Answered step by step

Verified Expert Solution

Question

1 Approved Answer

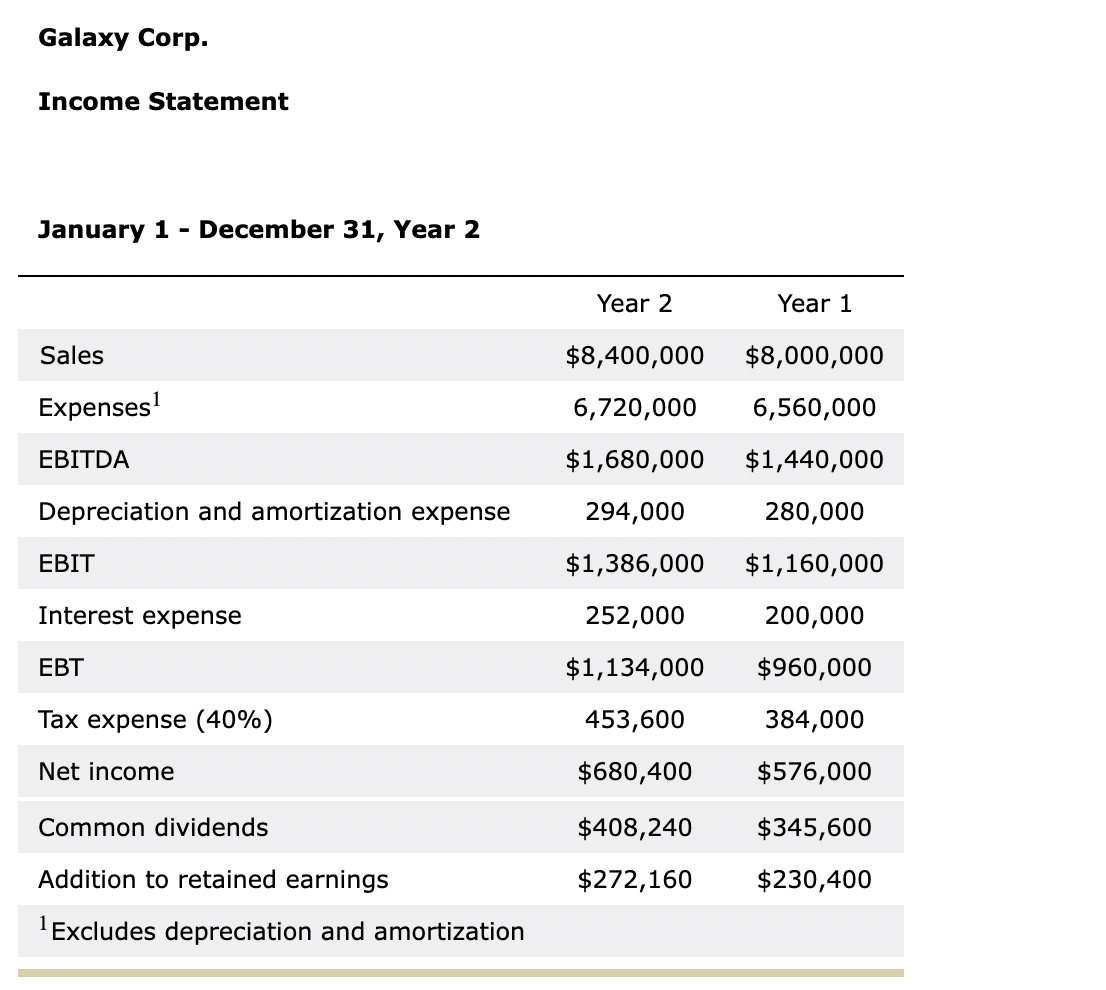

