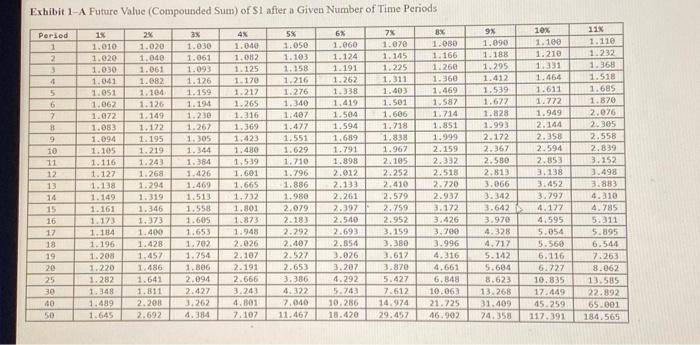

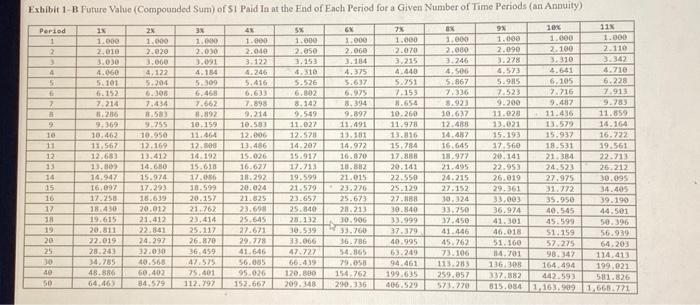

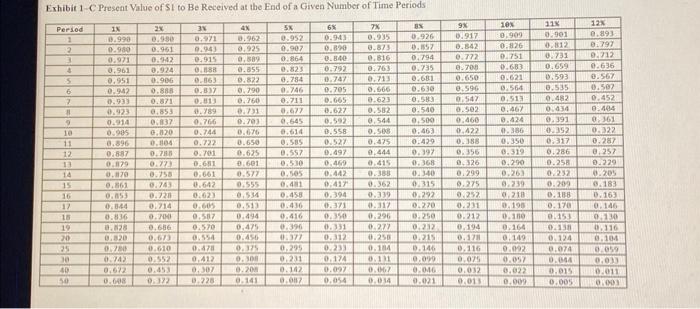

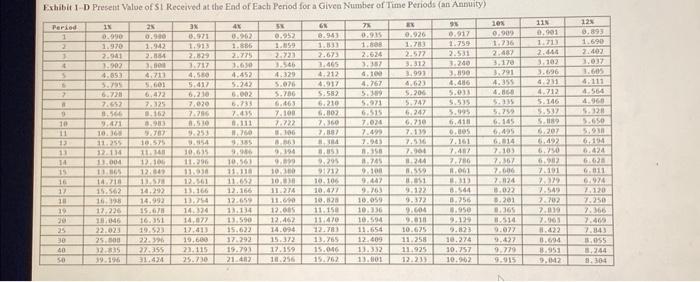

Janine is 25 and has a good job at a biotechnology compary. Janine estimates that she will need $943.000 in her total fetirement nest egg by the time she is 65 in order to have retirement income of $22.000 a year. (She expects that Soclal Security will pay her an additional $19,500 a year.) She currently has $6,000 in an IRA, an important part of her retirement nest egg. She believes her IRA will grow at an annual rate of 8 percent, and she plans to leave it untouched until she retires at age 65 . How much money will Janine have to accumulate in her company's 401(k) plan over the next 40 years in order to reach her retirement income goal? Use (Exhibit 1. . Exhibit 1. Exhibit 1.C. Exhibit1.D). Note: Use appropriate factor(s) from the tables provided. Round time value factor to 3 decimal places. Round intermediate and final answer to 2 decimal ploces. Exhibit 1-D Present Valoe of S1 Received at the End of Fach Period for a Given Number of Time Periods (an Annuity) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Feried & Ix & 28 & 3x & 4x & 5x & 6x & & Ex & n & 10x & 11x & 12x \\ \hline 1 & 0.9% & 0.990 & 0.971 & 0.262 & 0.252 & 0.943 & 0:935 & 0.226 & 0.917 & 0.909 & 0.901 & 0.893 \\ \hline 2 & 1.970 & 1,942 & 1,913 & 1.886 & 1.1559 & 1.613 & 1. deas & 1.783 & 1.759 & 1.736 & 1.711 & 1.690 \\ \hline 3 & 2.941 & 2.184 & 2.829 & 2.775 & 2.723 & 2.673 & 2.624 & 2.5n & 2.531 & 2.497 & 2.444 & 2.402 \\ \hline 4 & 3.902 & 3.809 & 3.717 & 3.690 & 3.546 & 1,465 & 3,37 & 3.312 & 3.240 & 3,170 & 3,102 & 3.037 \\ \hline 3 & 4.053 & 4.713 & 4,560 & 4.452 & 4.329 & 4.212 & & 3,993 & 3.199 & 3.791 & 3.626 & 3.605 \\ \hline 5 & 3.705 & 5,601 & 5.417 & 5.242 & 3.076 & 4.917 & 4.767 & 4.623 & 4.416 & 4.355 & 4.231 & 4.111 \\ \hline 2 & 6.721 & 6.472 & 6.210 & 6.002 & 5.706 & 5.582 & & 5.206 & 3.031 & & 4.712 & 4.564 \\ \hline a & 7.652 & 7.325 & 7.020 & 6.733 & 6.463 & 6.210 & 5.977 & 5.747 & 5.535 & 5.735 & 5.146 & 4.960 \\ \hline 9 & 0.546 & 0.162 & 7.716 & 7.415 & 7,100 & 6.807 & 6.515 & 6.247 & 3.995 & 3.75 & 5.537 & 5.321 \\ \hline 10 & 2.4 & 0.903 & 0.510 & 0.111 & 7.722 & 7,360 & 7.024 & 6.710 & 6.4111 & 6.145 & 5. 