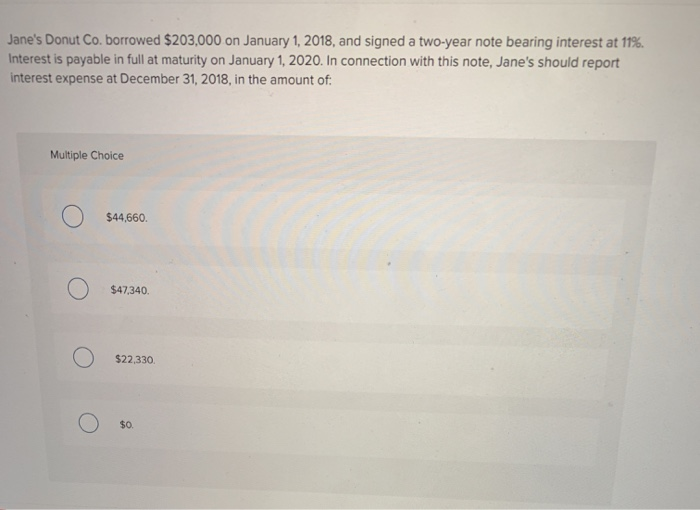

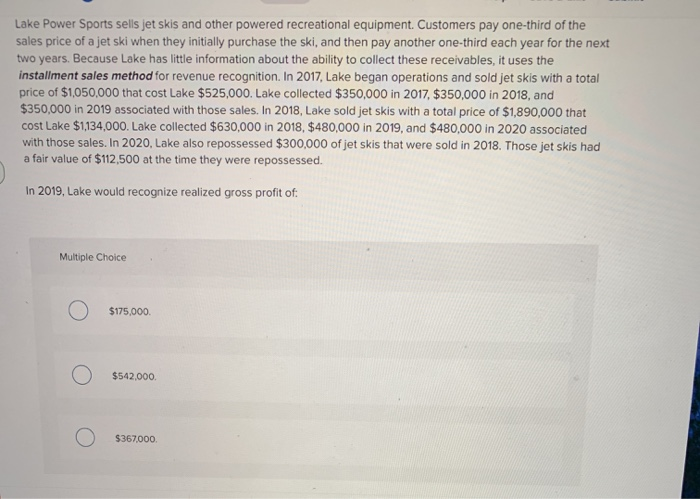

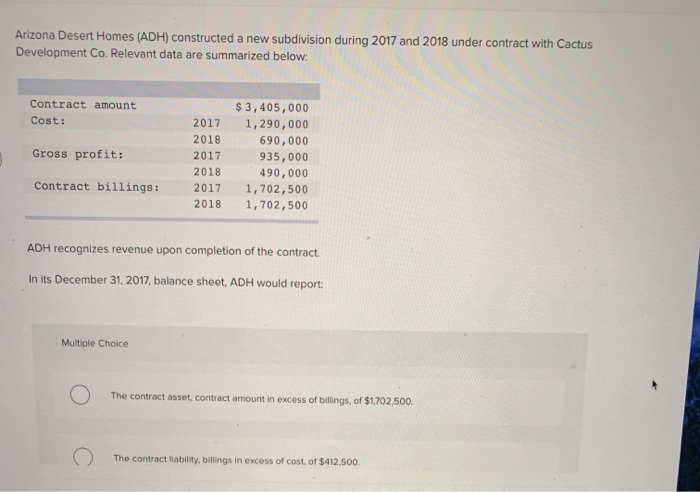

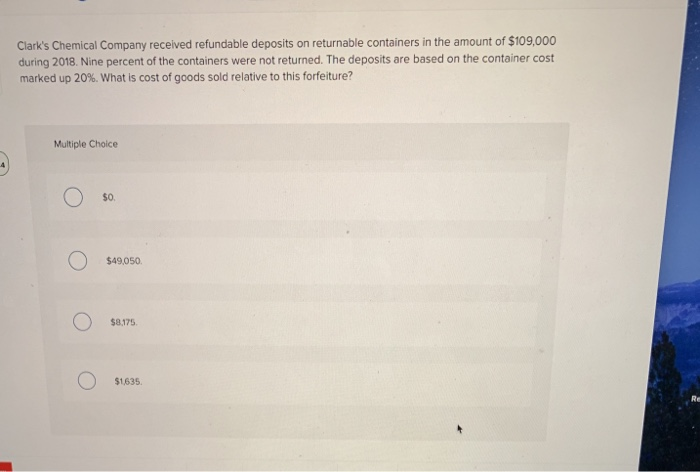

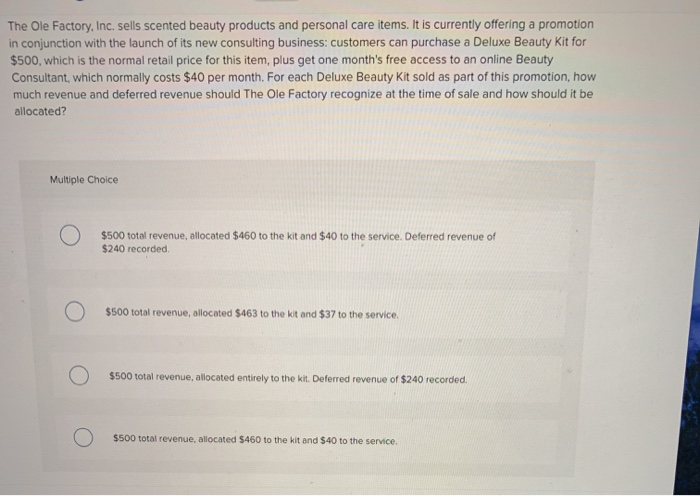

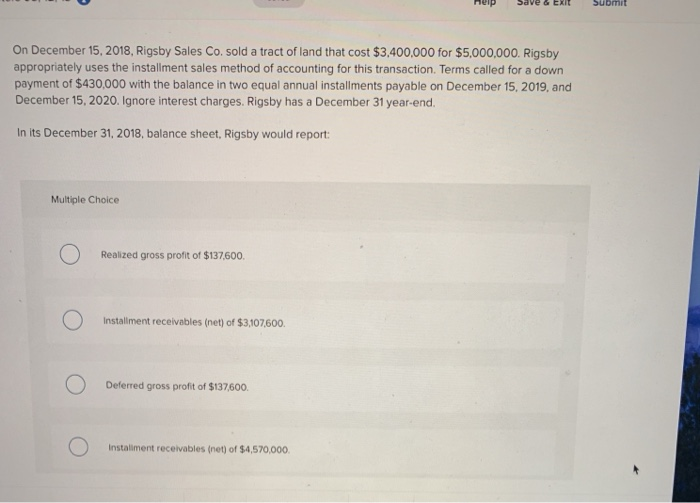

Jane's Donut Co. borrowed $203,000 on January 1, 2018, and signed a two-year note bearing interest at 11% Interest is payable in full at maturity on January 1, 2020. In connection with this note, Jane's should report interest expense at December 31, 2018, in the amount of: Multiple Choice $44,660. $47,340. $22.330 $0. Lake Power Sports sells jet skis and other powered recreational equipment. Customers pay one-third of the sales price of a jet ski when they initially purchase the ski, and then pay another one-third each year for the next two years. Because Lake has little information about the ability to collect these receivables, it uses the installment sales method for revenue recognition. In 2017, Lake began operations and sold jet skis with a total price of $1,050,000 that cost Lake $525,000. Lake collected $350,000 in 2017, $350,000 in 2018, and $350,000 in 2019 associated with those sales. In 2018, Lake sold jet skis with a total price of $1,890,000 that cost Lake $1,134,000. Lake collected $630,000 in 2018, $480,000 in 2019, and $480,000 in 2020 associated with those sales. In 2020, Lake also repossessed $300,000 of jet skis that were sold in 2018. Those jet skis had a fair value of $112,500 at the time they were repossessed. In 2019, Lake would recognize realized gross profit of Multiple Choice $175,000 $542,000. $367,000. Arizona Desert Homes (ADH) constructed a new subdivision during 2017 and 2018 under contract with Cactus Development Co. Relevant data are summarized below: Contract amount $3,405,000 Cost: 2017 1,290,000 2018 690,000 Gross profit: 2017 935,000 2018 490,000 Contract bill ings : 2017 1,702,500 1,702,500 2018 ADH recognizes revenue upon completion of the contract In its December 31, 2017, balance sheet, ADH would report