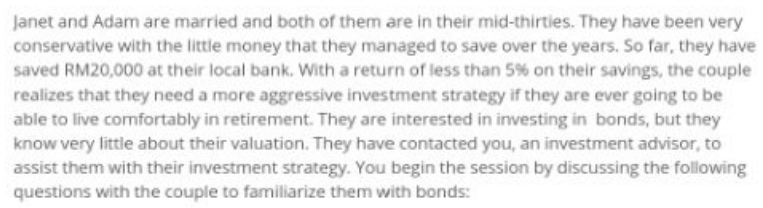

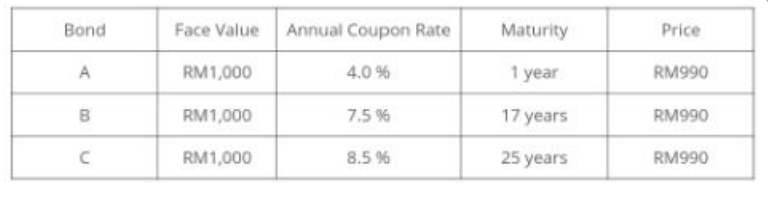

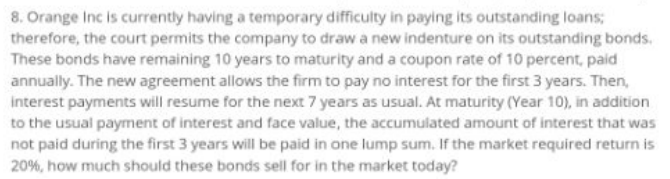

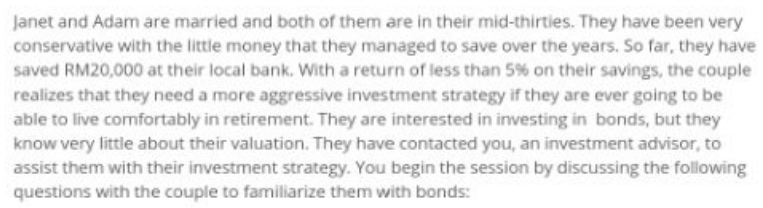

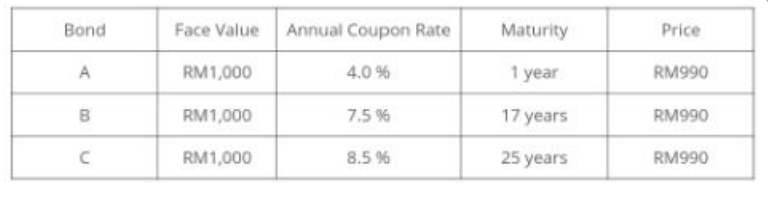

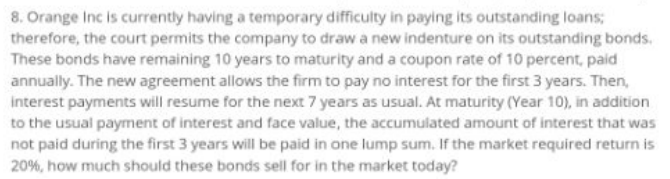

Janet and Adam are married and both of them are in their mid-thirties. They have been very conservative with the little money that they managed to save over the years. So far, they have saved RM20,000 at their local bank. With a return of less than 5% on their savings, the couple realizes that they need a more aggressive investment strategy if they are ever going to be able to live comfortably in retirement. They are interested in investing in bonds, but they know very little about their valuation. They have contacted you, an investment advisor to assist them with their investment strategy. You begin the session by discussing the following questions with the couple to familiarize them with bonds: Bond Face Value Annual Coupon Rate Maturity Price A RM1,000 4.0 % 1 year RM990 B RM1,000 7.5 % 17 years RM990 RM1,000 8.5 % 25 years RM990 8. Orange Inc is currently having a temporary difficulty in paying its outstanding loans therefore, the court permits the company to draw a new indenture on its outstanding bonds These bonds have remaining 10 years to maturity and a coupon rate of 10 percent, paid annually. The new agreement allows the firm to pay no interest for the first 3 years. Then, Interest payments will resume for the next 7 years as usual. At maturity (Year 10), in addition to the usual payment of interest and face value, the accumulated amount of interest that was not paid during the first 3 years will be paid in one lump sum. If the market required return is 20%, how much should these bonds sell for in the market today? Janet and Adam are married and both of them are in their mid-thirties. They have been very conservative with the little money that they managed to save over the years. So far, they have saved RM20,000 at their local bank. With a return of less than 5% on their savings, the couple realizes that they need a more aggressive investment strategy if they are ever going to be able to live comfortably in retirement. They are interested in investing in bonds, but they know very little about their valuation. They have contacted you, an investment advisor to assist them with their investment strategy. You begin the session by discussing the following questions with the couple to familiarize them with bonds: Bond Face Value Annual Coupon Rate Maturity Price A RM1,000 4.0 % 1 year RM990 B RM1,000 7.5 % 17 years RM990 RM1,000 8.5 % 25 years RM990 8. Orange Inc is currently having a temporary difficulty in paying its outstanding loans therefore, the court permits the company to draw a new indenture on its outstanding bonds These bonds have remaining 10 years to maturity and a coupon rate of 10 percent, paid annually. The new agreement allows the firm to pay no interest for the first 3 years. Then, Interest payments will resume for the next 7 years as usual. At maturity (Year 10), in addition to the usual payment of interest and face value, the accumulated amount of interest that was not paid during the first 3 years will be paid in one lump sum. If the market required return is 20%, how much should these bonds sell for in the market today