1189 & 5.650 \\ \hline 11 & 10.36 & 9.70 & 9.253 & 11.76 & 0.106 & 7. Bas & 7.490 & 7.113 & 0.005 & 6.425 & 5.207 & 5.231 \\ \hline 13 & 11.255 & 10.55 & 3.954 & 9.355 & a.nol & i. III & 7.203 & 7.516 & 7.161 & 6.014 & 0.492 & 6.104 \\ \hline 11 & 12.114 & & 10.675 & 9,946 & 9.124 & B. 853 & & 7.964 & 7.417 & 7.103 & 6.150 & 0.424 \\ \hline 14 & 11.004 & 12.106 & 11.296 & 10,561 & & 9.295 & & 1.244 & 7.780 & 7.367 & 6.917 & 6.628 \\ \hline is & 11.165 & 12.062 & 11.32 & 11.111 & 10.250 & 91717 & 9.100 & 0.559 & & 7.606 & 7.101 & 6.011 \\ \hline 16 & 14.211 & 1).sm & 12.561 & 11.657 & 10,04 & 10,106 & 9.447 & & & 7.1124 & & 6.974 \\ \hline 1) & 15.562 & 14,297 & 13.166 & 12.166 & 11.214 & 10.477 & 9.163 & 9.172 & 8.544 & 0.022 & 7.549 & 1,120 \\ \hline III & 16. 128 & 14.992 & 13.754 & 12.659 & 11.6% & 10.628 & 10.059 & 9.372 & 0.756 & 0.201 & 7.702 & 7.250 \\ \hline 19. & 12,226 & 15.671 & 14.320 & 13.134 & 12.005 & 11.151 & 10.336 & 9.604 & 0.950 & 0.365 & 7.119 & 7.366 \\ \hline 20 & 11,046 & 16.351 & 14,077 & 13.590 & 12,467 & 11.470 & 10.594 & 9.011 & 9.127 & 1.514 & 7.001 & 7.463 \\ \hline 25 & 22.023 & 19.523 & 13,413 & 15.622 & 14.094 & 12.713 & 11.654 & 10.675 & 9.823 & 9.077 & 10.422 & 7.843 \\ \hline 30 & 25.500 & 22.3% & 19.660 & 17.292 & 15.372 & 13.765 & 12.409 & 11.258 & 10.274 & 9,47 & 0.694 & B.oss \\ \hline 40 & 32.835 & 27.155 & 22.115 & 19.793 & 17.159 & 15.046 & 11.332 & 11,925 & 10.757 & 9.770 & 8.951 & 18.244 \\ \hline 30 & 99.196 & 31,424 & 25.730 & 21.4 & 18.256 & 15.762 & 13.1101 & 12.233 & 10.262 & 9,915 & 9,042 & 0.304 \\ \hline \end{tabular} Exhibit 1-A Future Value (Compounded Sum) of S1 after a Given Number of Time Periods \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Deried. & 18 & 2x & 3x & 4x & 5x & 6x & 7x & 8x & 9x & 10x & 11x \\ \hline 1 & 1.010 & 1.020 & 1.030 & 1.049 & 1.050 & 1.060 & 1.070 & 1.e80 & 1.090 & 1. 