Answered step by step

Verified Expert Solution

Question

1 Approved Answer

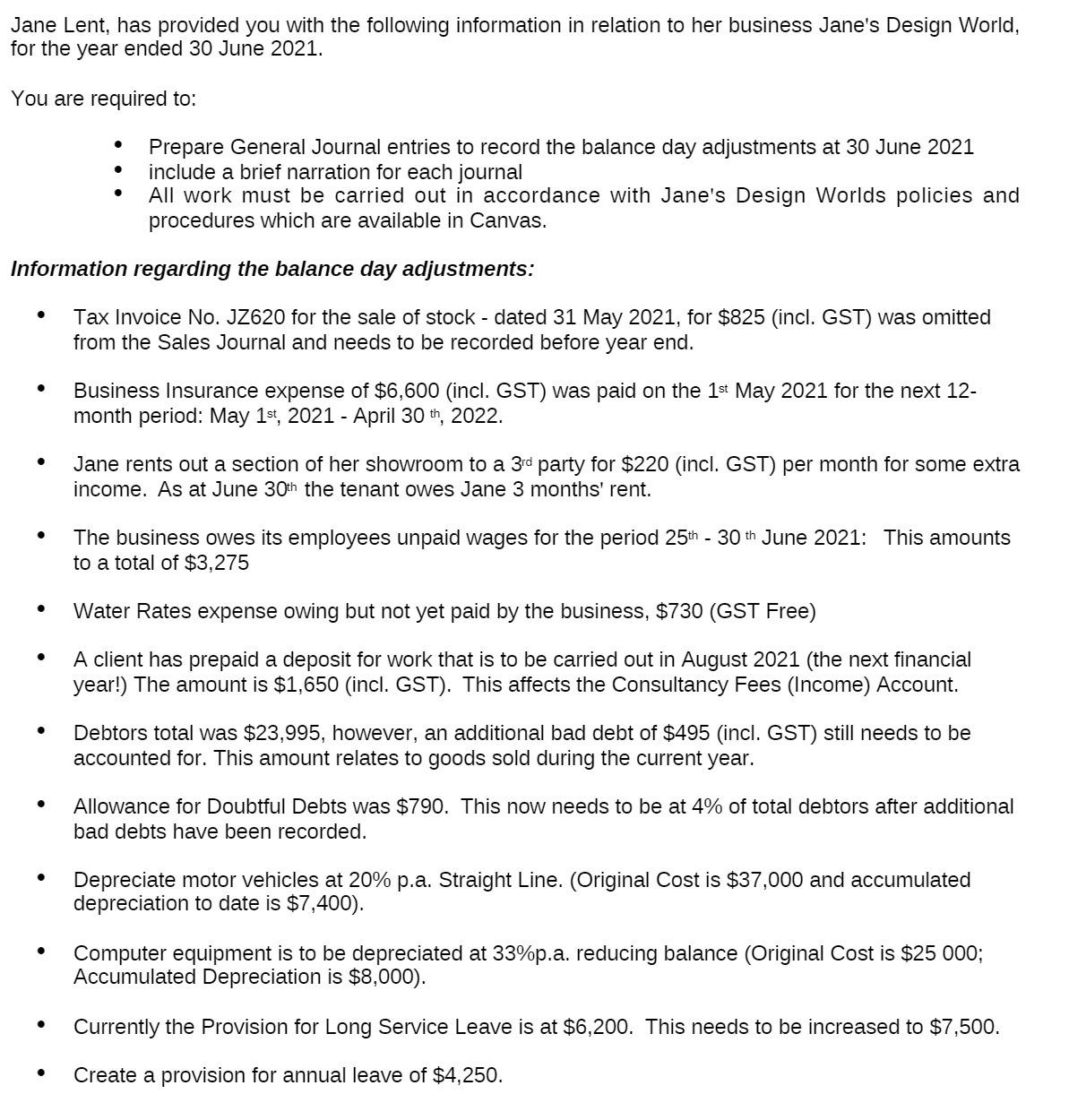

Jane Lent, has provided you with the following information in relation to her business Jane's Design World, for the year ended 30 June 2021.

Jane Lent, has provided you with the following information in relation to her business Jane's Design World, for the year ended 30 June 2021. You are required to: Information regarding the balance day adjustments: Tax Invoice No. JZ620 for the sale of stock - dated 31 May 2021, for $825 (incl. GST) was omitted from the Sales Journal and needs to be recorded before year end. Prepare General Journal entries to record the balance day adjustments at 30 June 2021 include a brief narration for each journal All work must be carried out in accordance with Jane's Design Worlds policies and procedures which are available in Canvas. Business Insurance expense of $6,600 (incl. GST) was paid on the 1st May 2021 for the next 12- month period: May 1st, 2021 - April 30th, 2022. Jane rents out a section of her showroom to a 3rd party for $220 (incl. GST) per month for some extra income. As at June 30th the tenant owes Jane 3 months' rent. The business owes its employees unpaid wages for the period 25th - 30th June 2021: This amounts to a total of $3,275 Water Rates expense owing but not yet paid by the business, $730 (GST Free) A client has prepaid a deposit for work that is to be carried out in August 2021 (the next financial year!) The amount is $1,650 (incl. GST). This affects the Consultancy Fees (Income) Account. Debtors total was $23,995, however, an additional bad debt of $495 (incl. GST) still needs to be accounted for. This amount relates to goods sold during the current year. Allowance for Doubtful Debts was $790. This now needs to be at 4% of total debtors after additional bad debts have been recorded. Depreciate motor vehicles at 20% p.a. Straight Line. (Original Cost is $37,000 and accumulated depreciation to date is $7,400). Computer equipment is to be depreciated at 33%p.a. reducing balance (Original Cost is $25 000; Accumulated Depreciation is $8,000). Currently the Provision for Long Service Leave is at $6,200. This needs to be increased to $7,500. Create a provision for annual leave of $4,250.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

GENERAL JOURNAL Here are the General Journal entries for Janes Design World for the year ended 30 Ju...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started