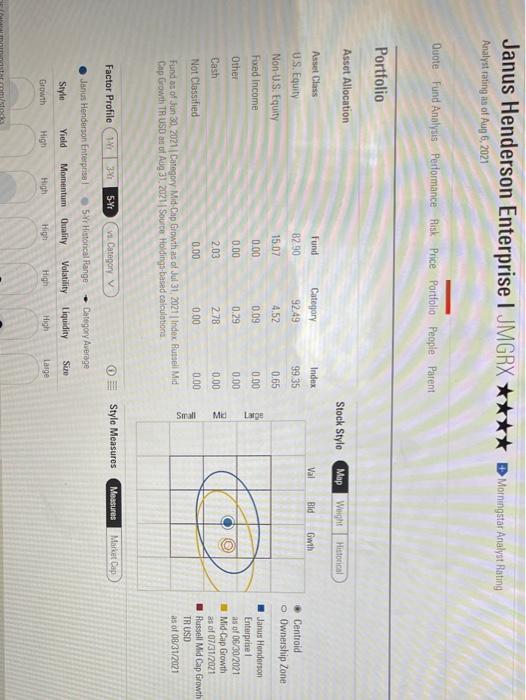

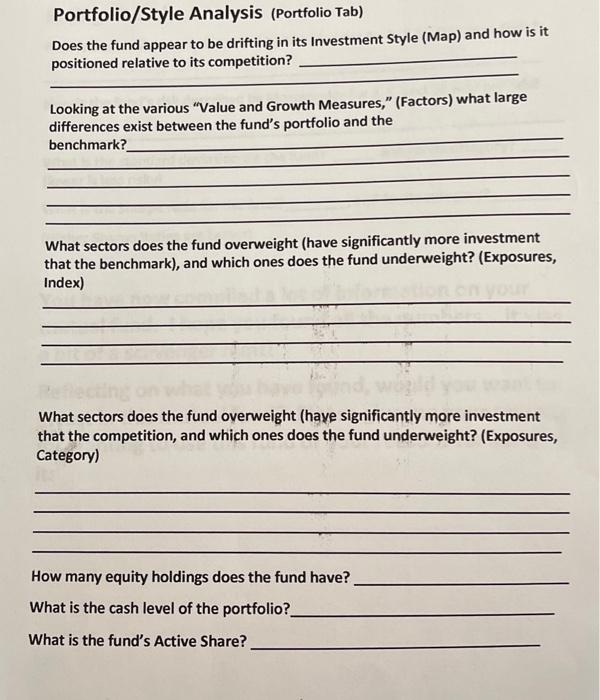

Janus Henderson Enterprise I JMGRX **** Morningstar Analyst Rating Analyst rating as of Aug 6, 2021 Quote Fund Analysis Performance Risk Price Portfolio People Patent Portfolio Asset Allocation Stock Style Map Weight Historical Fund Val Bid Category 92.49 Gwth Index 9935 82 90 Asset Class U.S. Equity Non-U.S. Equity Fixed Income Centroid Ownership Zone 15.07 4.52 0.65 3 0.00 0.09 0.00 Large Other 0.00 0.29 0.00 Cash 2.03 2.78 0.00 Mid Janus Henderson Enterprise as of 06/30/2021 Mid Cap Growth as of 07/31/2021 Russell Mid Cap Growth IF USD as of 08/31/2021 Not Classified 0.00 0.00 0.00 Sirali Fund as of Jun 30, 2021 Category Mid Cap Growth as of Jul 31 2021 | Index Butell Mid Cap Geowth TR USD as of Aug 21.2021 Source Holdings based calculations Factor Profile 14 341 5-Y Vu Category O Style Measures Measures Market Cap Janus Henderson Enterprise 5-Yr Hatoncal Range Category Average Yield Style Momentum Quality Volatility Size Liquidity Growth High High High High High Large sto Portfolio/Style Analysis (Portfolio Tab) Does the fund appear to be drifting in its Investment Style (Map) and how is it positioned relative to its competition? Looking at the various "Value and Growth Measures," (Factors) what large differences exist between the fund's portfolio and the benchmark? What sectors does the fund overweight (have significantly more investment that the benchmark), and which ones does the fund underweight? (Exposures, Index) What sectors does the fund overweight (haye significantly more investment that the competition, and which ones does the fund underweight? (Exposures, Category) How many equity holdings does the fund have? What is the cash level of the portfolio? What is the fund's Active Share? Janus Henderson Enterprise I JMGRX **** Morningstar Analyst Rating Analyst rating as of Aug 6, 2021 Quote Fund Analysis Performance Risk Price Portfolio People Patent Portfolio Asset Allocation Stock Style Map Weight Historical Fund Val Bid Category 92.49 Gwth Index 9935 82 90 Asset Class U.S. Equity Non-U.S. Equity Fixed Income Centroid Ownership Zone 15.07 4.52 0.65 3 0.00 0.09 0.00 Large Other 0.00 0.29 0.00 Cash 2.03 2.78 0.00 Mid Janus Henderson Enterprise as of 06/30/2021 Mid Cap Growth as of 07/31/2021 Russell Mid Cap Growth IF USD as of 08/31/2021 Not Classified 0.00 0.00 0.00 Sirali Fund as of Jun 30, 2021 Category Mid Cap Growth as of Jul 31 2021 | Index Butell Mid Cap Geowth TR USD as of Aug 21.2021 Source Holdings based calculations Factor Profile 14 341 5-Y Vu Category O Style Measures Measures Market Cap Janus Henderson Enterprise 5-Yr Hatoncal Range Category Average Yield Style Momentum Quality Volatility Size Liquidity Growth High High High High High Large sto Portfolio/Style Analysis (Portfolio Tab) Does the fund appear to be drifting in its Investment Style (Map) and how is it positioned relative to its competition? Looking at the various "Value and Growth Measures," (Factors) what large differences exist between the fund's portfolio and the benchmark? What sectors does the fund overweight (have significantly more investment that the benchmark), and which ones does the fund underweight? (Exposures, Index) What sectors does the fund overweight (haye significantly more investment that the competition, and which ones does the fund underweight? (Exposures, Category) How many equity holdings does the fund have? What is the cash level of the portfolio? What is the fund's Active Share