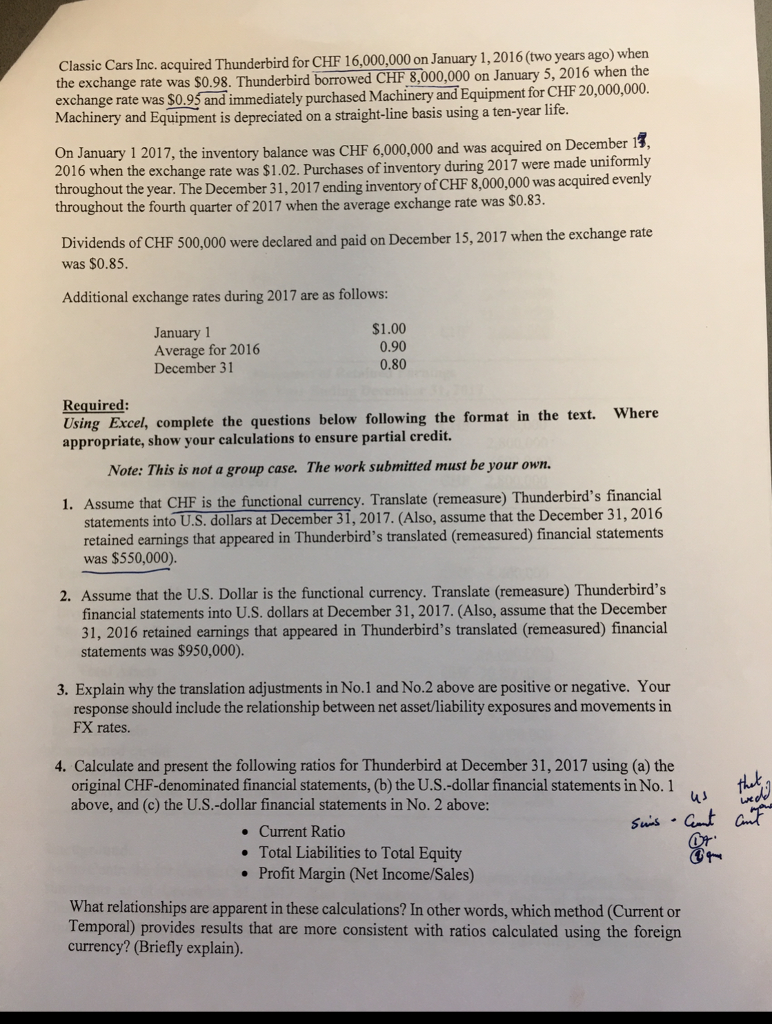

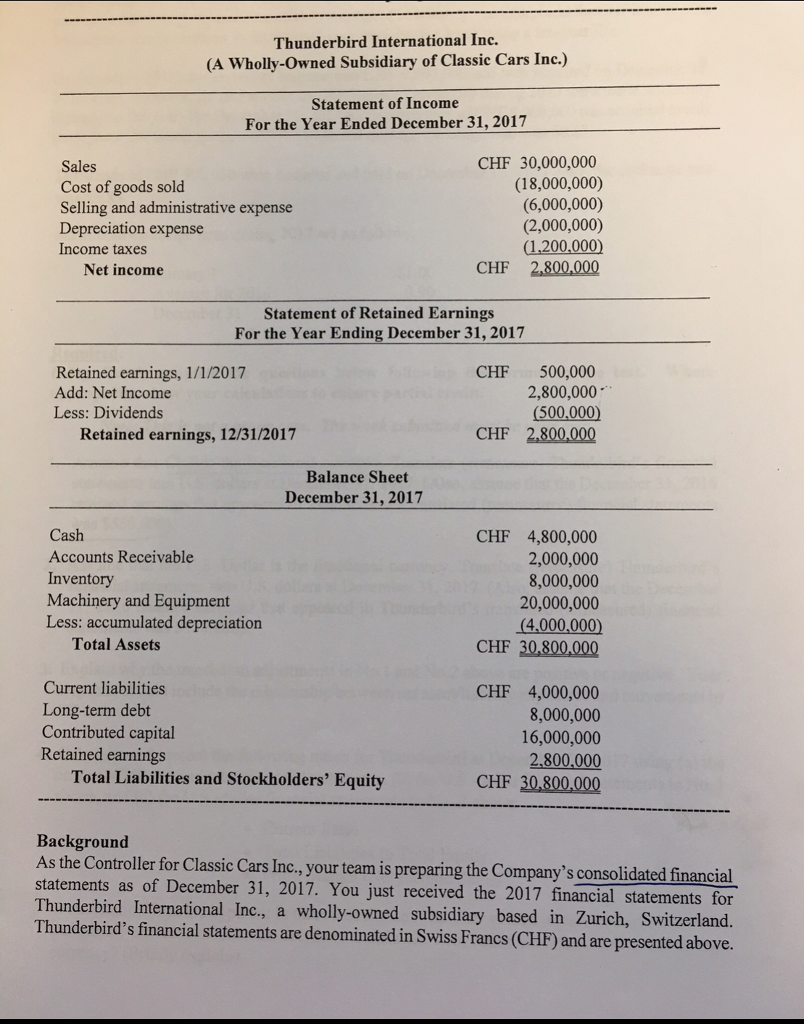

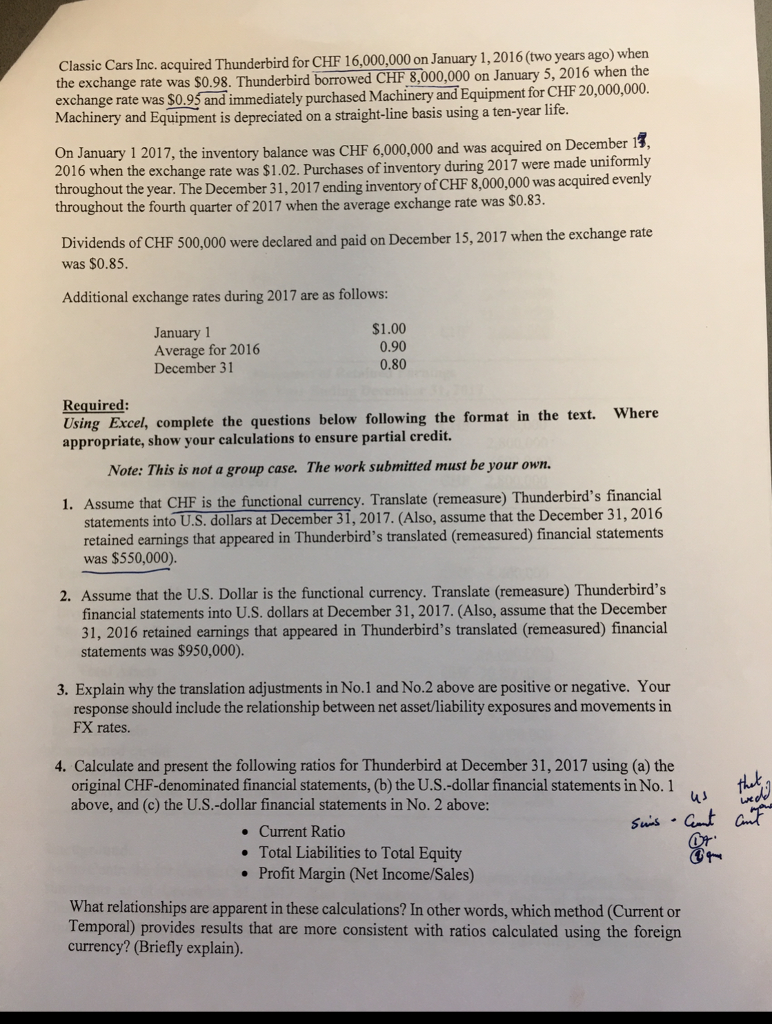

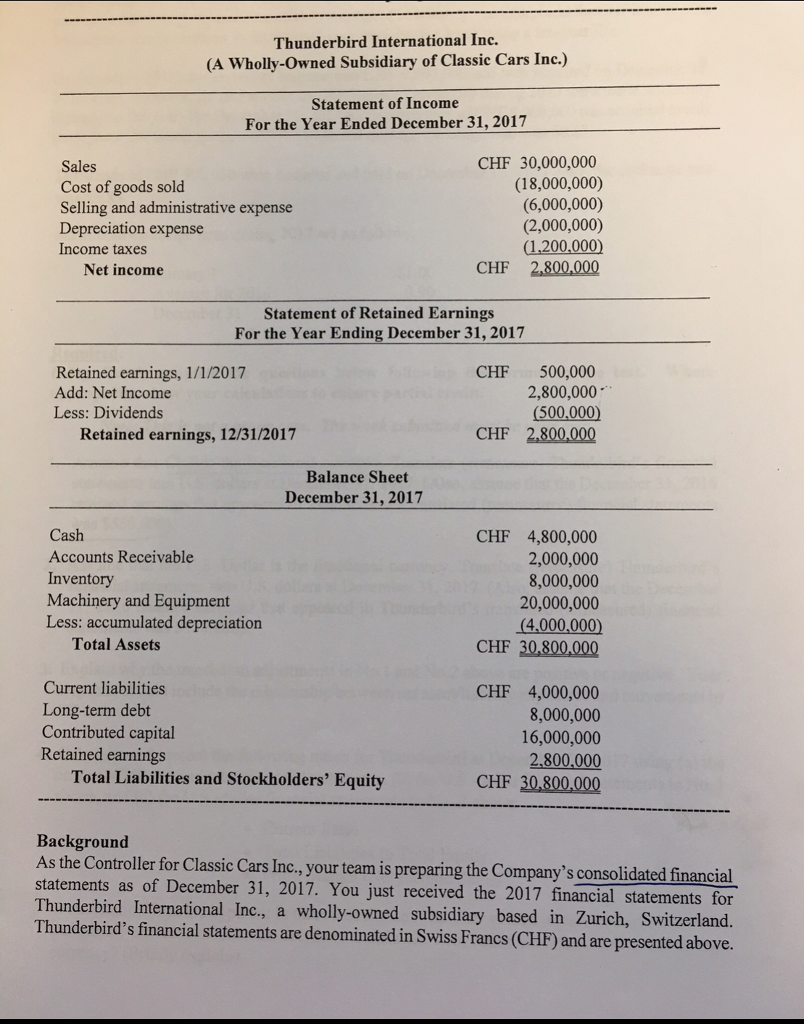

January 1, 2016(two years ago) when Classic Cars Inc. acquired Thunderbird for CHF 16,000,000 on the exchange rate was s0.98. Thunderbird borrowed CHF 8,000,000 on January 5, 2016 when the exchange rate was $0.95 and immediately purchased Machinery and Equipment for CHF 20,000,000. Machinery and Equipment is depreciated on a straight-line basis using a ten-year life On January 1 2017, the inventory balance was CHF 6,000,000 and was acquired on December 1 2016 when the exchange rate was $1.02. Purchases of inventory during 2017 were made uniformly throughout the year. The December 31, 2017 ending inventory of CHF 8,000,000 was acquired throughout the fourth quarter of 2017 when the average exchange rate was $0.83 evenly Dividends of CHF 500,000 were declared and paid on December 15, 2017 when the exchange rate was $0.85. Additional exchange rates during 2017 are as follows: January 1 Average for 2016 December 31 $1.00 0.90 0.80 Required: Using Excel, complete the questions below following the format in the text. Where appropriate, show your calculations to ensure partial credit. Note: This is not a group case. The work submitted must be your own. 1. Assume that CHF is the functional currency. Translate (remeasure) Thunderbird's financial statements into U.S. dollars at December 31, 2017. (Also, assume that the December 31,2016 retained earnings that appeared in Thunderbird's translated (remeasured) financial statements was $550,000). 