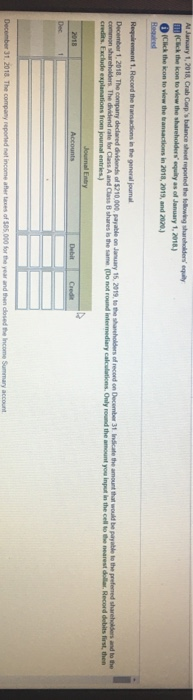

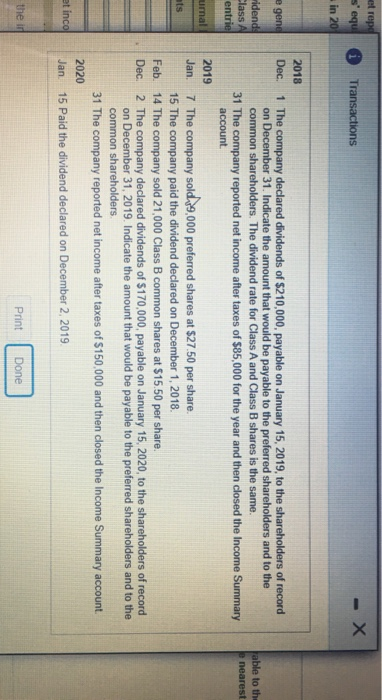

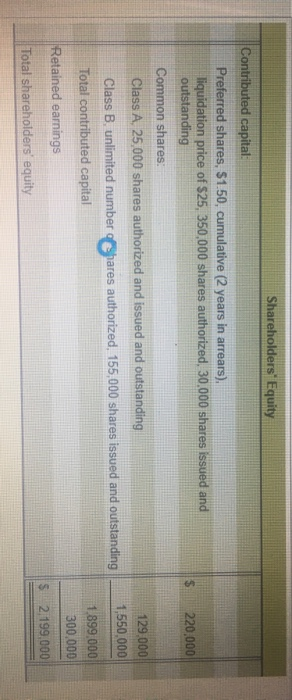

January 1, 2018, Crab Carp's balance sheet reported the following shareholders' equally Cck the icon to view the shareholders'qiy as of January 1, 2018) Click the icon to view the ansactions in 2018, 2019 and 2020.) Read Requirement 1. Record the transactions in the general joumal December 1, 2016. The company declared dividends of 210.000 payable on January 15, 2019. to the shareholders of record on December 31, indicate the amount that would be payable to the preferred shareholders and to the common shareholders. The dividend rate for Class A and Class B shares is the same. (Do not round intermediary calculations. Only round the amount you input in the cell to the nearest dollar. Record debits first, then credits. Exclude explanations from ouma entries) Journal 2018 Accounts Debit Credit Der 1 December 31, 2018. The company reported income after of S05.000 for the year and then dosed the income Summary account et rep s'equ Transactions - X in 20 egend vidend Class A entriel able to the e nearest ural ats 2018 Dec. 1 The company declared dividends of $210,000, payable on January 15, 2019, to the shareholders of record on December 31. Indicate the amount that would be payable to the preferred shareholders and to the common shareholders. The dividend rate for Class A and Class B shares is the same. 31 The company reported net income after taxes of $85,000 for the year and then closed the Income Summary account 2019 Jan 7 The company sold 9,000 preferred shares at $27.50 per share. 15 The company paid the dividend declared on December 1, 2018 Feb 14 The company sold 21,000 Class B common shares at $15.50 per share. Dec. 2 The company declared dividends of $170,000, payable on January 15, 2020, to the shareholders of record on December 31, 2019. Indicate the amount that would be payable to the preferred shareholders and to the common shareholders 31 The company reported net income after taxes of $150,000 and then closed the Income Summary account. 2020 Jan. 15 Paid the dividend declared on December 2, 2019 et inco the in Print Done $ 220,000 Shareholders' Equity Contributed capital: Preferred shares, $1.50, cumulative (2 years in arrears). liquidation price of $25, 350,000 shares authorized, 30,000 shares issued and outstanding Common shares Class A 25,000 shares authorized and issued and outstanding Class B, unlimited number ohares authorized, 155,000 shares issued and outstanding Total contributed capital 129.000 1,550,000 1.899,000 300,000 Retained earnings 2,199,000 Total shareholders' equity