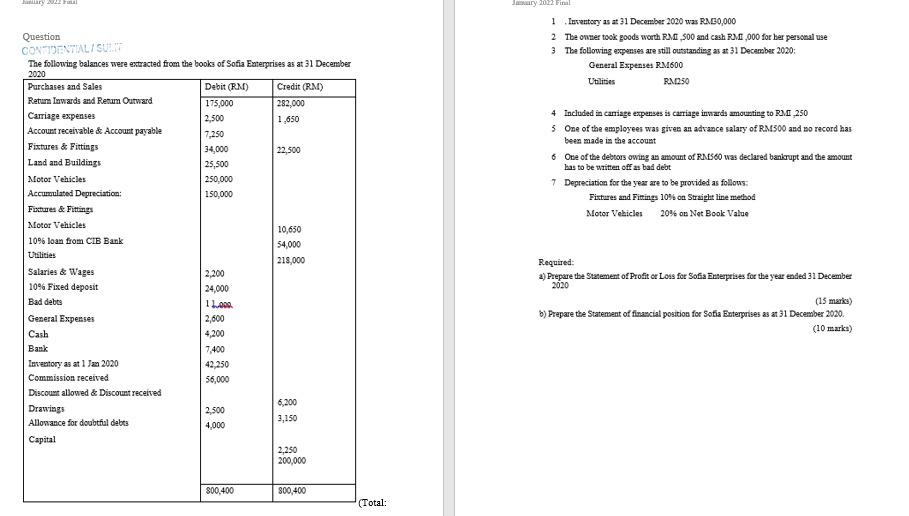

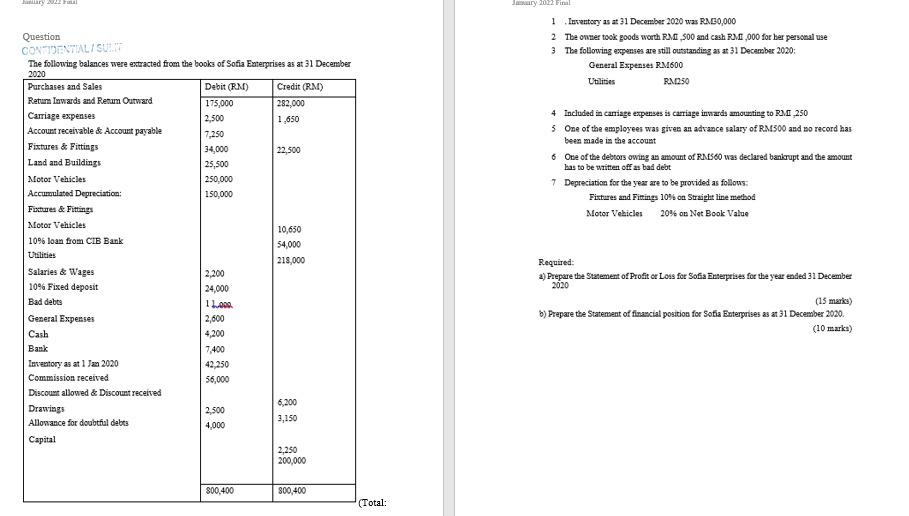

January 2012 Final 1 Inventory as at 31 December 2000 was RM30,000 2 The owner took goods worth RM 500 and cash RM6,000 for her personal use 3. The following expenses are still outstanding as at 31 December 2020: General Expenses RM600 Utilities RM250 4 Included in caniage expenses as carriage inwards amounting to RM 250 One of the employees was given an advance salary of RM300 and no record has been made in the account 6 One of the debtors owing an amount of RM560 was declared bankrupt and the amount has to be written off as bad debt 7 Depreciation for the year are to be provided as follows: Fixtures and Fittings 10% on Straight line method Motor Vehicles 20% on Net Book Value Question CONFIDENTIALISUNT The following balances were extracted from the books of Sofia Enterprises as at 31 December 2020 Purchases and Sales Debit (RM) Credit (RM) Return Tawards and Renam Outward 175,000 282,000 Carriage expenses 2,500 1.650 Account receivable & Account payable 7,250 Fixtures & Fittings 34,000 22,500 Land and Building 25,500 Motor Vehicles 250,000 Accumulated Depreciation: 150,000 Fictures & Fittings Motor Vehicles 10,650 10% loan from CIB Bank 54,000 Urslities 218,000 Salaries & Wages 2,200 10% Fixed deposit 24,000 Bad debts 1.000. General Expenses 2,600 Cash 4,200 Bank 7.400 letectory as at 1 Jan 2020 42,250 Commission received 56,000 Discount allowed & Discount received 6,200 Drawings 2.500 Allowance for doubtful debts 3,150 4,000 Capital 2,250 200,000 Required: 2) Prepare the Statement of Profit or Loss for Sofia Enterprises for the year ended 31 December 2020 (15 marks) b) Prepare the Statement of financial position for Sofia Enterprises as at 31 December 2020. (10 marka) 800,400 800,400 (Total: January 2012 Final 1 Inventory as at 31 December 2000 was RM30,000 2 The owner took goods worth RM 500 and cash RM6,000 for her personal use 3. The following expenses are still outstanding as at 31 December 2020: General Expenses RM600 Utilities RM250 4 Included in caniage expenses as carriage inwards amounting to RM 250 One of the employees was given an advance salary of RM300 and no record has been made in the account 6 One of the debtors owing an amount of RM560 was declared bankrupt and the amount has to be written off as bad debt 7 Depreciation for the year are to be provided as follows: Fixtures and Fittings 10% on Straight line method Motor Vehicles 20% on Net Book Value Question CONFIDENTIALISUNT The following balances were extracted from the books of Sofia Enterprises as at 31 December 2020 Purchases and Sales Debit (RM) Credit (RM) Return Tawards and Renam Outward 175,000 282,000 Carriage expenses 2,500 1.650 Account receivable & Account payable 7,250 Fixtures & Fittings 34,000 22,500 Land and Building 25,500 Motor Vehicles 250,000 Accumulated Depreciation: 150,000 Fictures & Fittings Motor Vehicles 10,650 10% loan from CIB Bank 54,000 Urslities 218,000 Salaries & Wages 2,200 10% Fixed deposit 24,000 Bad debts 1.000. General Expenses 2,600 Cash 4,200 Bank 7.400 letectory as at 1 Jan 2020 42,250 Commission received 56,000 Discount allowed & Discount received 6,200 Drawings 2.500 Allowance for doubtful debts 3,150 4,000 Capital 2,250 200,000 Required: 2) Prepare the Statement of Profit or Loss for Sofia Enterprises for the year ended 31 December 2020 (15 marks) b) Prepare the Statement of financial position for Sofia Enterprises as at 31 December 2020. (10 marka) 800,400 800,400 (Total