100 & 1.110 \\ \hline 2 & 1.020 & 1.040 & 1.061 & 1.082 & 1.103 & 1.124 & 1.145 & 1.166 & 1.188 & 1.210 & 1.232 \\ \hline 3 & 1.030 & 1.061 & 1.093 & 1.125 & 1.158 & 1.191 & 1.225 & 1.260 & 1.295 & 1. 331 & 1.368 \\ \hline 4 & 1.041 & 1.082 & 1.126 & 1.170 & 1.216 & 1.262 & 1.311 & 1.360 & 1.412 & 1.464 & 1.518 \\ \hline 5 & 1.051 & 1.184 & 1.159 & 1.217 & 1.276 & 1.338 & 1.403 & 1.469 & 1.539 & 1.611 & 1.685 \\ \hline 6 & 1.062 & 1.126 & 1.194 & 1.265 & 1.340 & 1.419 & 1.501 & 1.587 & 1.677 & 1.772 & 1.870 \\ \hline 7 & 1.072 & 1. 149 & 1.230 & 1.316 & 1:407 & 1.504 & 1.606 & 1.714 & 1.828 & 1.949 & 2.076 \\ \hline 8 & 1.083 & 1.172 & 1.267 & 1.369 & 1.477 & 1.594 & 1.718 & 1.851 & 1.993 & 2.144 & 2. 305 \\ \hline 9 & 1.094 & 1.195 & 1.305 & 1,423 & 1.551 & 1,689 & 1.838 & 1.999 & 2.172 & 2.358 & 2.558 \\ \hline 10 & 1.105 & 1.219 & 1.344 & 1.480 & 1.629 & 1.791 & 1.967 & 2.159 & 2.367 & 2.594 & 2.839 \\ \hline 11 & 1.116 & 1.243 & 1.384 & 1.539 & 1.710 & 1.898 & 2.105 & 2.332 & 2.580 & 2.853 & 3.152 \\ \hline 12 & 1.127 & 1.268 & 1.426 & 1.601 & 1.796 & 2.012 & 2.252 & 2.518 & 2,813 & 3.138 & 3.498 \\ \hline 13 & 1.138 & 1.294 & 1.469 & 1.665 & 1.886 & 2.133 & 2,410 & 2.720 & 3.066 & 3.452 & 3.883 \\ \hline 14 & 1.149 & 1.319 & 1.513 & 1,732 & 1.980 & 2.261 & 2.579 & 2.937 & 3.342 & 3.797 & 4.310 \\ \hline 15 & 1.161 & 1.346 & 1.558: & 1.801 & 2.079 & 2.397 & 2.759 & 3.172 & 3.642 & 4.177 & 4. 785 \\ \hline 16 & 1.173 & 1.373 & 1. 605 & 1.873 & 2.183 & 2.540 & 2.952 & 3.426 & 3.970 & 4.595 & 5.311 \\ \hline 17 & 1.184 & 1.400 & 1.653 & 1.948 & 2.292 & 2.693 & 3.159 & 3,700 & 4.328 & 5.054 & 5.895 \\ \hline 18 & 1. 196 & 1. 428 & 1.702 & 2.026 & 2.407 & 2.854 & 3.380 & 3.996 & 4.717 & 5.569 & 6.544 \\ \hline 19 & 1.208 & 1,457 & 1.754 & 2.107 & 2.527 & 3.026 & 3.617 & 4.316 & 5.142 & 6.116 & 7.263 \\ \hline 20 & 1.220 & 1.486 & 1. 