Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Janet Jones is a pro gym teacher. She began her own company, Janet's Gym (proprietorship) in 2014. Consider the following facts, (as of December 31,

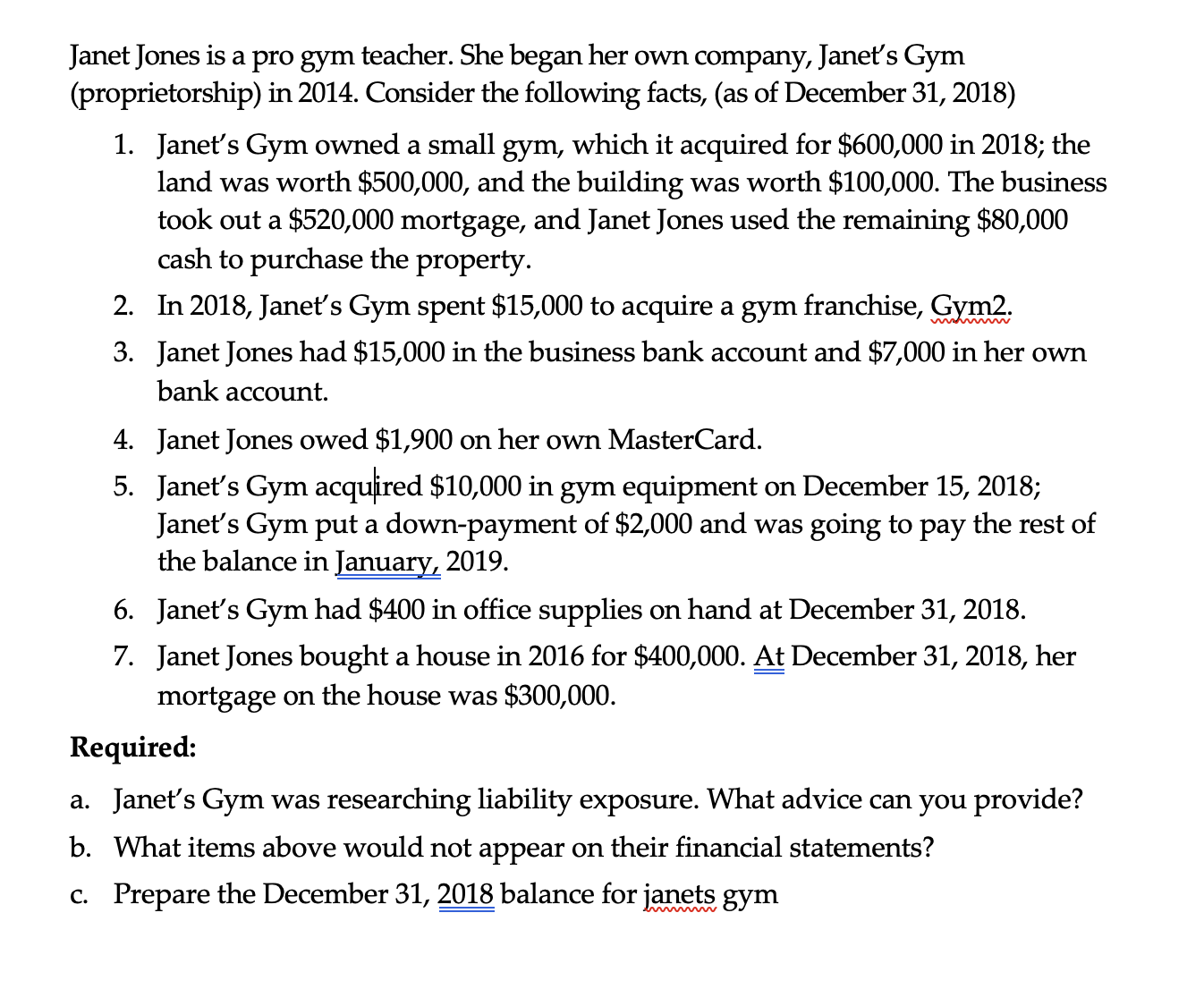

Janet Jones is a pro gym teacher. She began her own company, Janet's Gym (proprietorship) in 2014. Consider the following facts, (as of December 31, 2018) 1. Janet's Gym owned a small gym, which it acquired for $600,000 in 2018; the land was worth $500,000, and the building was worth $100,000. The business took out a $520,000 mortgage, and Janet Jones used the remaining $80,000 cash to purchase the property. 2. In 2018, Janet's Gym spent $15,000 to acquire a gym franchise, Gym2. 3. Janet Jones had $15,000 in the business bank account and $7,000 in her own bank account. 4. Janet Jones owed $1,900 on her own MasterCard. 5. Janet's Gym acquired \$10,000 in gym equipment on December 15, 2018; Janet's Gym put a down-payment of $2,000 and was going to pay the rest of the balance in January, 2019. 6. Janet's Gym had $400 in office supplies on hand at December 31, 2018. 7. Janet Jones bought a house in 2016 for $400,000. At December 31 , 2018, her mortgage on the house was $300,000. Required: a. Janet's Gym was researching liability exposure. What advice can you provide? b. What items above would not appear on their financial statements? c. Prepare the December 31, 2018 balance for janets gym

Janet Jones is a pro gym teacher. She began her own company, Janet's Gym (proprietorship) in 2014. Consider the following facts, (as of December 31, 2018) 1. Janet's Gym owned a small gym, which it acquired for $600,000 in 2018; the land was worth $500,000, and the building was worth $100,000. The business took out a $520,000 mortgage, and Janet Jones used the remaining $80,000 cash to purchase the property. 2. In 2018, Janet's Gym spent $15,000 to acquire a gym franchise, Gym2. 3. Janet Jones had $15,000 in the business bank account and $7,000 in her own bank account. 4. Janet Jones owed $1,900 on her own MasterCard. 5. Janet's Gym acquired \$10,000 in gym equipment on December 15, 2018; Janet's Gym put a down-payment of $2,000 and was going to pay the rest of the balance in January, 2019. 6. Janet's Gym had $400 in office supplies on hand at December 31, 2018. 7. Janet Jones bought a house in 2016 for $400,000. At December 31 , 2018, her mortgage on the house was $300,000. Required: a. Janet's Gym was researching liability exposure. What advice can you provide? b. What items above would not appear on their financial statements? c. Prepare the December 31, 2018 balance for janets gym Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started