January Activity to review and record, respond as applicable 3-Jan Strong Construction purchases lumber on account. A large person driving an AZCO tow truck

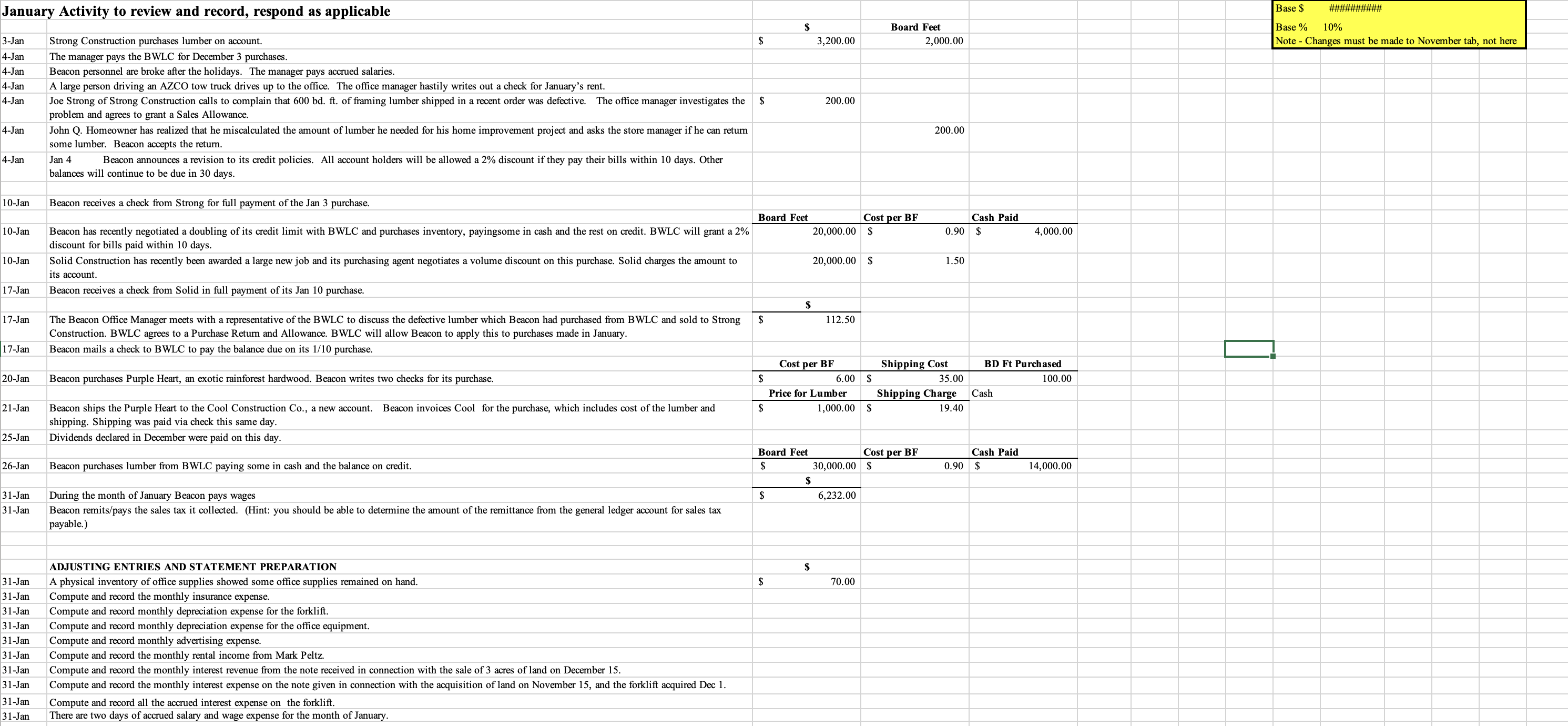

January Activity to review and record, respond as applicable 3-Jan Strong Construction purchases lumber on account. A large person driving an AZCO tow truck drives up to the office. The office manager hastily writes out a check for January's rent. 4-Jan The manager pays the BWLC for December 3 purchases. 4-Jan Beacon personnel are broke after the holidays. The manager pays accrued salaries. 4-Jan 4-Jan 4-Jan 4-Jan Joe Strong of Strong Construction calls to complain that 600 bd. ft. of framing lumber shipped in a recent order was defective. The office manager investigates the problem and agrees to grant a Sales Allowance. John Q. Homeowner has realized that he miscalculated the amount of lumber he needed for his home improvement project and asks the store manager if he can return some lumber. Beacon accepts the return. Jan 4 Beacon announces a revision to its credit policies. All account holders will be allowed a 2% discount if they pay their bills within 10 days. Other balances will continue to be due in 30 days. S Board Feet $ 3,200.00 2,000.00 $ 200.00 200.00 10-Jan Beacon receives a check from Strong for full payment of the Jan 3 purchase. Board Feet Cost per BF 10-Jan Beacon has recently negotiated a doubling of its credit limit with BWLC and purchases inventory, payingsome in cash and the rest on credit. BWLC will grant a 2% discount for bills paid within 10 days. 20,000.00 $ 0.90 Cash Paid $ 4,000.00 10-Jan Solid Construction has recently been awarded a large new job and its purchasing agent negotiates a volume discount on this purchase. Solid charges the amount to its account. 20,000.00 $ 1.50 17-Jan Beacon receives a check from Solid in full payment of its Jan 10 purchase. $ 17-Jan The Beacon Office Manager meets with a representative of the BWLC to discuss the defective lumber which Beacon had purchased from BWLC and sold to Strong Construction. BWLC agrees to a Purchase Return and Allowance. BWLC will allow Beacon to apply this to purchases made in January. $ 112.50 17-Jan Beacon mails a check to BWLC to pay the balance due on its 1/10 purchase. Cost per BF 20-Jan Beacon purchases Purple Heart, an exotic rainforest hardwood. Beacon writes two checks for its purchase. $ 6.00 $ 21-Jan Beacon ships the Purple Heart to the Cool Construction Co., a new account. Beacon invoices Cool for the purchase, which includes cost of the lumber and shipping. Shipping was paid via check this same day. $ Price for Lumber 1,000.00 $ Shipping Cost 35.00 Shipping Charge 19.40 BD Ft Purchased 100.00 Cash 25-Jan Dividends declared in December were paid on this day. Board Feet Cost per BF 26-Jan Beacon purchases lumber from BWLC paying some in cash and the balance on credit. $ 30,000.00 $ 0.90 Cash Paid $ 14,000.00 $ 31-Jan During the month of January Beacon pays wages $ 6,232.00 31-Jan Beacon remits/pays the sales tax it collected. (Hint: you should be able to determine the amount of the remittance from the general ledger account for sales tax payable.) ADJUSTING ENTRIES AND STATEMENT PREPARATION 31-Jan A physical inventory of office supplies showed some office supplies remained on hand. 31-Jan Compute and record the monthly insurance expense. 31-Jan Compute and record monthly depreciation expense for the forklift. 31-Jan Compute and record monthly depreciation expense for the office equipment. 31-Jan Compute and record monthly advertising expense. 31-Jan Compute and record the monthly rental income from Mark Peltz. 31-Jan Compute and record the monthly interest revenue from the note received in connection with the sale of 3 acres of land on December 15. 31-Jan Compute and record the monthly interest expense on the note given in connection with the acquisition of land on November 15, and the forklift acquired Dec 1. 31-Jan Compute and record all the accrued interest expense on the forklift. 31-Jan There are two days of accrued salary and wage expense for the month of January. $ $ 70.00 Base $ Base % 10% Note Changes must be made to November tab, not here

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started