806 & 2.191 & 2.653 & 3.207 & 3.870 & 4,661 & 5.684 & 6.727 & 8.062 \\ \hline 25 & 1.282 & 1.641 & 2.094 & 2.666 & 3,386 & 4.292 & 5.427 & 6.848 & 8.623 & 10,835 & 13.585 \\ \hline 30 & 1.348 & 1.811 & 2.427 & 3.243 & 4.322 & 5.743 & 7.612 & 10.063 & 13.268 & 17.449 & 22.892 \\ \hline 40 & 1.489 & 2.208 & 3.262 & 4.891 & 7.040 & 10.286 & 14.974 & 21.725 & 31.499 & 45.259 & 65.001 \\ \hline 50 & 1.645 & 2.692 & 4. 384 & 7.107 & 11.467 & 18.420 & 29.457 & 46.902 & 74,358 & 117,391 & 184.565 \\ \hline \end{tabular} Exhibit 1-B Future Value (Compounded Sum) of $1 Paid In at the Find of Each Period for a Given Number of Time Periods (an Annuity) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Period & Ix & 2x & 3x & 4x & 5x & 6x & 7x & 8x & 9x & 10x & 11x \\ \hline 1 & 1.000 & 1.600 & 1.600 & 1.000 & 1.000 & 1.000 & 1.090 & 1.000 & 1.090 & 1.600 & 1.000 \\ \hline 2 & 2.010 & 2.020 & 2.030 & 2.049 & 2.650 & 2,060 & 2.070 & 2,080 & 2.090 & 2.100 & 2.110 \\ \hline 3 & 3.030 & 3.060 & 3.091 & 3.122 & 3.253 & 3.184 & 3.215 & 3.246 & 3.278 & 3.310 & 3.342 \\ \hline 4 & 4.060 & 4,122 & 4.184 & 4.246 & 4.310 & 4.375 & 4.440 & 4.506 & 4.573 & 4.641 & 4.710 \\ \hline 5 & 5.101 & 5.704 & 5,309 & 5.A16 & 5.526 & 5.637 & 5.751 & 5.867 & 5.9415 & 6.105 & 6.228 \\ \hline fi & 6.152 & 6.306 & 6.468 & 6.633 & 6.802 & 6,975 & 7.153 & 7.336 & 7.523 & 7.716 & 7,913 \\ \hline 7 & 7.214 & 7.434 & 7.662 & 7.898 & 8.142 & 8.394 & 18.654 & 3.923 & 9.200 & 9.487 & 9.783 \\ \hline 8 & 8.286 & 8.583 & 8.892 & 9.214 & 9.549 & 9.897 & 10.260 & 10.637 & 11.028 & 11.436 & 11.859 \\ \hline 2 & 9.362 & 9.755 & 10.159 & 10.583 & 11.027 & 11,491 & 11.978 & 12.468 & 13.021 & 13.572 & 14.164 \\ \hline 16 & 10.462 & 10.950 & 11.464 & 12.006 & 12.571 & 13.181 & 13.1116 & 14.487 & 15.193 & 15,937 & 16.722 \\ \hline 11 & 11.567 & 12.169 & 12,898 & 13,486 & 14.207 & 14,972 & 15.784 & 16,645 & 17,560 & 18,531 & 19.561 \\ \hline 12 & 12.683 & 13.412 & 14.192 & 15.026 & 15.917 & 16.870 & 17.888 & 18.977 & 20.141 & 21.384 & 22.713 \\ \hline 13 & 1), 809 & 14,650 & 15.610 & 16.627 & 17.713 & 10.882 & 20.141 & 21.495 & 22.953 & 24,523 & 26,212 \\ \hline 14 & 14.947 & 15.974 & 