Question

Jane recently passed her CFA Level II and joined Overseas United Bank (OUB) as a wealth manager. On her first day at work, she meets

Jane recently passed her CFA Level II and joined Overseas United Bank (OUB) as a wealth manager. On her first day at work, she meets with her supervisor, Jacky, CFA, who introduces Jane to his team of wealth managers, who are responsible for a combined $1 billion in assets. Most of the accounts the team services are advisory in nature, although the team also manages some monies on a discretionary basis.

Before Jane joined OUB, she had already heard about its notoriously bad legacy information systems. Things got so bad that when OUBs equity research analysts make a revision to their recommendations, it takes a day before the updated reports are published on their system for customer access. So as to prevent its discretionary customers from being disadvantaged relative to those of competitors, Jacky instructed his team to check with the equity research team twice a day to check for updates and to communicate updates immediately to the customers of their discretionary accounts. Jacky advises Jane to do this as well, and she complies.

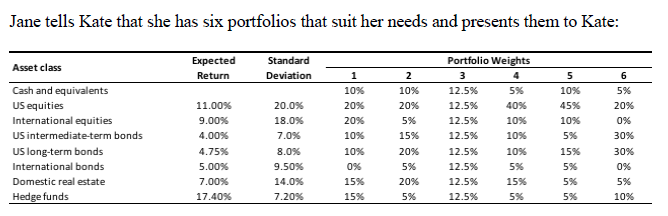

A week in, Jacky asks Jane to meet with Kate, a prospective client, on an urgent basis as Kate will only be in town for a short time and will be flying off the next day. Since this is Janes first potential client, she is eager to onboard the client. So she hurriedly schedules the first meeting with Kate for the next morning and quickly puts together six stock portfolios. At their first meeting, Jane plans to recommend one of these portfolios to Kate.

At the meeting, Jane notes that Kate is a 40-year-old property agent living in the United States, with investable assets of USD20 million. Of this amount, Kate needs about $2 million three months from now in order to make a housing downpayment. She is not a big spender but hopes to fund at least part of her annual expenses, which are highly predictable, from her investment portfolio for the next twenty years. She is concerned, however, about the general increase in the prices of goods and services over time. Furthermore, Kate would like a portfolio that can be liquidated quickly and at fair value. She strongly supports American businesses and would like her investments to primarily contribute to the overall growth of the US economy.

As Kate is rushing off for the flight, she promptly decides on a portfolio. However, before she leaves, she asks Jane to destroy all notes that were taken during that meeting due to privacy concerns. Since OUB is customer-centric, Jane obliges, records the minimum needed to open an account, and invests Kates monies in the portfolio that she selected. Shortly after Kate has left for the United States, a pandemic caused national lockdowns and severe travel restrictions. Jane is forced to work from home. Fortunately, the pandemic caused the OUB to make some much needed IT upgrades, almost everything is stored in the cloud, and all Jane had to do was to bring home a case of client business cards, which her predecessor at OUB had left for her. As she browsed through the cards, she came across the card of an old frenemy, which reads, Tracy Morgan, CFA Level I, expected completion 2021. Jane smiles, realising that she is ahead.

Janes happiness is shortlived, however, as she subsequently loses her job due to the pandemic. To make ends meet, she starts selling investment-linked plans as a freelancer by reaching out to contacts in the case of business cards.

Question 1 Discuss how Kates circumstances will affect her allocation to each asset class and rate each allocation as low, medium, or high and, hence, recommend a portfolio that is most suitable for her. No calculations are required.

Question 2 Specify at most five (5) violations of the CFA Institute Code of Ethics and Standards of Professional Conduct. State clearly who violated the Code and Standards, which specific Standard or part of the Standard has been violated, and present evidence from the case to support your answer. Each non-violation that has been incorrectly identified as a violation will be penalised, as will any violations in excess of five, including correct ones.

Jane tells Kate that she has six portfolios that suit her needs and presents them to Kate: Expected Return Standard Deviation 6 5% 20% 0% Asset class Cash and equivalents US equities International equities US intermediate-term bonds US long-term bonds International bonds Domestic real estate Hedge funds 11.00% 9.00% 4.00% 4.75% 5.00% 7.00% 17.40% 20.0% 18.0% 7.0% 8.0% 9.50% 14.0% 7.20% 1 10% 20% 20% 10% 10% 0% 15% 15% 2 10% 20% 5% 15% 20% 5% 20% 5% Portfolio Weights 3 12.5% 5% 12.5% 40% 12.5% 10% 12.5% 10% 12.5% 10% 12.5% 5% 12.5% 15% 12.5% 5% 5 10% 45% 10% 5% 15% 5% 5% 5% 30% 30% 0% 5% 10% Jane tells Kate that she has six portfolios that suit her needs and presents them to Kate: Expected Return Standard Deviation 6 5% 20% 0% Asset class Cash and equivalents US equities International equities US intermediate-term bonds US long-term bonds International bonds Domestic real estate Hedge funds 11.00% 9.00% 4.00% 4.75% 5.00% 7.00% 17.40% 20.0% 18.0% 7.0% 8.0% 9.50% 14.0% 7.20% 1 10% 20% 20% 10% 10% 0% 15% 15% 2 10% 20% 5% 15% 20% 5% 20% 5% Portfolio Weights 3 12.5% 5% 12.5% 40% 12.5% 10% 12.5% 10% 12.5% 10% 12.5% 5% 12.5% 15% 12.5% 5% 5 10% 45% 10% 5% 15% 5% 5% 5% 30% 30% 0% 5% 10%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started