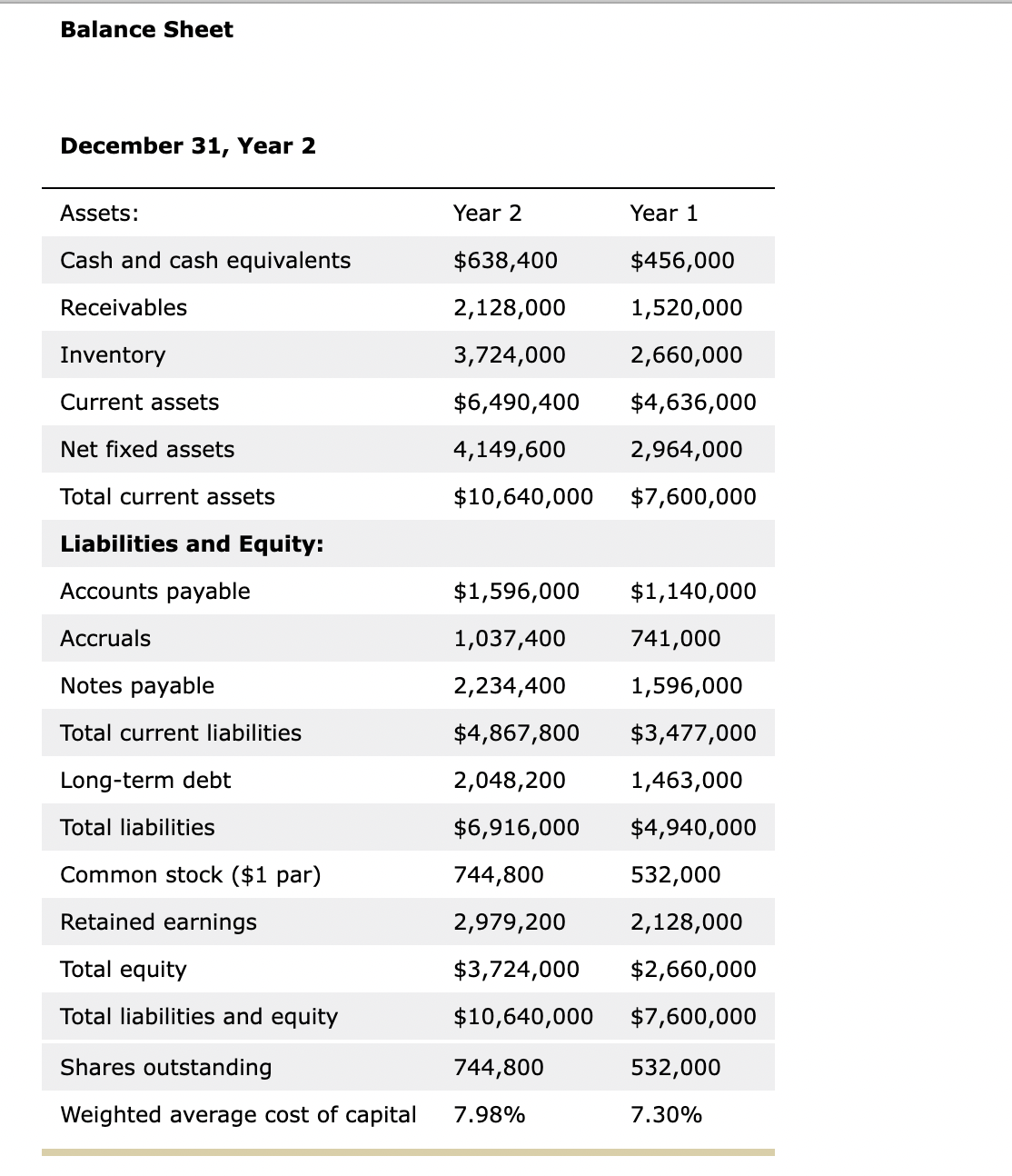

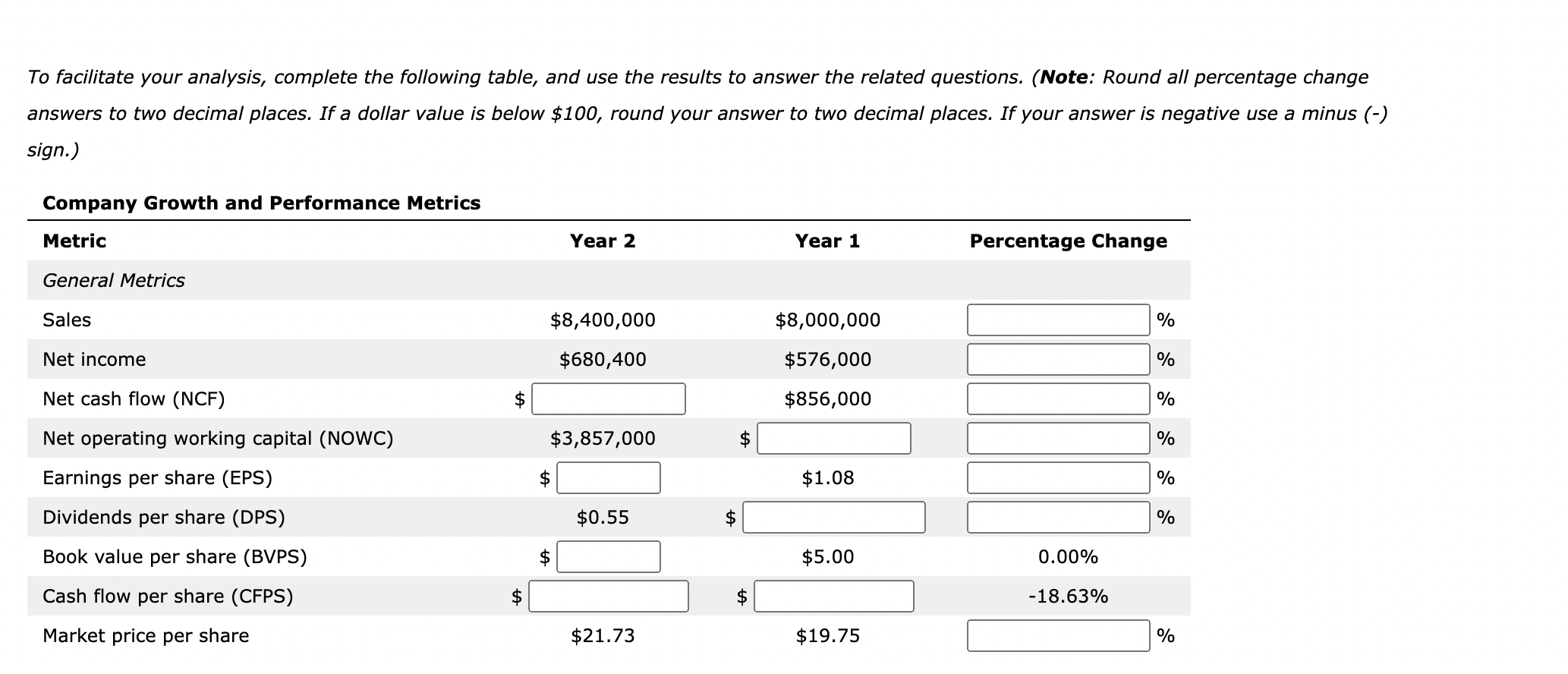

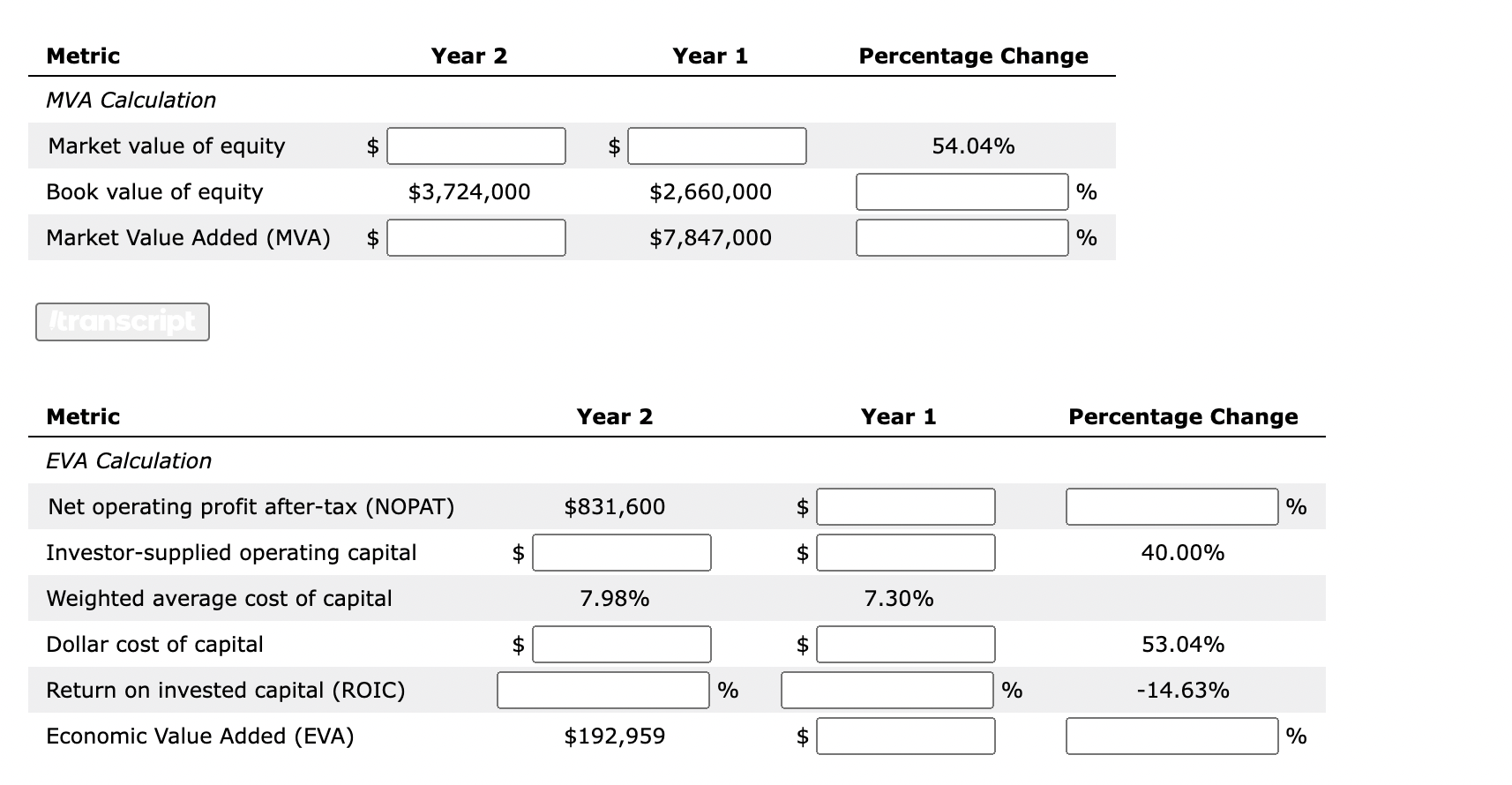

January 1 - December 31, Year 2 Balance Sheet December 31. Year 2 To facilitate your analysis, complete the following table, and use the results

