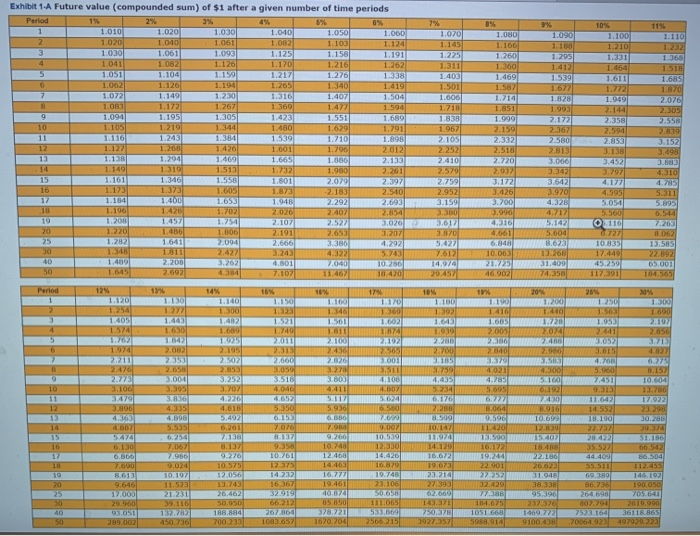

Janine is 25 and has a good job at a biotechnology company. Janine estimates that she will need $935,000 in her total retirement nest egg by the time she is 65 in order to have retirement income of $28,000 a year. (She expects that Social Security will pay her an additional $16,000 a year) She currently has $2,000 in an IRA, an important part of her retirement nest egg. She believes her IRA will grow at an annual rate of 12 percent, and she plans to leave it untouched until she retires at age 65. How much will Janine's IRA be worth when she needs to start withdrawing money from it when she retires? Use Exhibit 1-A. (Round time value factor to 3 decimal places and answer to 2 decimal places.) Future value of RA Exhibit 1.A Future value (compounded sum) of $1 after a given number of time periods Period 2% 3% 6% 7% 8% 9% 10% 11% 1 1.010 1.020 1.030 1.040 1.050 1.000 1.070 1.080 1.090 1.100 1.110 1.020 1,040 1.061 1.082 1.103 1.124 1.160 1.188 1.210 3 1.030 1.061 1.093 1.125 1.150 1.191 1.225 1.260 1.295 1.331 1.368 4 1.041 1.082 1.126 1.170 1.216 1.262 1.311 1.300 1.412 1.518 5 1.051 1.104 1.159 1.217 1.226 1.338 1.403 1.469 1.539 1.611 1.65 0 1.062 1.120 1.194 1.340 1.419 1.501 1.587 1.772 1.870 7 1.072 1.149 1.230 1.310 1.407 1.504 1.000 1.7141 1.828 2.070 8 1.08 1.172 1.267 1.369 1.472 1.594 1.718 1.851 1.993 2.144 2.305 9 1.094 1.105 1.305 1.423 1.551 1.689 1.83 1.999) 2.172 2.358 10 1.105 1.219 1.344 1.480 1.629 1.967 2.159 2 167 2.594 2.8.19 11 1.116 1.243 1.384 1.559 1.710 1.898 2.1051 2.332 2.580 2.853 3.152 1.601 1.790 2012 27252 2.513 2.813 3130 3.498 13 1.138 1.200 1.665 1.030 2.133 2.410 2.720 3.000 3.452 1.149 1 319 1.513 1.732 1.980 2.261 2.579 2.937 15 1.161 1.346 1.558 1.801 2.079 2.397 2.759 3.172 3.642 4.785 16 1.173 1.373 1.605 1.873 -2.183 2.540 2.952 3.426 3.970 5.311 1.400 1.653 1.945 2.292 2.693.159 3.700 5.054 5.895 1.196 1.420 1.7021 2.020 2.407 2.854 3.990 5560 19 1.200 1.754 2.107 2.527 3.020 4.3161 5.142 0110 7.263 1.220 1.486 1.000 2.191 2.653 3.870 4.661 5.604 G727 25 1.282 1.641 2.094 2.666 3.80 4.292 5.427 6.848 3.623 10835 13.585 30 2.427 3.243 4322 5.743 7612 10.00 13.260 17.449 22.892 40 2.2001 4.501 7040 10280 14.974 21.725 31.409 45259 05.001 50 2.692 7.107 11.467 10.470 294571 46.002 74.358 117391 164.505 Period 13 14% 16% 17 10% tin 20 26% 1.120 1.1301 1.140 1.100 1.170 1.180 1.10.200 1250 1300 2 1.300 1346360 10 1410 1440 1:50 1000 3 1.405 1.4403 1.482 1.643 1.065 2.107 4 1.574 1.630 1.7401 1874 1.939 2005 2856 5 1642 27011 2.100 2.192 2286 3.052 1.974 2.002 2.1 24365 2700 3.015 26601 3.001 2.1 2.476 2.658 3.759 4,021 4.300 5.900 1.157 9 3.000 3516 BOU 4,105 4.435 4.785 S1607,451 10.604 10 3.100 1.707 4.040 4.411 4.0/5234 5.695 11 3.479 3.836 4.652 5.11715.624 E 6170 627430 11.642 17.922 12 3.000 4.335 5.350 5.936 6.580 2.25 B.064 B916 14,552 23 298 13 5.492 6.15 6.680 7.00 8.509 9.590 10.699 18.190 30.286 4.567 6.201 7.07 ona 19.007 10.147 11:40 12.30 8.137 9.266 10.5.39 11974 15.500 157407 28.422 51.186 6.130 7.067 8.137 10,748 12.330 14.120 16.172 1840 35.527 06542 6.366 7.966 9.270 10/61 12.460 14.420 16.6721 19.240 22.100 44.400 66.504 7.000 3.024 10,57 12375 14.463 19.073 20.023 55.511 8.613 10.1971 12.056 14.232 16.777 19.748 23214 27252 31.048 69.389 146.192 20 9.646 11.523 13.743 16,367 19.461 23.106 27393 32.429 38.338 86.736 190.050 25 17.000 21.231 40.67 50.658 62.009 95.96 264.698 705 640 29.1960 50.950 66:212 85.850 111.065 143.3171 104.675 237376 807,794 2619.900 40 93,050 132.782 166.884 267.860 378.721 53.600 750.370 1051.668 1469.272 7523.164 36116.865 289.002 450.730 700.233 1083037 1670.700 2566.215 3927.357 5958.914 9100.4 70064.92 1 CEET 1.953 POR 001 COSTE Isco's RT 10.879 22.901