Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Milton Industries expects free cash flow of $15 million each year. Milton's corporate tax rate is 21%, and its unlevered cost of capital is

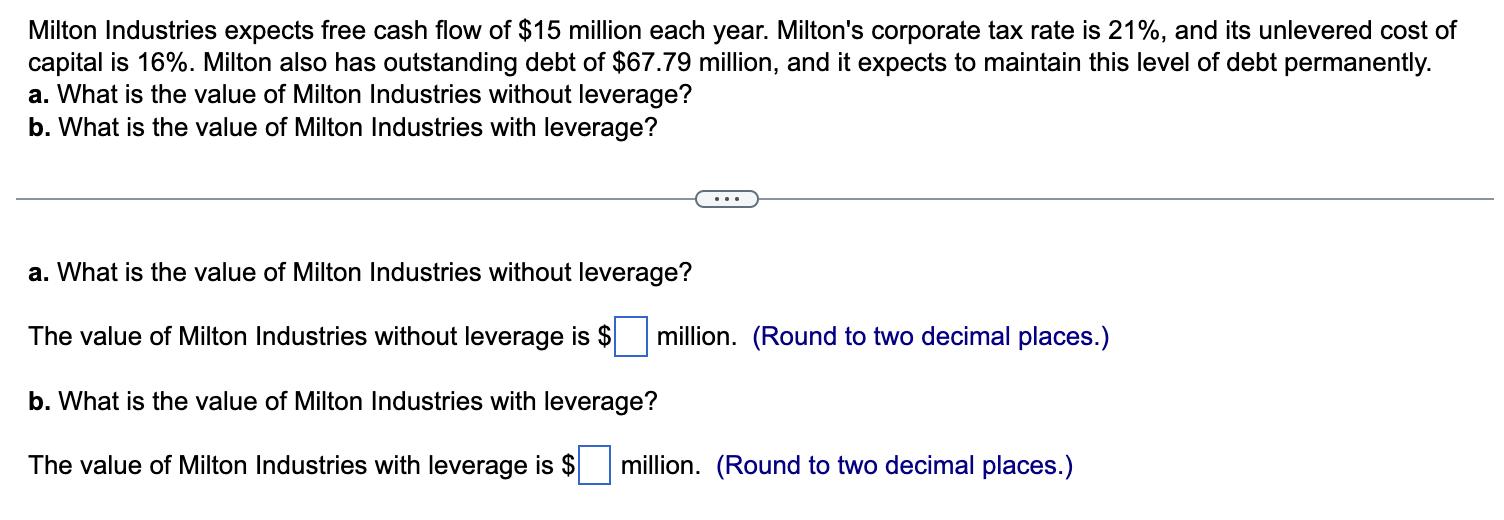

Milton Industries expects free cash flow of $15 million each year. Milton's corporate tax rate is 21%, and its unlevered cost of capital is 16%. Milton also has outstanding debt of $67.79 million, and it expects to maintain this level of debt permanently. a. What is the value of Milton Industries without leverage? b. What is the value of Milton Industries with leverage? a. What is the value of Milton Industries without leverage? The value of Milton Industries without leverage is $ b. What is the value of Milton Industries with leverage? The value of Milton Industries with leverage is $ million. (Round to two decimal places.) million. (Round to two decimal places.)

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 General guidance The answer provided below has been develo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started