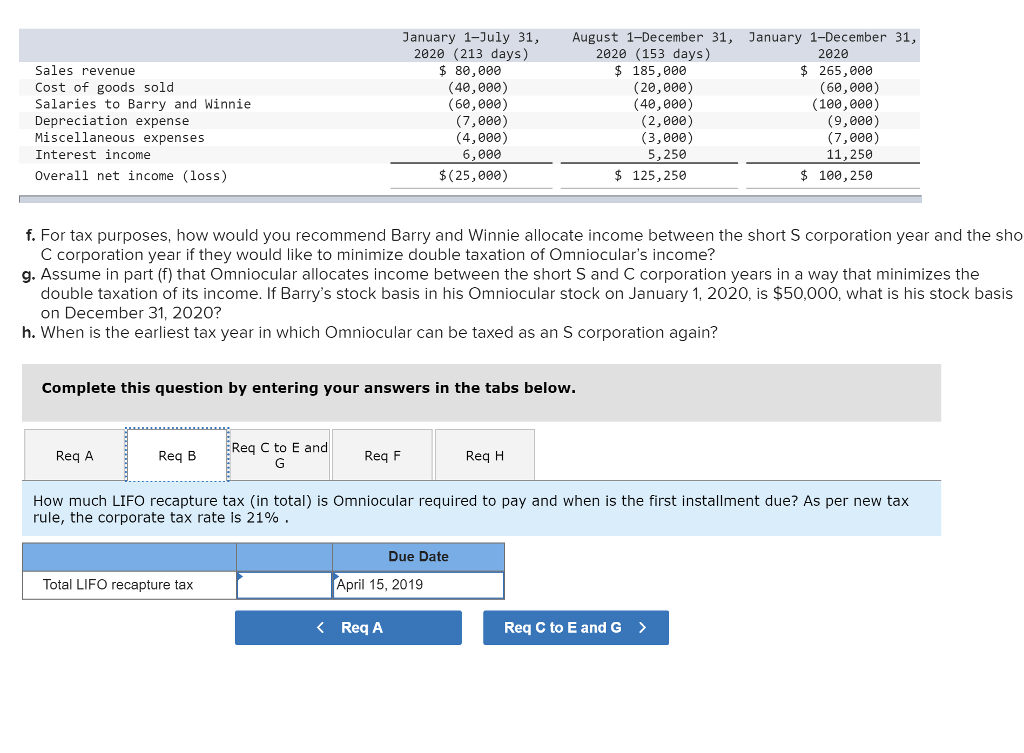

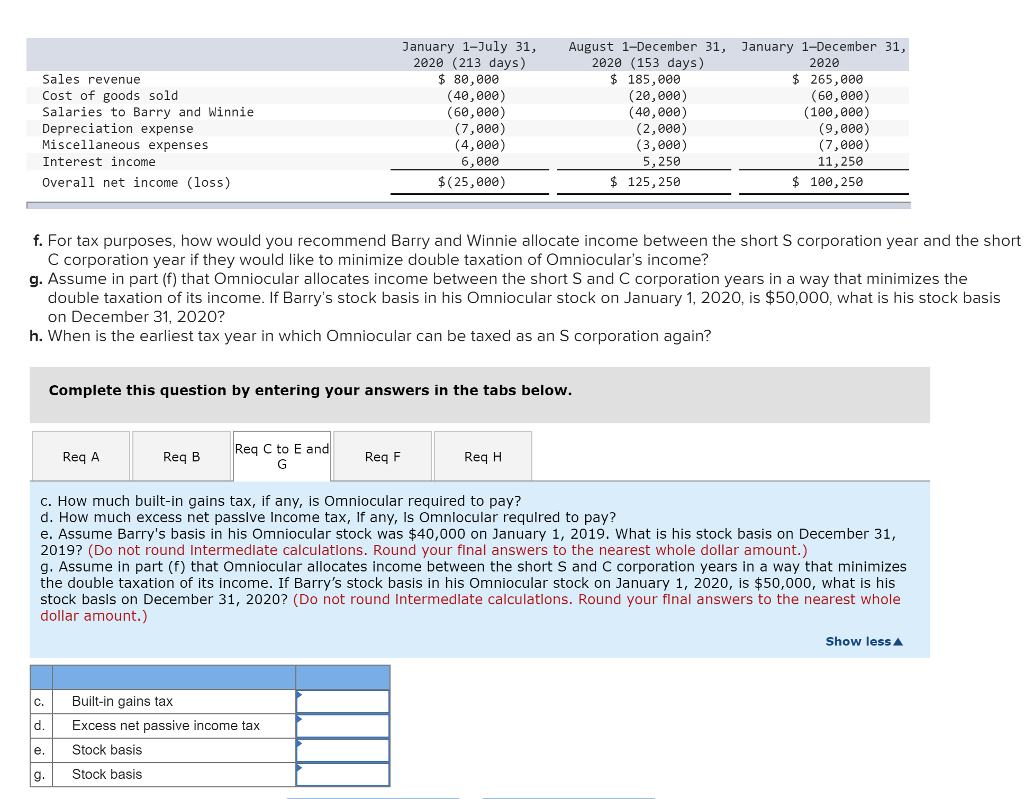

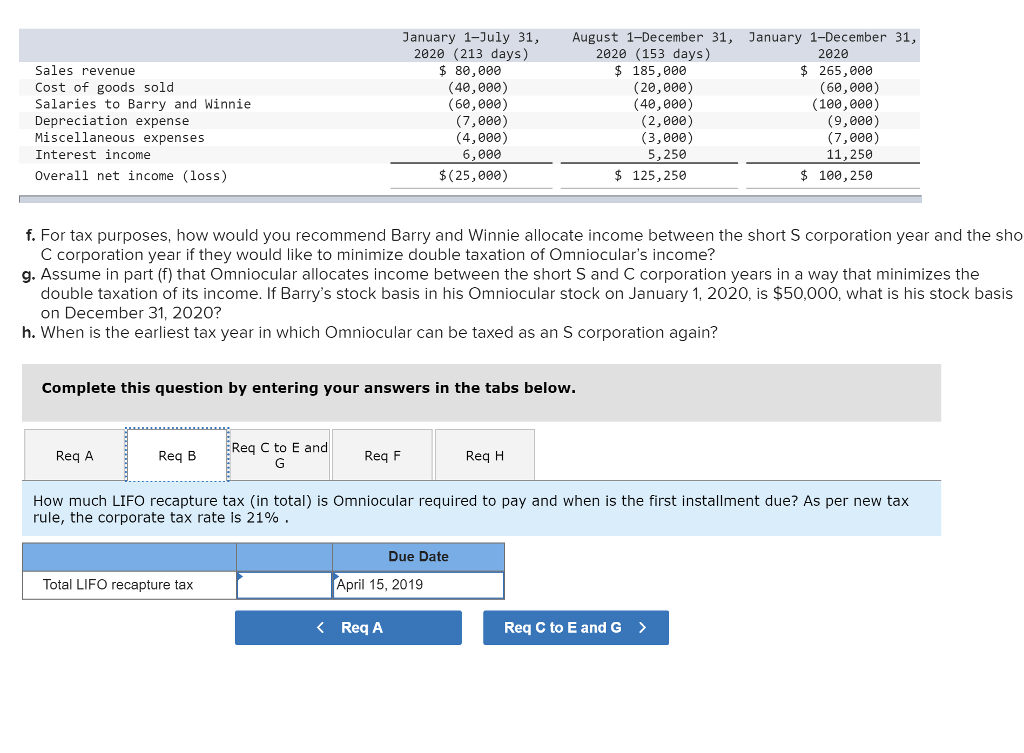

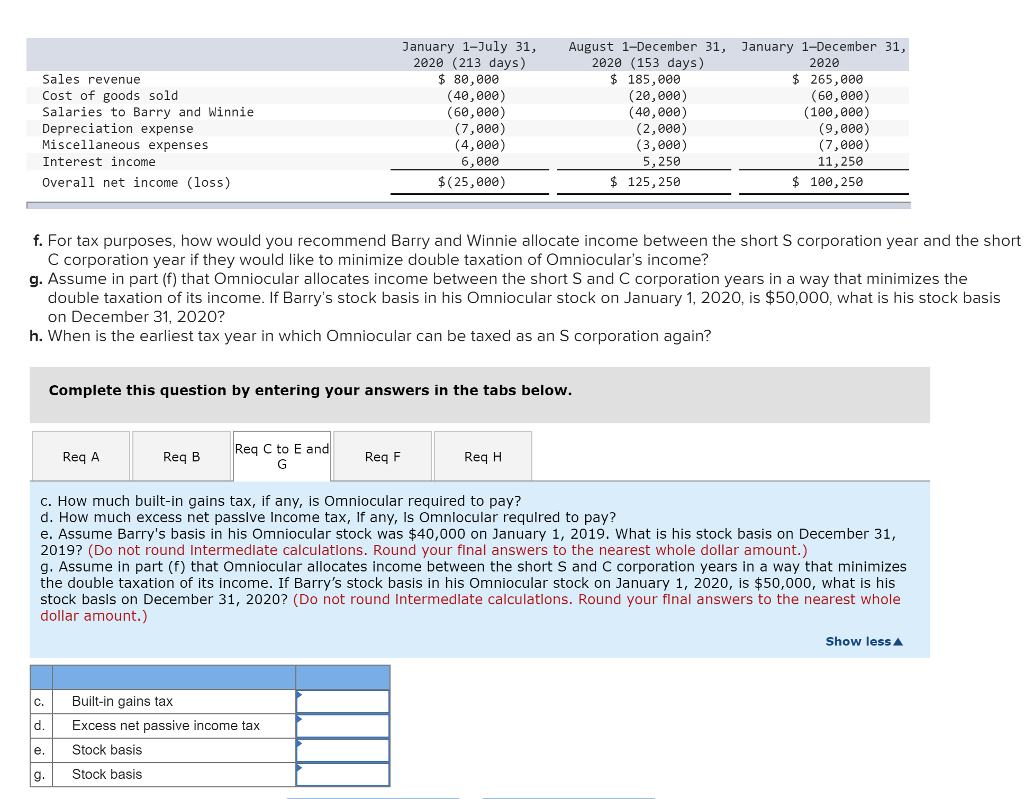

January 1-July 31 2020 (213 days) % 80,000 August 1-December 31, January 1-December 31, 2020 (153 days) $ 185,000 2020 Sales revenue Cost of goods sold Salaries to Barry and Winnie Depreciation expense Miscellaneous expenses Interest income (40,000) (60,000) (7,900) (4,000) 6,000 (20,000) (40,000) (2,000) (3,000) 5,250 $ 125,250 $ 265,000 (60,000) (100,000) (9,000) (7,000) 11,250 Overall net income (loss) $(25,000) $ 190,250 f. For tax purposes, how would you recommend Barry and Winnie allocate income between the short S corporation year and the sho C corporation year if they would like to minimize double taxation of Omniocular's income? g. Assume in part (f) that Omniocular allocates income between the short S and C corporation years in a way that minimizes the double taxation of its income. If Barry's stock basis in his Omniocular stock on January 1, 2020, is $50,000, what is his stock basis on December 31, 2020? h. When is the earliest tax year in which Omniocular can be taxed as an S corporation again? Complete this question by entering your answers in the tabs below. Req C to E and Req A Req B Req F Req H How much LIFO recapture tax (in total) is Omniocular required to pay and when is the first installment due? As per new tax rule, the corporate tax rate is 21% . Due Date Total LIFO recapture tax April 15, 2019 Req A Req C to E and G> January 1-July 31, 2020 (213 days) August 1-December 31, January 1-December 31, 2020 (153 days) $ 185,000 2020 $ 265,000 Sales revenue Cost of goods sold Salaries to