2. Assume that the U.S. Dollar is the functional currency. Translate (remeasure) Thunderbird's financial statements into U.S. dollars at December 31, 2017. (Also, assume that the December 31, 2016 retained earnings that appeared in Thunderbird's translated (remeasured) financial statements was $950,000). 3. Explain why the translation adjustments in No.1 and No.2 above are positive or negative. Your response should include the relationship between net asset/liability exposures and movements in FX rates. 4. Calculate and present the following ratios for Thunderbird at December 31, 2017 using (a) the original CHF-denominated financial statements, (b) the U.S.-dollar financial statements in No.1 above, and (c) the U.S.-dollar financial statements in No. 2 above: 4 ? Current Ratio . Total Liabilities to Total Equity Profit Margin (Net Income/Sales) What relationships are apparent in these calculations? In other words, which method (Current or Temporal) provides results that are more consistent with ratios calculated using the foreign currency? (Briefly explain) January 1, 2016(two years ago) when Classic Cars Inc. acquired Thunderbird for CHF 16,000,000 on the exchange rate was s0.98. Thunderbird borrowed CHF 8,000,000 on January 5, 2016 when the exchange rate was $0.95 and immediately purchased Machinery and Equipment for CHF 20,000,000. Machinery and Equipment is depreciated on a straight-line basis using a ten-year life On January 1 2017, the inventory balance was CHF 6,000,000 and was acquired on December 1 2016 when the exchange rate was $1.02. Purchases of inventory during 2017 were made uniformly throughout the year. The December 31, 2017 ending inventory of CHF 8,000,000 was acquired throughout the fourth quarter of 2017 when the average exchange rate was $0.83 evenly Dividends of CHF 500,000 were declared and paid on December 