Question

January 1 transaction will be recorded as: * Debit Cash and Credit Owners Capital Debit Cash and Credit Common Stock Debit Cash and Credit Treasury

January 1 transaction will be recorded as: * Debit Cash and Credit Owners Capital Debit Cash and Credit Common Stock Debit Cash and Credit Treasury Stock None of the options ....... The entry of January 12 transaction will include a debit of: * Service Revenue $8,000 Cash $8,000 Notes Receivable $4,000 None of the options ........ January 17 transaction will be recorded as: * Debit Supplies and Credit Accounts Payable of $2,000 Debit Supplies and Credit Supplies Expense of $2,000 Debit Supplies Expense and Credit Accounts Payable of $2,000 None of the options ........ The entry of January 31 will include a credit of: * Cash $3,000 Cash Dividend $3,000 Dividend Payable $3,000 None of the options ....... The Cash balance as of January 17 is: * $51,000 $53,000 $55,000 None of the options ......... The Accounts Payable balance at the end of the month is: * $2,000 $5,000 $7,000 None of the options

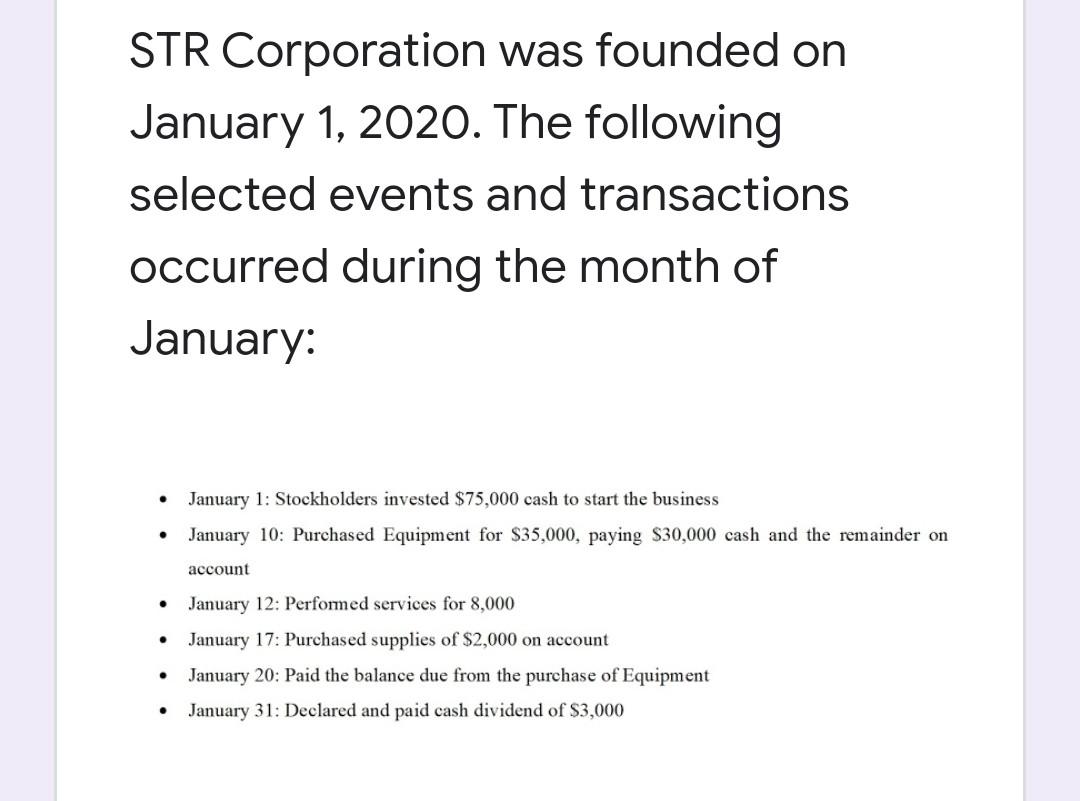

STR Corporation was founded on January 1, 2020. The following selected events and transactions occurred during the month of January: January 1: Stockholders invested $75,000 cash to start the business January 10: Purchased Equipment for $35,000, paying $30,000 cash and the remainder on . account . January 12: Performed services for 8,000 January 17: Purchased supplies of $2,000 on account January 20: Paid the balance due from the purchase of Equipment January 31: Declared and paid cash dividend of $3,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started