Question

Janet, a single taxpayer, sells bakery goods as a sole proprietor. The qualified business income (QBI) from the business for the current year is

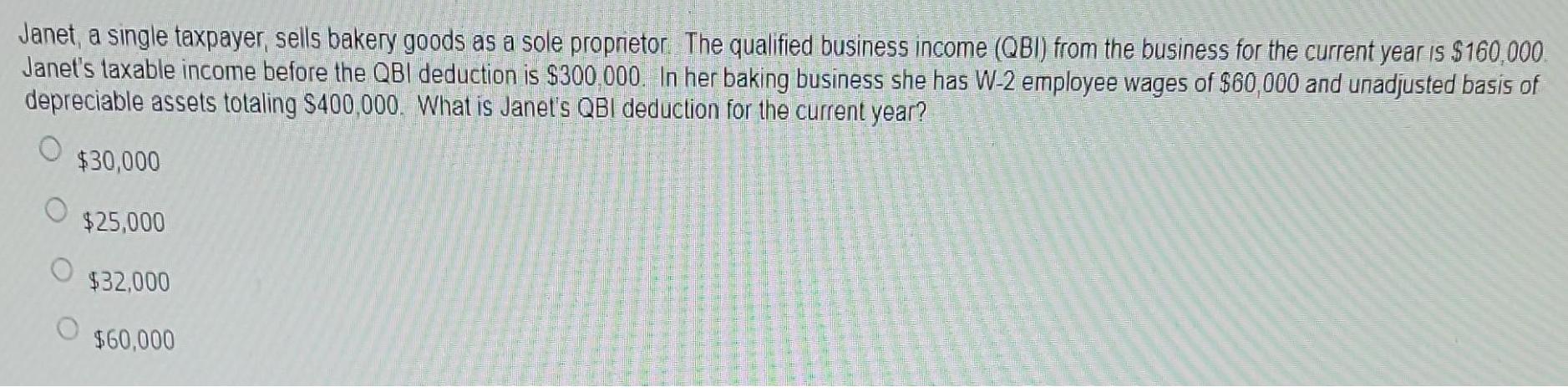

Janet, a single taxpayer, sells bakery goods as a sole proprietor. The qualified business income (QBI) from the business for the current year is $160,000 Janet's taxable income before the QBI deduction is $300,000. In her baking business she has W-2 employee wages of $60,000 and unadjusted basis of depreciable assets totaling $400,000. What is Janet's QBI deduction for the current year? $30,000 $25,000 $32,000 $60,000

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer Particulars Amount Amount Amount 1 First limit Qualified bu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

34th Edition

0135919460, 978-0135919460

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App