Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Phoenix Electronics Inc is evaluating a microprocessor investment. The company's management team rec- ognizes the superiority of the NPV technique, but like the presentational

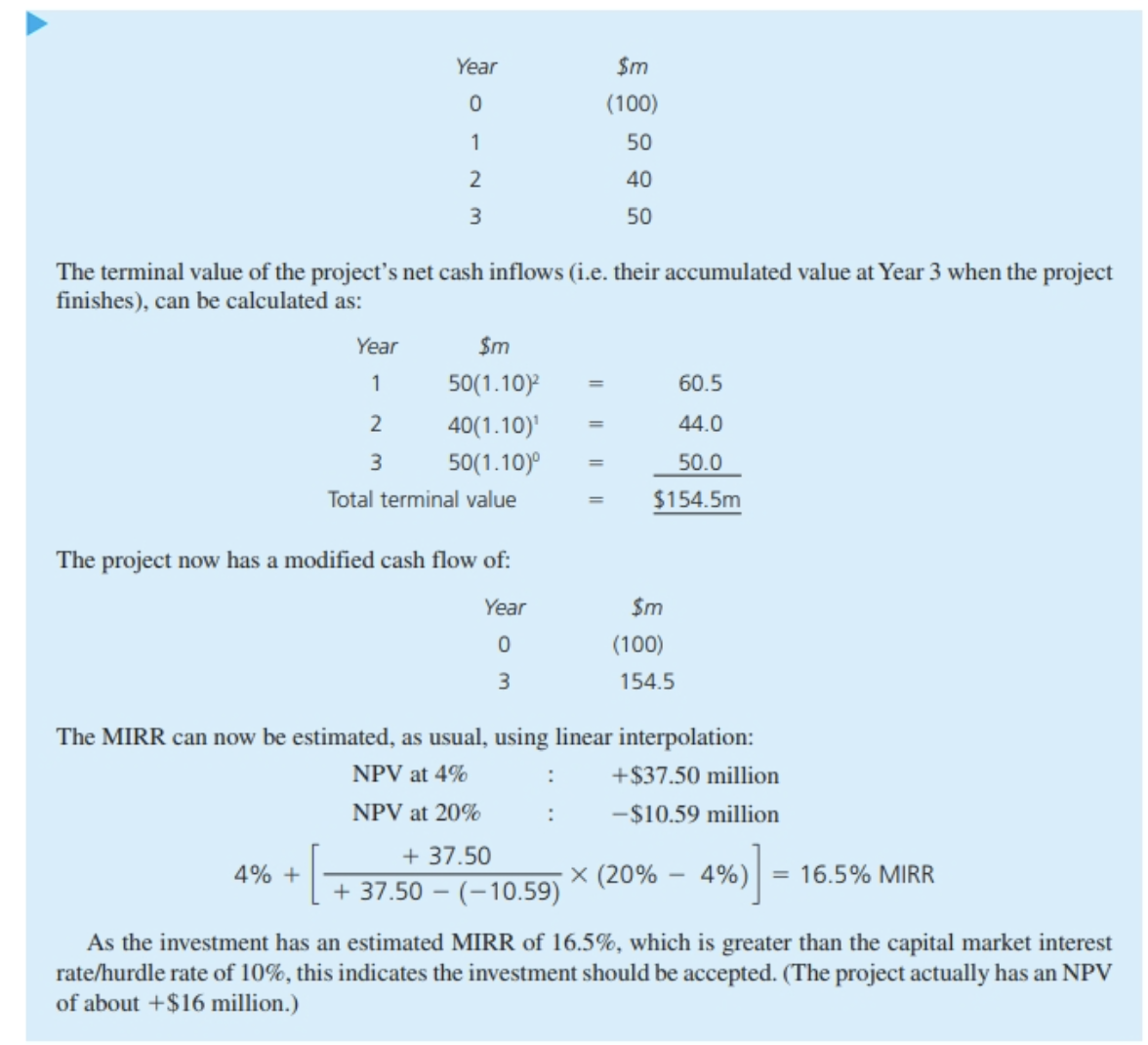

Phoenix Electronics Inc is evaluating a microprocessor investment. The company's management team rec- ognizes the superiority of the NPV technique, but like the presentational advantages of IRR (for when they have to approach the bank for help with funding), and so propose to use the modified IRR appraisal tech- nique to assess the investment. The appropriate capital market rate of interest is 10%. The investment's expected cash flow is as follows: Year 0123 $m (100) 50 40 50 The terminal value of the project's net cash inflows (i.e. their accumulated value at Year 3 when the project finishes), can be calculated as: Year $m 1 50(1.10) 60.5 2 40(1.10)' == 44.0 3 50(1.10) = 50.0 Total terminal value $154.5m The project now has a modified cash flow of: Year $m 0 3 (100) 154.5 The MIRR can now be estimated, as usual, using linear interpolation: NPV at 4% : +$37.50 million NPV at 20% : -$10.59 million 4% + + 37.50 +37.50 - X (20% 4%) = 16.5% MIRR (-10.59) As the investment has an estimated MIRR of 16.5%, which is greater than the capital market interest rate/hurdle rate of 10%, this indicates the investment should be accepted. (The project actually has an NPV of about +$16 million.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided the management team of Phoenix Electronics Inc is evaluating a mic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started