Question

Japan is an oil importer. Japan's currency is the Japanese yen (JPY), but oil is priced in USD per barrel. If the Federal Reserve

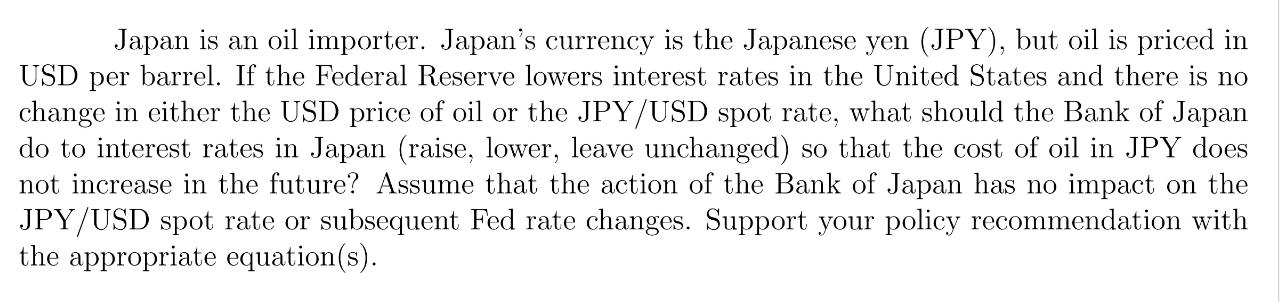

Japan is an oil importer. Japan's currency is the Japanese yen (JPY), but oil is priced in USD per barrel. If the Federal Reserve lowers interest rates in the United States and there is no change in either the USD price of oil or the JPY/USD spot rate, what should the Bank of Japan do to interest rates in Japan (raise, lower, leave unchanged) so that the cost of oil in JPY does not increase in the future? Assume that the action of the Bank of Japan has no impact on the JPY/USD spot rate or subsequent Fed rate changes. Support your policy recommendation with the appropriate equation(s).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prevent a future increase in the cost of oil imports for Japan the Bank of Japan should also lowe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Marketing And Export Management

Authors: Gerald Albaum , Alexander Josiassen , Edwin Duerr

8th Edition

1292016922, 978-1292016924

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App