Barry and Winnie Depreciation expense Miscellaneous expenses Interest income Overall net income (loss) $ 80,900 (40,000) (60,ee0) (7,000) (4,000) 6,000 $ (25,000) (20,e00) (40,000) (2,000) (3,000) 5,250 $ 125,250 (60,000) (100,000) (9,000) (7,000) 11,250 $ 100,250 f. For tax purposes, how would you recommend Barry and Winnie allocate income between the short S corporation year and the short C corporation year if they would like to minimize double taxation of Omniocular's income? g. Assume in part (f) that Omniocular allocates income between the short S and C corporation years in a way that minimizes the double taxation of its income. If Barry's stock basis in his Omniocular stock on January 1, 2020, is $50,000, what is his stock basis on December 31, 2020? h. When is the earliest tax year in which Omniocular can be taxed as an S corporation again? Complete this question by entering your answers in the tabs below. Req C to E and Req A Req B Req F Req H c. How much built-in gains tax, if any, is Omniocular required to pay? d. How much excess net passlve Income tax, If any, Is Omniocular required to pay? e. Assume Barry's basis in his Omniocular stock was $40,000 on January 1, 2019. What is his stock basis on December 31, 2019? (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) g. Assume in part (f) that Omniocular allocates income between the short S and C corporation years in a way that minimizes the double taxation of its income. If Barry's stock basis in his Omniocular stock on January 1, 2020, is $50,000, what is his stock basis on December 31, 2020? (Do not round Intermediate calculations. Round your final answers to the nearest whole dollar amount.) Show