Multiple Choice The contract asset, contract amount in excess of billings, of $1,702.500 The contract liability, billings in excess of cost, of $412,500. Clark's Chemical Company received refundable deposits on returnable containers in the amount of $109,000 during 2018. Nine percent of the containers were not returned. The deposits are based on the container cost marked up 20%. What is cost of goods sold relative to this forfeiture? Multiple Choice $0. $49,050 $8,175 $1,635. The Ole Factory, Inc. sells scented beauty products and personal care items. It is currently offering a promotion in conjunction with the launch of its new consulting business: customers can purchase a Deluxe Beauty Kit for $500, which is the normal retail price for this item, plus get one month's free access to an online Beauty Consultant, which normally costs $40 per month. For each Deluxe Beauty Kit sold as part of this promotion, how much revenue and deferred revenue should The Ole Factory recognize at the time of sale and how should it be allocated? Multiple Choice $500 total revenue, allocated $460 to the kit and $40 to the service. Deferred revenue of $240 recorded $500 total revenue, allocated $463 to the kit and $37 to the service. $500 total revenue, allocated entirely to the kit. Deferred revenue of $240 recorded. $500 total revenue, allocated $460 to the kit and $40 to the service. Submit On December 15, 2018, Rigsby Sales Co. sold a tract of land that cost $3,400,000 for $5,000,00 0. Rigsby appropriately uses the installment sales method of accounting for this transaction. Terms called for a down payment of $430,000 with the balance in two equal annual installments payable on December 15, 2019, and December 15, 2020. Ignore interest charges. Rigsby has a December 31 year-end. In its December 31, 2018, balance sheet, Rigsby would report Multiple Choice Realized gross profit of $137,600. Installment receivables (net) of $3,107,600. Deferred gross profit of $137,600 Instaliment receivables (net) of $4,570,000