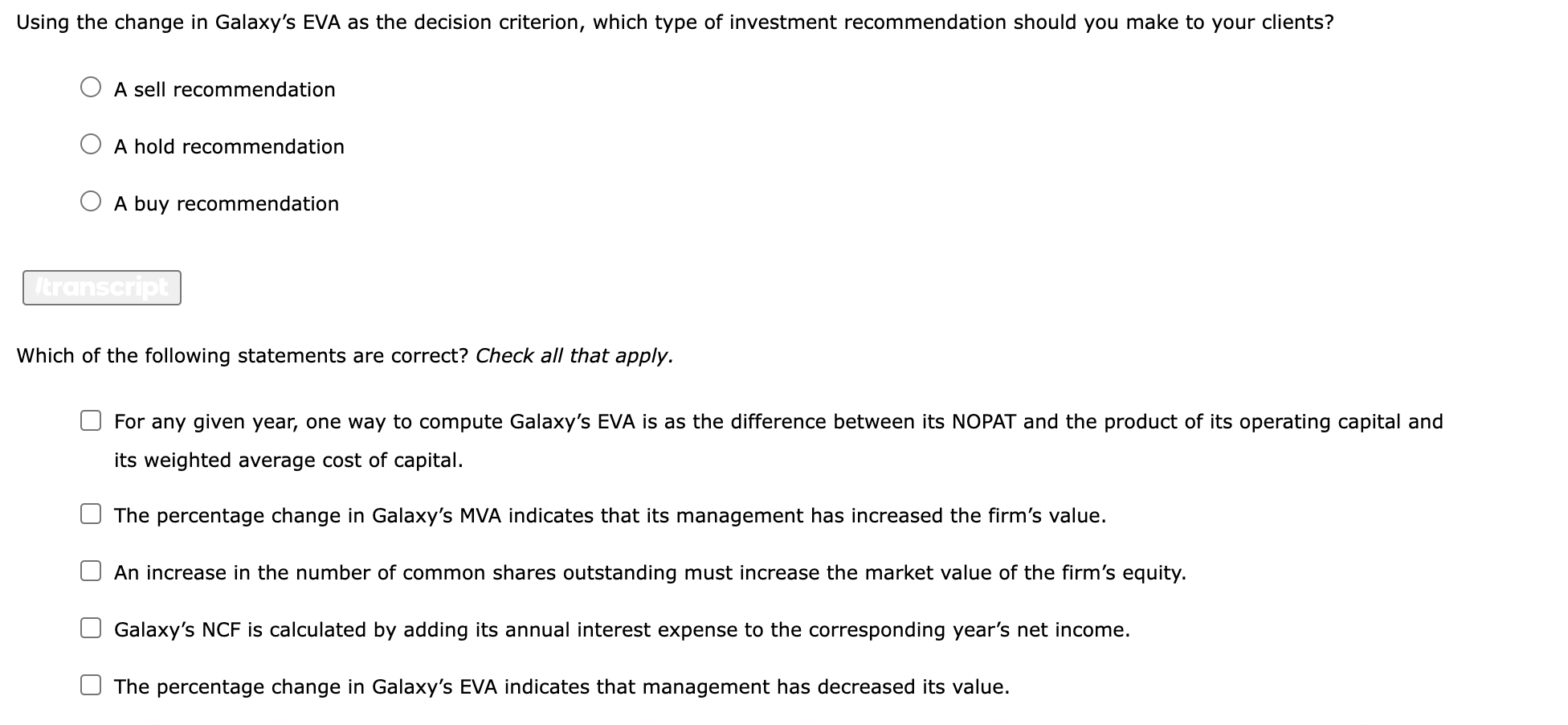

January 1 - December 31, Year 2 Balance Sheet December 31. Year 2 To facilitate your analysis, complete the following table, and use the results to answer the related questions. (Note: Round all percentage change answers to two decimal places. If a dollar value is below $100, round your answer to two decimal places. If your answer is negative use a minus ( - ) sign.) Using the change in Galaxy's EVA as the decision criterion, which type of investment recommendation should you make to your clients? A sell recommendation A hold recommendation A buy recommendation Which of the following statements are correct? Check all that apply. For any given year, one way to compute Galaxy's EVA is as the difference between its NOPAT and the product of its operating ca its weighted average cost of capital. The percentage change in Galaxy's MVA indicates that its management has increased the firm's value. An increase in the number of common shares outstanding must increase the market value of the firm's equity. Galaxy's NCF is calculated by adding its annual interest expense to the corresponding year's net income. The percentage change in Galaxy's EVA indicates that management has decreased its value. January 1 - December 31, Year 2 Balance Sheet December 31. Year 2 To facilitate your analysis, complete the following table, and use the results to answer the related questions. (Note: Round all percentage change answers to two decimal places. If a dollar value is below $100, round your answer to two decimal places. If your answer is negative use a minus ( - ) sign.) Using the change in Galaxy's EVA as the decision criterion, which type of investment recommendation should you make to your clients? A sell recommendation A hold recommendation A buy recommendation Which of the following statements are correct? Check all that apply. For any given year, one way to compute Galaxy's EVA is as the difference between its NOPAT and the product of its operating ca its weighted average cost of capital. The percentage change in Galaxy's MVA indicates that its management has increased the firm's value. An increase in the number of common shares outstanding must increase the market value of the firm's equity. Galaxy's NCF is calculated by adding its annual interest expense to the corresponding year's net income. The percentage change in Galaxy's EVA indicates that management has decreased its value

