Answered step by step

Verified Expert Solution

Question

1 Approved Answer

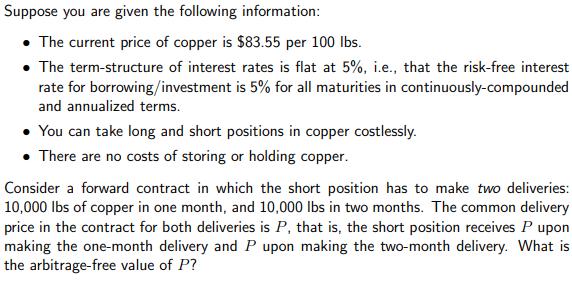

Suppose you are given the following information: The current price of copper is $83.55 per 100 lbs. The term-structure of interest rates is flat

Suppose you are given the following information: The current price of copper is $83.55 per 100 lbs. The term-structure of interest rates is flat at 5%, i.e., that the risk-free interest rate for borrowing/investment is 5% for all maturities in continuously-compounded and annualized terms. You can take long and short positions in copper costlessly. There are no costs of storing or holding copper. Consider a forward contract in which the short position has to make two deliveries: 10,000 lbs of copper in one month, and 10,000 lbs in two months. The common delivery price in the contract for both deliveries is P, that is, the short position receives P upon making the one-month delivery and P upon making the two-month delivery. What is the arbitrage-free value of P?

Step by Step Solution

★★★★★

3.56 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started