17.0186 & 111.297 & 19.599 & 21.015 & 22,559 & 24.215 & 26.019 & 27.975 & 30.095 \\ \hline 15 & 16.897 & 17.293 & 111.599 & 20.024 & 21.579 & 23.276 & 25.129 & 27.152 & 29.361 & 31.772 & 34.405 \\ \hline 16 & 17.258 & 18.639 & 20.157 & 21.025 & 23.657 & 25,673 & 27.1183 & 30.324 & 33,003 & 35.950 & 39.190 \\ \hline 17 & 18.434 & 20.012 & 21.762 & 23.691 & 25.849 & 28.213 & 39.840 & 33.750 & 36.974 & 40,545 & 44.501 \\ \hline 18 & 19.615 & 21.412 & 2), 414 & 25.645 & 25.132 & 30.906 & 33.999 & 37.450 & 41.301 & 45.599 & 50.396 \\ \hline 19 & 20.811 & 22.841 & 25.117 & 27.671 & 30.539 & 1833.760 & 37.379 & 41.446 & 46.018 & 51.159 & 56.939 \\ \hline 20 & 22.019 & 24.297 & 26.870 & 29.778 & 33.066 & 36.786 & 40.995 & 45.762 & 51.160 & 57.275 & 64.203 \\ \hline 25 & 28.243 & 32.030 & 36.459 & 41,646 & 47.727 & 54.865 & 63.249 & 73.106 & 114.701 & 98.347 & 114.413 \\ \hline 30 & 34.785 & 40.560 & 42.575 & 56.055 & 66.439 & 79.056 & 94.461 & 113.2113 & 136,308 & 164.494 & 199.021 \\ \hline 40 & 48.886 & 60.402 & 75.401 & 95.026 & 1720.860 & 154,762 & 199.635 & 259.057 & 337.882 & 442.593 & 581.826 \\ \hline 50 & 64,463 & 84,579 & 112,797 & 152.667 & 209.348 & 290,336 & 406.529 & 573.770 & 615,084 & 1,163,999 & 1,668.771 \\ \hline \end{tabular} Exhibit 1-C Present Value of S1 to Be Received at the Find of a Given Number of Time Periods \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Period & 1x & 2x & 3x & 4x & 5x & 6x & 7x & 8x & 9x & 10x & 118 & 12x \\ \hline 1 & 0.990 & 0.980 & 0.971 & 0.962 & 0.952 & 0.943 & 0.935 & 0.926 & 0.917 & 0.909 & 0.901 & 0.893 \\ \hline 2 & 0.950 & 0.961 & 0.243 & 0.925 & 0.907 & 0.8%9 & 0.873 & 0.1557 & 0.842 & 0.8726 & 0.812 & 0.797 \\ \hline 3 & 0.971 & 0.242 & 0.915 & 0,589 & 0.864 & 0.840 & 0.816 & 0.794 & 0.7m & 0.751 & 0.731 & 0.712 \\ \hline 4 & 0.961 & 0.924 & 0.1138 & 0.355 & 0.823 & 0.792 & 0.763 & 0.735 & e. 700 & 0.683 & 0.659 & 0.636 \\ \hline 5 & 0.951 & 0.996 & 0.063 & 0.822 & 0.784 & 0.747 & 0.713 & 0.681 & 0.650 & 0.621 & 0.593 & 0.567 \\ \hline 6 & 0.942 & 0.886 & 0.837 & 