15, 2017 when the exchange rate was $0.85. Additional exchange rates during 2017 are as follows: January 1 Average for 2016 December 31 $1.00 0.90 0.80 Required: Using Excel, complete the questions below following the format in the text. Where appropriate, show your calculations to ensure partial credit. Note: This is not a group case. The work submitted must be your own. 1. Assume that CHF is the functional currency. Translate (remeasure) Thunderbird's financial statements into U.S. dollars at December 31, 2017. (Also, assume that the December 31,2016 retained earnings that appeared in Thunderbird's translated (remeasured) financial statements was $550,000). 2. Assume that the U.S. Dollar is the functional currency. Translate (remeasure) Thunderbird's financial statements into U.S. dollars at December 31, 2017. (Also, assume that the December 31, 2016 retained earnings that appeared in Thunderbird's translated (remeasured) financial statements was $950,000). 3. Explain why the translation adjustments in No.1 and No.2 above are positive or negative. Your response should include the relationship between net asset/liability exposures and movements in FX rates. 4. Calculate and present the following ratios for Thunderbird at December 31, 2017 using (a) the original CHF-denominated financial statements, (b) the U.S.-dollar financial statements in No.1 above, and (c) the U.S.-dollar financial statements in No. 2 above: 4 ? Current Ratio . Total Liabilities to Total Equity Profit Margin (Net Income/Sales) What relationships are apparent in these calculations? In other words, which method (Current or Temporal) provides results that are more consistent with ratios calculated using the foreign currency? (Briefly explain)