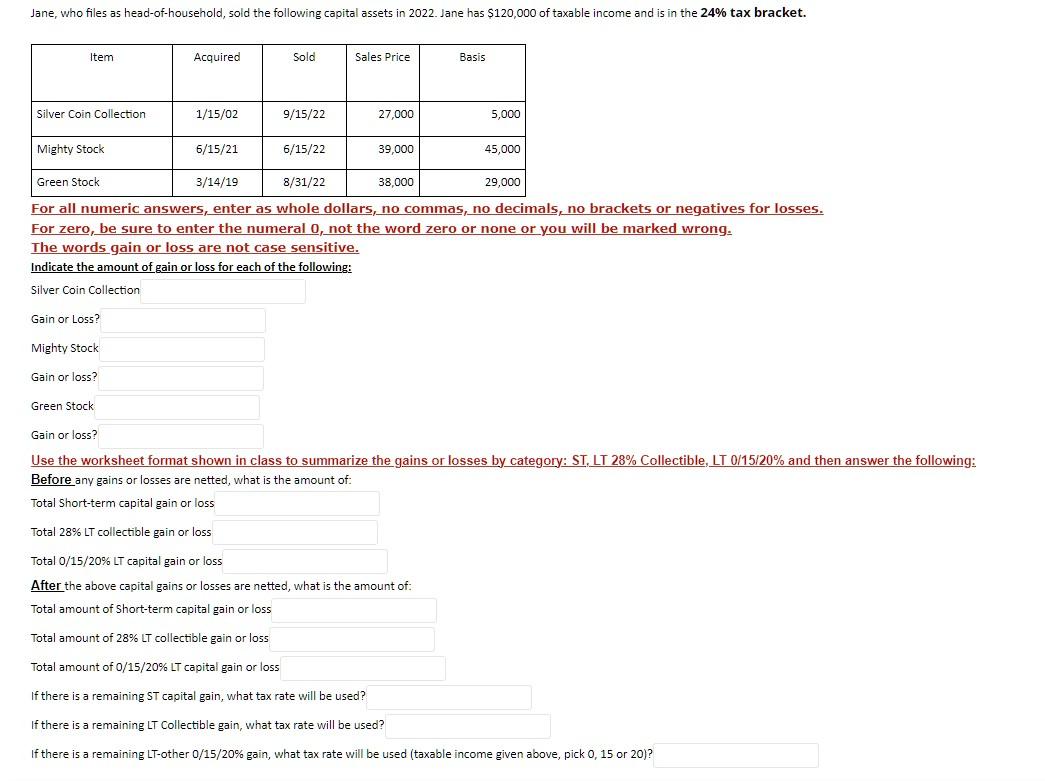

Jane, who files as head-of-household, sold the following capital assets in 2022. Jane has $120,000 of taxable income and is in the 24% tax bracket. For all numeric answers, enter as whole dollars, no commas, no decimals, no brackets or negatives for losses. For zero, be sure to enter the numeral 0 , not the word zero or none or you will be marked wrong. The words gain or loss are not case sensitive. Indicate the amount of gain or loss for each of the following: Silver Coin Collection Gain or Loss! Mighty Stock Gain or loss? Green Stock Gain or loss? Use the worksheet format shown in class to summarize the gains or losses by category: ST, LT 28% Collectible, LT 0/15/20% and then answer the following: Before any gains or losses are netted, what is the amount of: Total Short-term capital gain or loss Total 28%LT collectible gain or loss Total 0/15/20% LT capital gain or loss After the above capital gains or losses are netted, what is the amount of: Total amount of Short-term capital gain or loss Total amount of 28%LT collectible gain or loss Total amount of 0/15/20\% LT capital gain or loss If there is a remaining ST capital gain, what tax rate will be used? If there is a remaining LT Collectible gain, what tax rate will be used! If there is a remaining LT-other 0/15/20% gain, what tax rate will be used (taxable income given above, pick 0,15 or 20 )? Jane, who files as head-of-household, sold the following capital assets in 2022. Jane has $120,000 of taxable income and is in the 24% tax bracket. For all numeric answers, enter as whole dollars, no commas, no decimals, no brackets or negatives for losses. For zero, be sure to enter the numeral 0 , not the word zero or none or you will be marked wrong. The words gain or loss are not case sensitive. Indicate the amount of gain or loss for each of the following: Silver Coin Collection Gain or Loss! Mighty Stock Gain or loss? Green Stock Gain or loss? Use the worksheet format shown in class to summarize the gains or losses by category: ST, LT 28% Collectible, LT 0/15/20% and then answer the following: Before any gains or losses are netted, what is the amount of: Total Short-term capital gain or loss Total 28%LT collectible gain or loss Total 0/15/20% LT capital gain or loss After the above capital gains or losses are netted, what is the amount of: Total amount of Short-term capital gain or loss Total amount of 28%LT collectible gain or loss Total amount of 0/15/20\% LT capital gain or loss If there is a remaining ST capital gain, what tax rate will be used? If there is a remaining LT Collectible gain, what tax rate will be used! If there is a remaining LT-other 0/15/20% gain, what tax rate will be used (taxable income given above, pick 0,15 or 20 )