0.790 & 0.746 & 0.705 & 0.566 & 0.636 & 0.596 & 0.564 & 0.535 & 0.507 \\ \hline 7 & 0.933 & 0.871 & 0.813 & 0.760 & 0.711 & 0.665 & 0.623 & 0,5B3 & 0.547 & 0,517 & 0.482 & 0.452 \\ \hline & 0.923 & 0.853 & 0.789 & 0.731 & 0.677 & 0.627 & 0.582 & 0.540 & 0.502 & 0.467 & 0.434 & 0.404 \\ \hline 2 & 0.914 & 0.0137 & 0.766 & 0.703 & 0.645 & 0.592 & 0.544 & 0.500 & 0.460 & 0.424 & 0.391 & 0.361 \\ \hline 10 & 0.995 & 0,020 & 0.744 & 0.676 & 0.614 & 0.558 & 0.508 & 0.463 & 0.422 & 0.386 & 0.352 & 0.322 \\ \hline 11 & 0.396 & 0,104 & 0.722 & 0.650 & 0.585 & 0.527 & 0,475 & 0.429 & 0.188 & 0.350 & 0.317 & 0.287 \\ \hline 12 & 0.637 & 0.7118 & 0.701 & 0.625 & 0.557 & 0.497 & 0.444 & 0.397 & 0.356 & 0.319 & 0.286 & 0.257 \\ \hline 13 & 0.1789 & 0.7n & 0.611 & 0.601 & 0.5310 & 0,459 & 0.415 & 0,368 & e. 126 & 0.290 & 0.25 . & 0.229 \\ \hline 14 & 0.1170 & 0.758 & 0.661 & 0.5n & 0.505 & 0.442 & 0.3818 & 0.340 & 0.299 & 0.263 & 0.232 & 0.205 \\ \hline 15 & 0.861 & 0.743 & 0.642 & 0.555 & 0.411 & 0.417 & 0.362 & 0.315 & 0.275 & 0.239 & 0.209 & 0.183 \\ \hline 16 & 0.053 & 0.7211 & 0.623 & 0.534 & 0.458 & 0,324 & 0.339 & 0.292 & 0.252 & 0.218 & 0.188 & 0.163 \\ \hline 17 & 0.044 & 0.714 & 0.605 & 0,513 & 0.436 & 0.371 & 0.317 & 0.270 & 0.231 & 0.195 & 0.170 & 0.146 \\ \hline 15 & 0.836 & 0.704 & 0.5817 & 0.494 & 0.416 & 0.350 & 0.296 & 0.250 & 0.212 & 0.1110 & 0.153 & 0.130 \\ \hline 19 & a.k28 & 0.686 & 0.570 & 0,475 & 0.396 & 0.331 & 0.277 & 0.212 & 0.194 & 0.164 & 0.131 & 0.116 \\ \hline 20 & 0.820 & 0.673 & 0.554 & 0.456 & 0.37 & 0.312 & 0.250 & 0.215 & 0.1711 & 0.149 & 0.124 & 0.104 \\ \hline 25 & 0.780 & 0.610 & 0.877 & 0.375 & 0.225 & 0.233 & 0.184 & 0.146 & 0.116 & 0.002 & 0.074 & 0.059 \\ \hline 30 & 0.742 & 0.552 & 0,412 & 0.301 & 0,231 & 0,174 & 0.111 & 0.0% & 0.075 & 0.057 & 0.044 & 0.013 \\ \hline 40 & 0.672 & 0.453 & 0,307 & 0.20s & 0.142 & 0.027 & 0.067 & 0.046 & 0.032 & 0.022 & 0.015 & 0.011 \\ \hline 50 & 0.698 & 0,372 & 0.228 & 0.141 & 0.017 ? & 0.054 & 0.034 & 0.021 & 0.011 & 0.009 & 0.005 & 0.003 \\ \hline \end{tabular}