less C. Built-in gains tax Excess net passive income tax e. Stock basis g. Stock basis January 1-July 31 2020 (213 days) % 80,000 August 1-December 31, January 1-December 31, 2020 (153 days) $ 185,000 2020 Sales revenue Cost of goods sold Salaries to Barry and Winnie Depreciation expense Miscellaneous expenses Interest income (40,000) (60,000) (7,900) (4,000) 6,000 (20,000) (40,000) (2,000) (3,000) 5,250 $ 125,250 $ 265,000 (60,000) (100,000) (9,000) (7,000) 11,250 Overall net income (loss) $(25,000) $ 190,250 f. For tax purposes, how would you recommend Barry and Winnie allocate income between the short S corporation year and the sho C corporation year if they would like to minimize double taxation of Omniocular's income? g. Assume in part (f) that Omniocular allocates income between the short S and C corporation years in a way that minimizes the double taxation of its income. If Barry's stock basis in his Omniocular stock on January 1, 2020, is $50,000, what is his stock basis on December 31, 2020? h. When is the earliest tax year in which Omniocular can be taxed as an S corporation again? Complete this question by entering your answers in the tabs below. Req C to E and Req A Req B Req F Req H How much LIFO recapture tax (in total) is Omniocular required to pay and when is the first installment due? As per new tax rule, the corporate tax rate is 21% . Due Date Total LIFO recapture tax April 15, 2019 Req A Req C to E and G> January 1-July 31, 2020 (213 days) August 1-December 31, January 1-December 31, 2020 (153 days) $ 185,000 2020 $ 265,000 Sales revenue Cost of goods sold Salaries to Barry and Winnie Depreciation expense Miscellaneous expenses Interest income Overall