Answered step by step

Verified Expert Solution

Question

1 Approved Answer

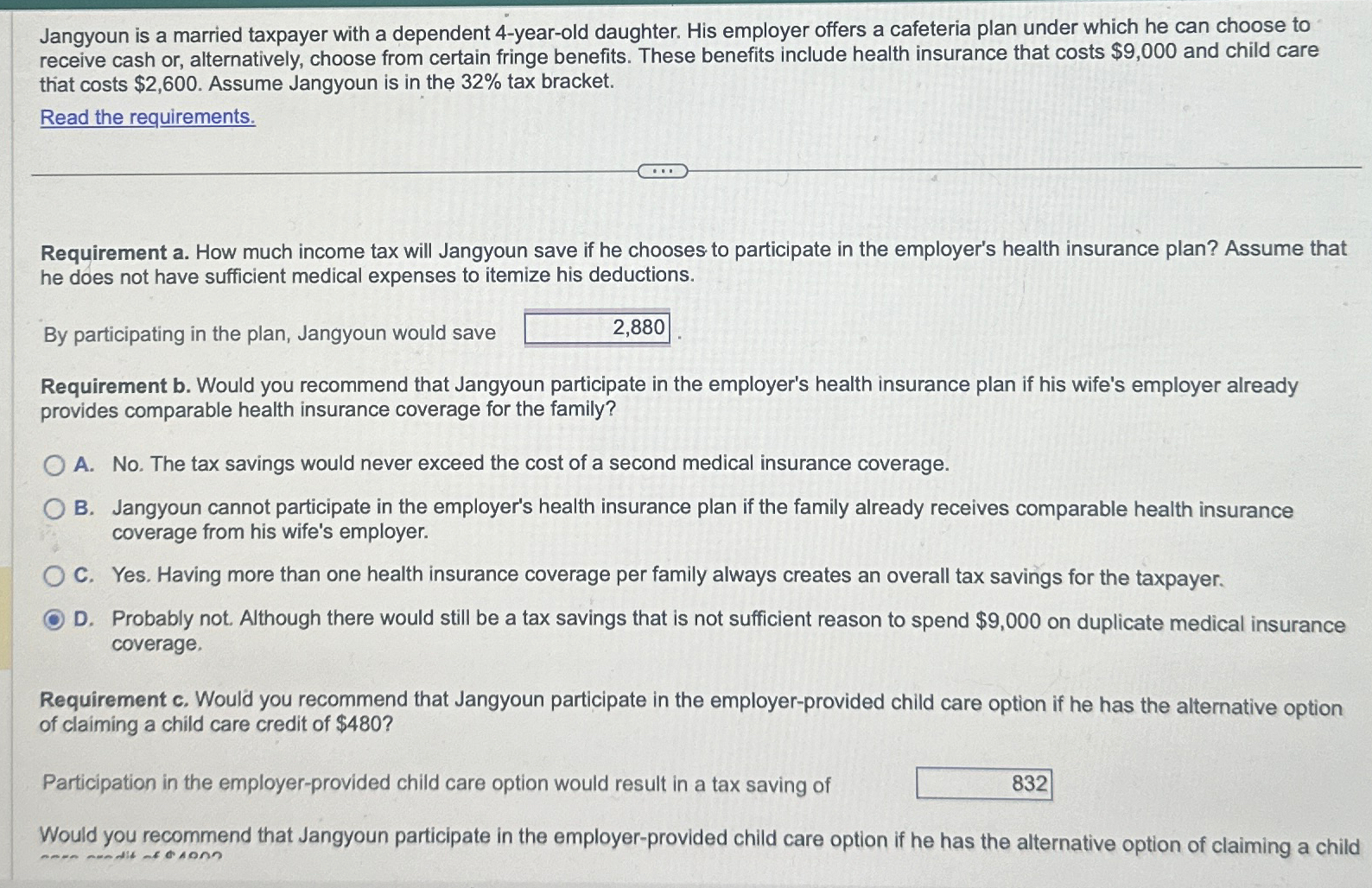

Jangyoun is a married taxpayer with a dependent 4 - year - old daughter. His employer offers a cafeteria plan under which he can choose

Jangyoun is a married taxpayer with a dependent yearold daughter. His employer offers a cafeteria plan under which he can choose to receive cash or alternatively, choose from certain fringe benefits. These benefits include health insurance that costs $ and child care that costs $ Assume Jangyoun is in the tax bracket.

Read the requirements.

Requirement a How much income tax will Jangyoun save if he chooses to participate in the employer's health insurance plan? Assume that he does not have sufficient medical expenses to itemize his deductions.

By participating in the plan, Jangyoun would save

Requirement b Would you recommend that Jangyoun participate in the employer's health insurance plan if his wife's employer already provides comparable health insurance coverage for the family?

A No The tax savings would never exceed the cost of a second medical insurance coverage.

B Jangyoun cannot participate in the employer's health insurance plan if the family already receives comparable health insurance coverage from his wife's employer.

C Yes. Having more than one health insurance coverage per family always creates an overall tax savings for the taxpayer.

D Probably not. Although there would still be a tax savings that is not sufficient reason to spend $ on duplicate medical insurance coverage.

Requirement Would you recommend that Jangyoun participate in the employerprovided child care option if he has the alternative option of claiming a child care credit of $

Participation in the employerprovided child care option would result in a tax saving of

Would you recommend that Jangyoun participate in the employerprovided child care option if he has the alternative option of claiming a child

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started