Answered step by step

Verified Expert Solution

Question

1 Approved Answer

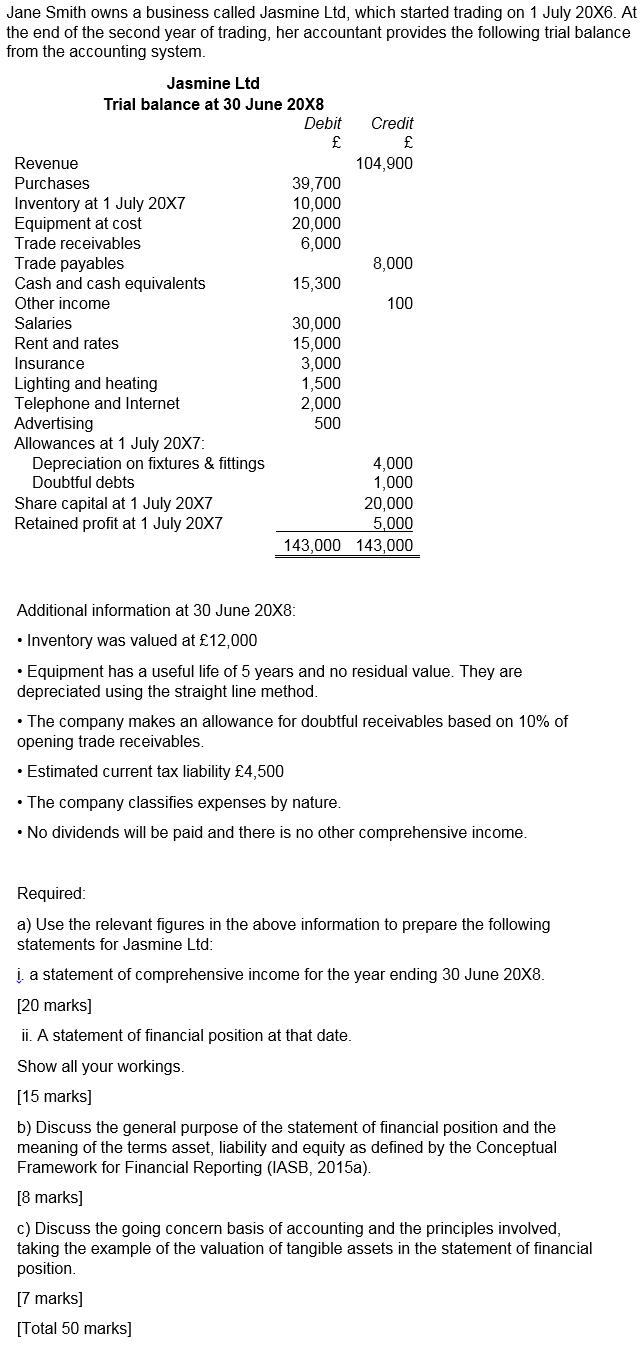

Jane Smith owns a business called Jasmine Ltd, which started trading on 1 July 20X6. At the end of the second year of trading,

Jane Smith owns a business called Jasmine Ltd, which started trading on 1 July 20X6. At the end of the second year of trading, her accountant provides the following trial balance from the accounting system. Jasmine Ltd Trial balance at 30 June 20X8 Debit Revenue Purchases Inventory at 1 July 20X7 Equipment at cost Trade receivables Trade payables Cash and cash equivalents Other income Salaries Rent and rates Insurance Lighting and heating Telephone and Internet Advertising Allowances at 1 July 20X7: Depreciation on fixtures & fittings Doubtful debts Share capital at 1 July 20X7 Retained profit at 1 July 20X7 39,700 10,000 20,000 6,000 15,300 30,000 15,000 3,000 1,500 2,000 500 Credit 104,900 8,000 100 4,000 1,000 20,000 5,000 143,000 143,000 Additional information at 30 June 20X8: Inventory was valued at 12,000 Equipment has a useful life of 5 years and no residual value. They are depreciated using the straight line method. The company makes an allowance for doubtful receivables based on 10% of opening trade receivables. Estimated current tax liability 4,500 The company classifies expenses by nature. No dividends will be paid and there is no other comprehensive income. Required: a) Use the relevant figures in the above information to prepare the following statements for Jasmine Ltd: . a statement of comprehensive income for the year ending 30 June 20X8. [20 marks] ii. A statement of financial position at that date. Show all your workings. [15 marks] b) Discuss the general purpose of the statement of financial position and the meaning of the terms asset, liability and equity as defined by the Conceptual Framework for Financial Reporting (IASB, 2015a). [8 marks] c) Discuss the going concern basis of accounting and the principles involved, taking the example of the valuation of tangible assets in the statement of financial position. [7 marks] [Total 50 marks]

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started