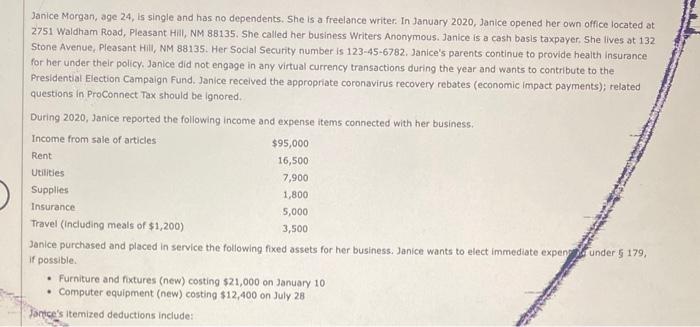

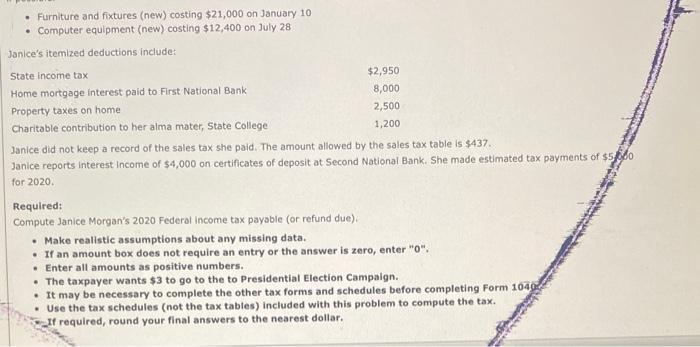

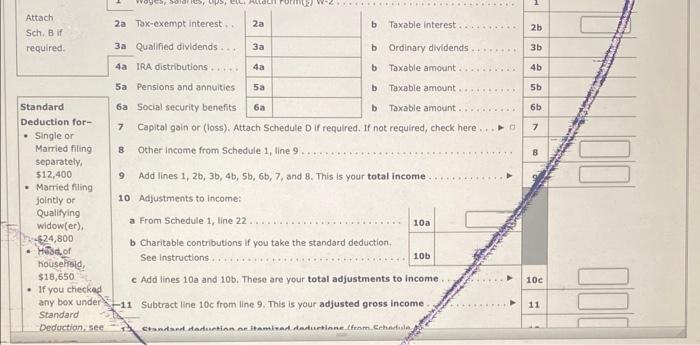

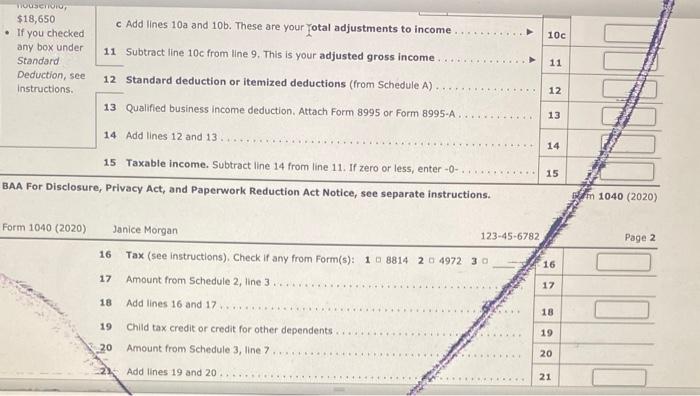

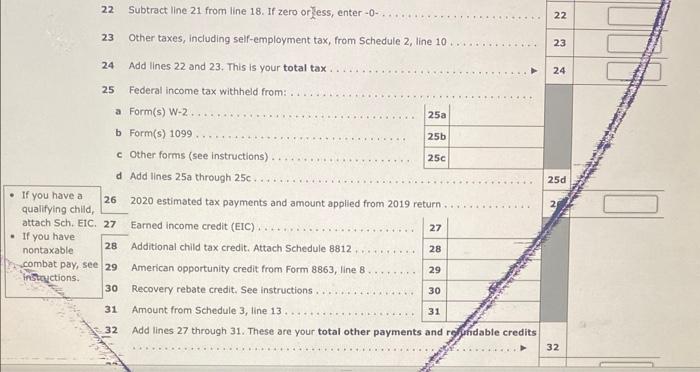

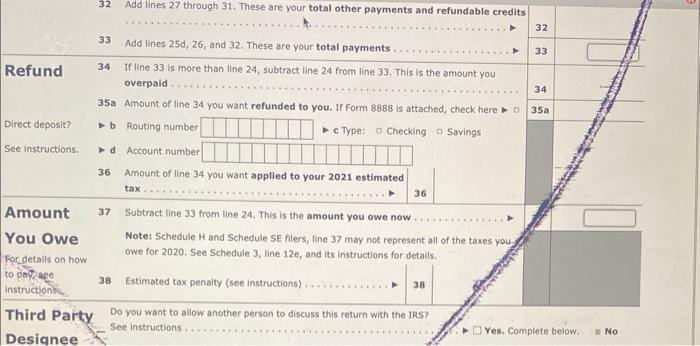

Janice Morgan, age 24, is single and has no dependents, She is a freelance writer. In January 2020, Janice opened her own office located at 2751 Waldham Road, Pleasant Hill, NM 88135. She called her business Writers Anonymous. Janice is a cash basis taxpayer. She lives at 132 Stone Avenue, Pleasant Hili, NM 88135. Her Soclal Security number is 123-45-6782. Janice's parents continue to provide health insurance for her under their policy. Janice did not engage in any virtual currency transactions during the year and wants to contribute to the Presidential Election Campaign Fund. Janice recelved the appropriate coronavirus recovery rebates (economic impact payments); related questions in ProConnect Tax should be ignored. During 2020, Janice reported the following income and expense items connected with her business. Janice purchased and placed in service the following fixed assets for her business. Janice wants to elect immediate expen /6 under 5179 , if possible. - Furniture and fixtures (new) costing $21,000 on January 10 - Computer equipment (new) costing $12,400 on July 28 Fontce's itemized deductions include: Janice did not keep a record of the sales tax she paid. The amount allowed by the sales tax table is $437. Janice reports interest income of $4,000 on certificates of deposit at Second National Bank. She made estimated tax payments of $5.560 22 Subtract line 21 from line 18. If zero or ess, enter 0 23 Other taxes, including self-employment tax, from Schedule 2 , line 10.... a Form(s) W-2........................ b Form(s) 1099 c Other forms (see instructions) ................. 25 c - If you have a 262020 estimated tax payments and amount applied from 2019 return .............. - If you have nontaxable 28 Additional child tax credit. Attach Schedule 8812 combat pay, see 29 American opportunity credit from Form 8863 , line 8 ....... insuretions. 30 Recovery rebate credit, See instructions 31 Amount from Schedule 3, line 13. 32. Add lines 27 through 31. These are your total other payments and ref fidable credits 32 Add lines 27 through 31 . These are your total other payments and refundable credits 33 Add lines 25d, 26, and 32. These are your total payments. 32 Third Party Do you want to allow another person to discuss this return with the IRS? Yes. Complete below. = No