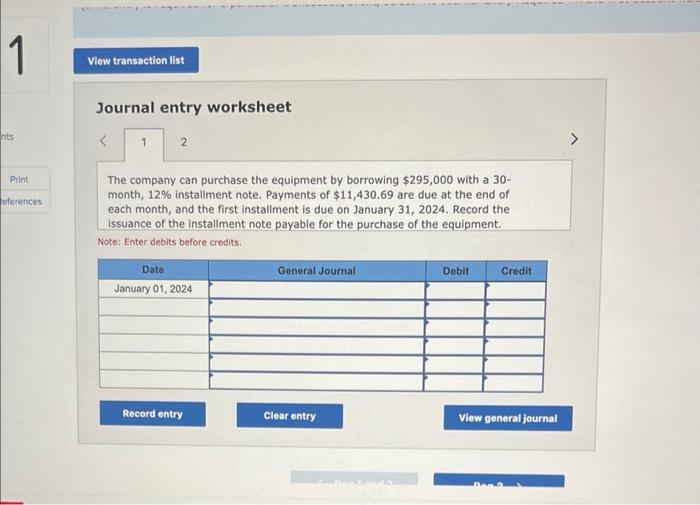

January 1, 2024. Paradise Parthers decides to upgrade recreational equipment at its resorts. The company is contemplating whether to purchase or lease the new equipment. Use.PV of \$1:and PVA of \$1. (Use appropriate factor(s) from the tables provided.) Required: 1. The company can purchase the equipment by borrowing $295,000 with a 30 -month, 12% instaliment note. Payments of $11,430.69 are due at the end of each month, and the first installment is due on January 31, 2024. Record the issuance of the installment note payable for the purchase of the equipment. 2. The company can sign a 30-month lease for the equipment by agreeing to pay $9,687.03 at the end of each month, beginning January 31, 2024. At the end of the lease, the equipment must be returned. Assuming a borrowing rate of 12\%, record the lease. 3. As of January 1, 2024, does the installment note or the lease have a greater effect on increasing the company's amount of reported debt, and by how much? 4. Suppose the equipment has a total value of $103,000 ot the end of the 30-month period, which option (purchasing with instaliment note or leosing) would likely be better? Complete this question by entering your answers in the tabs below. 1. The company can purchase the equipment by borrowing $295,000 with a 30 -month, 12% installment note. Payments of $11,430.69 are due at the end of each month, and the first instaliment is due on January 31, 2024. Record the issuance of the instaliment note payable for the purchase of the equipment. 2. The company can sign a 30 -month lease for the equipment by agreeing to pay $9,687.03 at the end of each month, beginning January 31, 2024. At the end of the lease, the equipment must be returned. Assuming a borrowing rate of 12%, record the lease. (If no entry is required for a particular trensaction/event, select "No Journal Entry Required" in the first account fleld.) Journal entry worksheet The company can purchase the equipment by borrowing $295,000 with a 30 month, 12% instaliment note. Payments of $11,430.69 are due at the end of each month, and the first instaliment is due on January 31,2024 . Record the issuance of the instaliment note payable for the purchase of the equipment. Note: Enter debits before credits