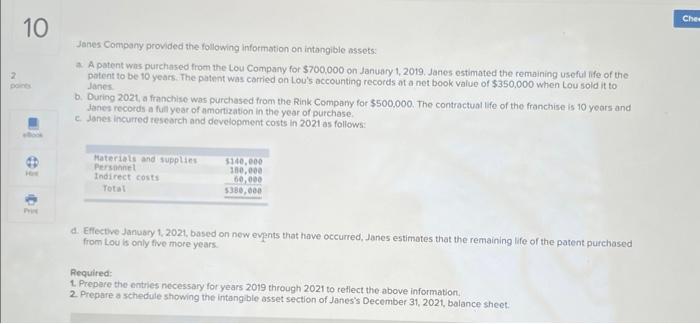

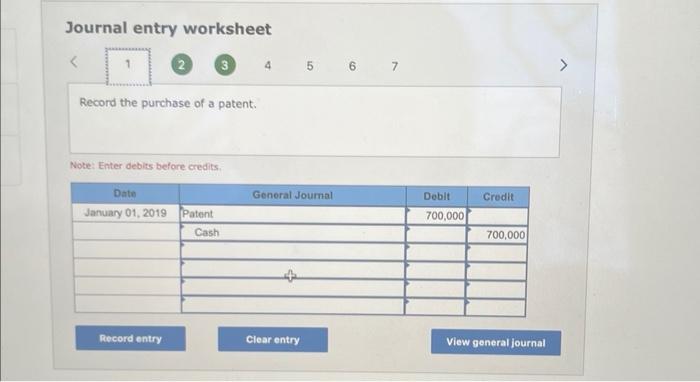

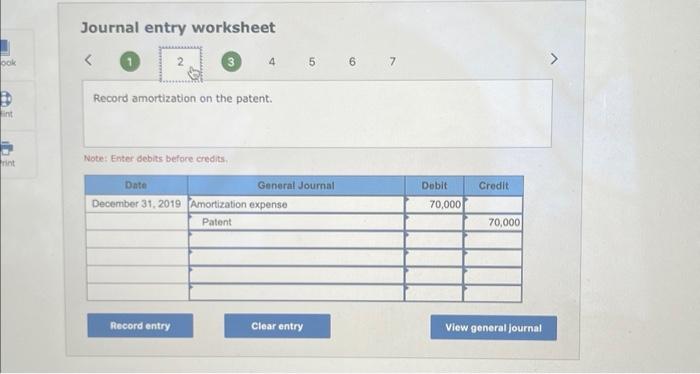

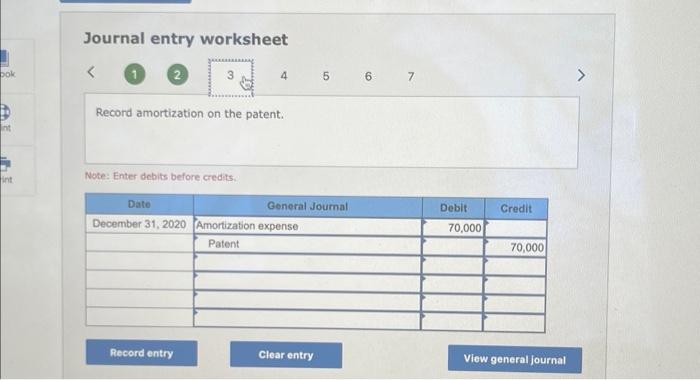

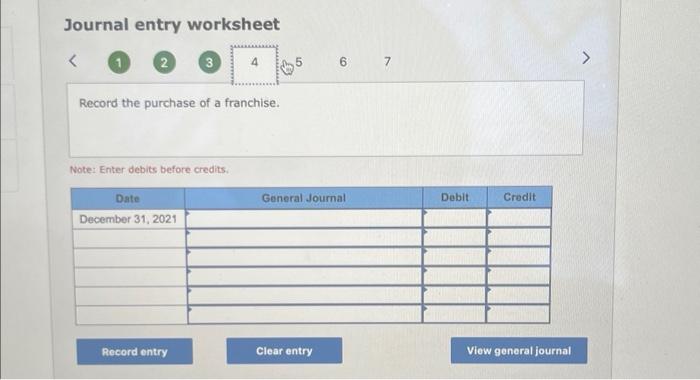

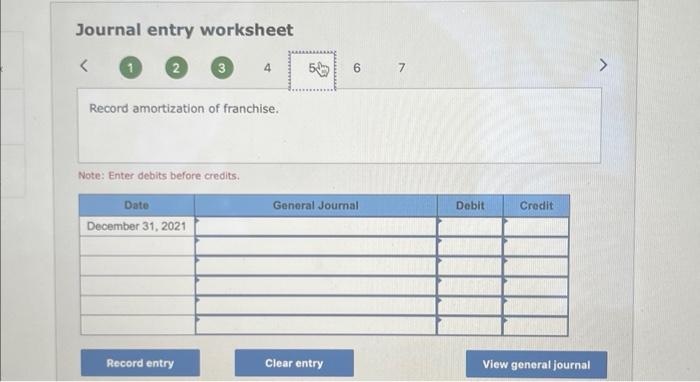

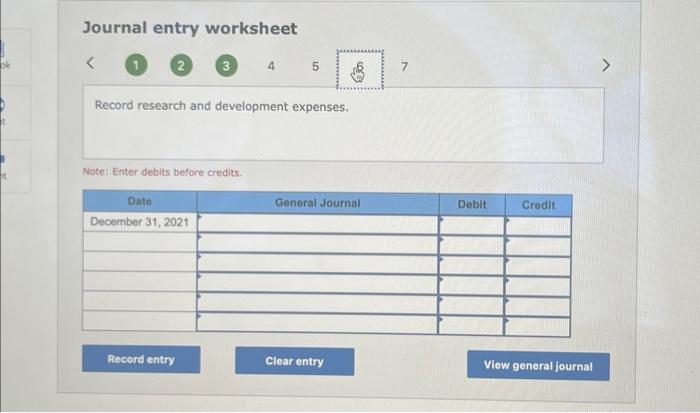

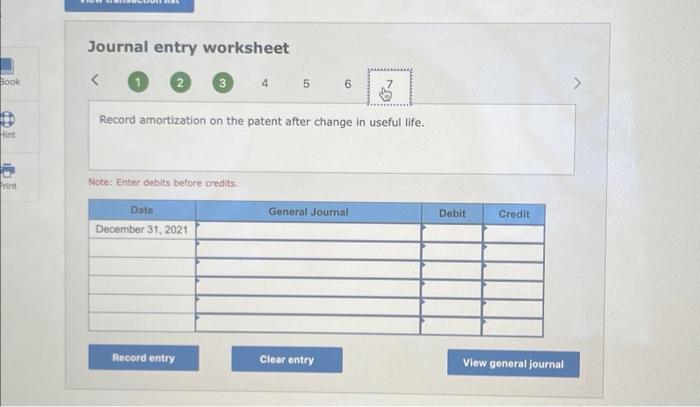

Janes Compony provided the following informotion on intangible assets: a. A patent whs purchased from the Lou Company for $700,000 on January 1,2019. Janes estimated the remaining useful ife of the potent to be 10 years. The patent was carried on Lou's accounting records ot a net book value of $350.000 when Lou sold it to Janes b. During 2021, a franchise was purchased from the Rink Company for $500,000. The controctual life of the franchise is 10 years and danes records a full year of amortization in the year of purchase. c. Janes incurred reseorch and development costs in 2021 as follows: a. Eflective Janusry 1, 2021, based on new evpnts that have occurred, Janes estimates that the remaining life of the patent purchased from tou is only five more years. Required: 1. Prepere the entries necessary for years 2019 through 2021 to retlect the above information 2. Prepare a schedule showing the intang ble asset section of Janes's December 31,2021 , balance sheet. Journal entry worksheet (2) 3 4 Journal entry worksheet (3) 4 Journal entry worksheet 1 4 Journal entry worksheet ( 2 Note: Enter debits before credits. Journal entry worksheet 1 2 3 Journal entry worksheet 1 (2 (3) 4 Record research and development expenses. Note: