Question

January 1st, 2015. Highland Beverages is a soft drink manufacturing company based in Wimberley, TX, specialized in the production and distribution of all-natural fruit-flavored sparkling

January 1st, 2015. Highland Beverages is a soft drink manufacturing company based in Wimberley, TX, specialized in the production and distribution of all-natural fruit-flavored sparkling beverages. It is considering replacing its existing plant by a larger, more modern facility, just outside the city. Management wishes, however, to go through a proper capital budgeting exercise before making any decision.

If it decides to build the new plant, the old one will be sold at the same time that the new one begins operating in order to avoid production delays. The opening of the new plant is planned for January 1st, 2016.

The purchase of the new plant will cost $75 Million payable at the time the plant opens. CEO Drew Crispin plans to sell the old plant for $12 Million. He already has a buyer.

The new plant will be fully depreciated over 40 years on a straight-line base basis, just like the old plant, which cost $40 Million to build and still has 12 years of economic life remaining.

Each 17-oz bottle of soft drink will be priced at $1.25 during 2015, and the price will increase by 3% per year thereafter (price increase takes effect on January 1st, and price is rounded to the nearest cent). These projected prices will hold regardless of whether the bottles are produced in the old or in the new plant. On the other hand, the direct costs of producing each bottle (direct labor, raw materials, and utilities related to operating the plant) will differ: 60% of the selling price if it is manufactured in the old plant, against 50% in the new plant.

The operating costs associated with Highlands head office in downtown Wimberley will amount to $5 million in 2015 (e.g., management salaries, marketing, selling, general and administrative expenses) and are expected to continue rising by about 2% per year, whether or not the company takes on the new project.

In addition, Highland management hired an outside consulting company to complete a feasibility study for this new project. When completed at the end of 2015, the company will pay a fee of $500,000 to the consulting company, due on January 1st, 2016.

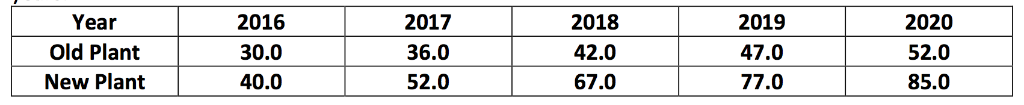

Below are the estimated future production amounts (in millions of bottles) in both plants for the next 5 years:

To somewhat simplify this capital budgeting exercise, management and its outside consultants have made the following assumptions:

a) For any given year, all revenues and expenses are received or paid at the end of the year. Revenues and expenses are to be expressed in millions of $, with 2 decimals maximum (e.g., $12.52 = Twelve million, five hundred and twenty thousand dollars).

b) The price of $12 Million (market value) at which the old plant will be sold happens to be exactly equal to its book value. This means that there will be no tax impact on the sale of the old plant.

c) We are considering only the next 5 years (2016-2020). Why? If management is to go ahead with the new plant, it wants the project to show positive economic value by the end of the first five years.

One of the points of discussion between management and its consultants is the choice of the discount rate for this capital budgeting exercise. It was finally decided that the discount rate would be the companys WACC.

Currently all of Highlands assets are exclusively financed by common equity and long-term debt (bonds).

The companys balance sheet shows the following values:

Bonds: $100,000,000 Common Equity:

Paid-in Capital: $35,000,000

Retained Earnings: $ 9,000,000

Bonds: In early January 2010, the company issued 100,000 20-year non-callable bonds with an 8% coupon paid semi-annually, at a$1,000 par value. They currently trade at $1,150. This is the only bond issue the company has made to date.

Common equity: Highland Beverages went public in 2005 and issued 1,000,000 shares at $35 each. It has not issued any new stock since then, nor has it repurchased any of its issued stock. The Highland stock currently trades at $54.

Currently, the yield on US Treasury bonds is 3.5%, and the required return for a well-diversified stock portfolio is 9%. Highland Beverages beta is estimated at 1.15.

Highland Beverages marginal tax rate is 40%.

Questions:

-

What are the relevant cash flows to consider for this project relative to the old plant? (Hint: use a timeline*)

-

What are the relevant cash flows to consider for this project relative to the new plant? (Hint: same as above)

-

Calculate the proper discount rate to use for this project (2 decimals)?

-

What are the NPV and IRR of this project as of today, January 1st 2015?

-

Based on all the assumptions and on your calculations, should the company proceed with the

new plant? Explain.

-

Aside from projected revenue and expense timing and amounts, tax considerations, or market

data, which assumption could be easily changed that would probably modify your answer in 4) and 5)?

*Timeline: To somewhat simplify capital budgeting exercises, each timeline year represents a particular point in time during the year. That point is either the beginning or the end date of the year. In this case, we assume that operating cash flows are incurred at the end of any given year. From an accounting standpoint, however, the last day of a given year (e.g., 12/31/2015) is exactly the same day as (01/01/2016).

Year Old Plant New Plant 2016 30.0 40.0 2017 36.0 52.0 2018 42.0 67.0 2019 47.0 77.0 2020 52.0 85.0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started