2023.

| Tax calculation |

Average tax rate |

|

Marginal tax rate |

|

TaxTips.ca - Combined Federal & Quebec Tax Brackets and Tax Rates QC 2023 Marginal Tax Rates QC 2022 Marginal Tax Rates 2023 Taxable Income (1) first $49,275 Canadian Dividends Canadian Dividends Other Capital Income Gains Eligible Non-Eligible 26.53% 13.26% 3.15% 17.90% 2022 Taxable Income (1) first $46,295 Other Capital Income Gains Eligible Non-Eligible 19.05% 24.80% 30.08% over $49,275 up to $53,359 31.53% 15.76% 10.05% over $53,359 up to $98,540 36.12% 18.06% 16.39% over $98,540 up to $106,717 41.12% 20.56% 23.29% over $106,717 up to $119,910 45.71% 22.86% 29.63% over $119,910 up to $165,430 47.46% 23.73% 32.04% over $165,430 up to $235,675 50.23% 25.12% 35.87% over $235,675 53.31% 26.65% 40.11% 27.53% 13.76% 4.53% 23.65% over $46,295 up to $50,197 32.53% 16.26% 11.43% 28.93% over $50,197 up to $92,580 37.12% 18.56% 17.77% 34.68% over $92,580 up to $100,392 41.12% 20.56% 23.29% 39.96% over $100,392 up to $112,655 45.71% 22.86% 29.63% 41.97% over $112,655 up to $155,625 47.46% 23.73% 32.04% 45.16% over $155,625 up to $221,708 50.28% 25.14% 35.94% 48.70% over $221,708 53.31% 26.65% 40.11% Marginal tax rate for dividends is a % of actual dividends received (not grossed-up taxable amount). Marginal tax rate for capital gains is a % of total capital gains (not taxable capital gains). Gross-up rate for eligible dividends is 38%, and for non-eligible dividends is 15%. For more information see Quebec dividend tax credits. Copyright 2002-2023 Boat Harbour Investments Ltd. 34.68% 39.96% 41.97% 45.22% 48.70%

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of Jane Does taxes payable for 2023 a Calculation of Total Income Employment income 7100...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started