January 1 - December 31, Year 2 Balance Sheet December 31. Year 2 To facilitate your analysis, complete the following table, and use the results to answer the related questions. (Note: Round all percentage change answers to two decimal places. If a dollar value is below $100, round your answer to two decimal places. If your answer is negative use a minus ( - ) sign.) Using the change in Galaxy's EVA as the decision criterion, which type of investment recommendation should you make to your clients? A sell recommendation A hold recommendation A buy recommendation Which of the following statements are correct? Check all that apply. For any given year, one way to compute Galaxy's EVA is as the difference between its NOPAT and the product of its operating ca its weighted average cost of capital. The percentage change in Galaxy's MVA indicates that its management has increased the firm's value. An increase in the number of common shares outstanding must increase the market value of the firm's equity. Galaxy's NCF is calculated by adding its annual interest expense to the corresponding year's net income. The percentage change in Galaxy's EVA indicates that management has decreased its value. January 1 - December 31, Year 2 Balance Sheet December 31. Year 2 To facilitate your analysis, complete the following table, and use the results to answer the related questions. (Note: Round all percentage change answers to two decimal places. If a dollar value is below $100, round your answer to two decimal places. If your answer is negative use a minus ( - ) sign.) Using the change in Galaxy's EVA as the decision criterion, which type of investment recommendation should you make to your clients? A sell recommendation A hold recommendation A buy recommendation Which of the following statements are correct? Check all that apply. For any given year, one way to compute Galaxy's EVA is as the difference between its NOPAT and the product of its operating ca its weighted average cost of capital. The percentage change in Galaxy's MVA indicates that its management has increased the firm's value. An increase in the number of common shares outstanding must increase the market value of the firm's equity. Galaxy's NCF is calculated by adding its annual interest expense to the corresponding year's net income. The percentage change in Galaxy's EVA indicates that management has decreased its value Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started