Enter debits before credits. Journal entry worksheet 1 (2 (3) 4 5 Record amortization on the patent after change in useful life. Note: Enter debits before credits. Janes Compony provided the following informotion on intangible assets: a. A patent whs purchased from the Lou Company for $700,000 on January 1,2019. Janes estimated the remaining useful ife of the potent to be 10 years. The patent was carried on Lou's accounting records ot a net book value of $350.000 when Lou sold it to Janes b. During 2021, a franchise was purchased from the Rink Company for $500,000. The controctual life of the franchise is 10 years and danes records a full year of amortization in the year of purchase. c. Janes incurred reseorch and development costs in 2021 as follows: a. Eflective Janusry 1, 2021, based on new evpnts that have occurred, Janes estimates that the remaining life of the patent purchased from tou is only five more years. Required: 1. Prepere the entries necessary for years 2019 through 2021 to retlect the above information 2. Prepare a schedule showing the intang ble asset section of Janes's December 31,2021 , balance sheet. Journal entry worksheet (2) 3 4 Journal entry worksheet (3) 4 Journal entry worksheet 1 4 Journal entry worksheet ( 2 Note: Enter debits before credits. Journal entry worksheet 1 2 3 Journal entry worksheet 1 (2 (3) 4 Record research and development expenses. Note: Enter debits before credits. Journal entry worksheet 1 (2 (3) 4 5 Record amortization on the patent after change in useful life. Note: Enter debits before credits