Answered step by step

Verified Expert Solution

Question

1 Approved Answer

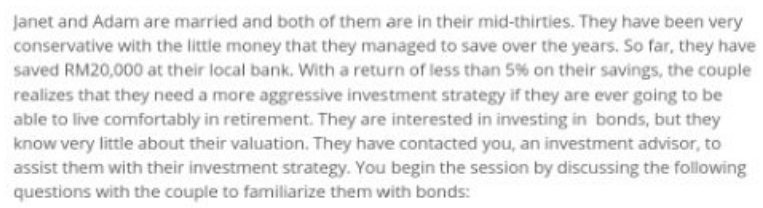

Janet and Adam are married and both of them are in their mid-thirties. They have been very conservative with the little money that they managed

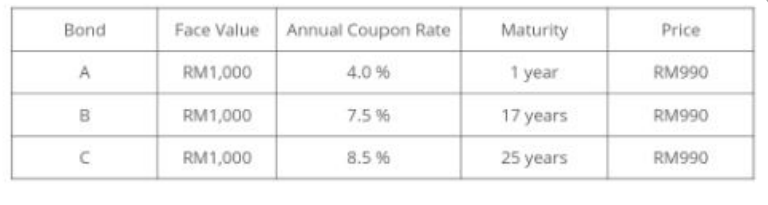

Janet and Adam are married and both of them are in their mid-thirties. They have been very conservative with the little money that they managed to save over the years. So far, they have saved RM20,000 at their local bank. With a return of less than 5% on their savings, the couple realizes that they need a more aggressive investment strategy if they are ever going to be able to live comfortably in retirement. They are interested in investing in bonds, but they know very little about their valuation. They have contacted you, an investment advisor to assist them with their investment strategy. You begin the session by discussing the following questions with the couple to familiarize them with bonds: Bond Face Value Annual Coupon Rate Maturity Price A RM1,000 4.0 % 1 year RM990 B RM1,000 7.5 % 17 years RM990 RM1,000 8.5 % 25 years RM990 6. Why do investors pay attention to bond ratings and demand a higher interest rate for bonds with low ratings? 7. What are the differences between bond's coupon rate, current yield, and yield to maturity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started