net income (loss) $ 80,900 (40,000) (60,ee0) (7,000) (4,000) 6,000 $ (25,000) (20,e00) (40,000) (2,000) (3,000) 5,250 $ 125,250 (60,000) (100,000) (9,000) (7,000) 11,250 $ 100,250 f. For tax purposes, how would you recommend Barry and Winnie allocate income between the short S corporation year and the short C corporation year if they would like to minimize double taxation of Omniocular's income? g. Assume in part (f) that Omniocular allocates income between the short S and C corporation years in a way that minimizes the double taxation of its income. If Barry's stock basis in his Omniocular stock on January 1, 2020, is $50,000, what is his stock basis on December 31, 2020? h. When is the earliest tax year in which Omniocular can be taxed as an S corporation again? Complete this question by entering your answers in the tabs below. Req C to E and Req A Req B Req F Req H c. How much built-in gains tax, if any, is Omniocular required to pay? d. How much excess net passlve Income tax, If any, Is Omniocular required to pay? e. Assume Barry's basis in his Omniocular stock was $40,000 on January 1, 2019. What is his stock basis on December 31, 2019? (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) g. Assume in part (f) that Omniocular allocates income between the short S and C corporation years in a way that minimizes the double taxation of its income. If Barry's stock basis in his Omniocular stock on January 1, 2020, is $50,000, what is his stock basis on December 31, 2020? (Do not round Intermediate calculations. Round your final answers to the nearest whole dollar amount.) Show less C. Built-in gains tax Excess net passive income tax e. Stock basis g. Stock basis