Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Japanese Yen Forward. Use the following spot and forward bid-ask rates for the Japanese yen/U.S. dollar (/$) exchange rate from September 16, 2010, to answer

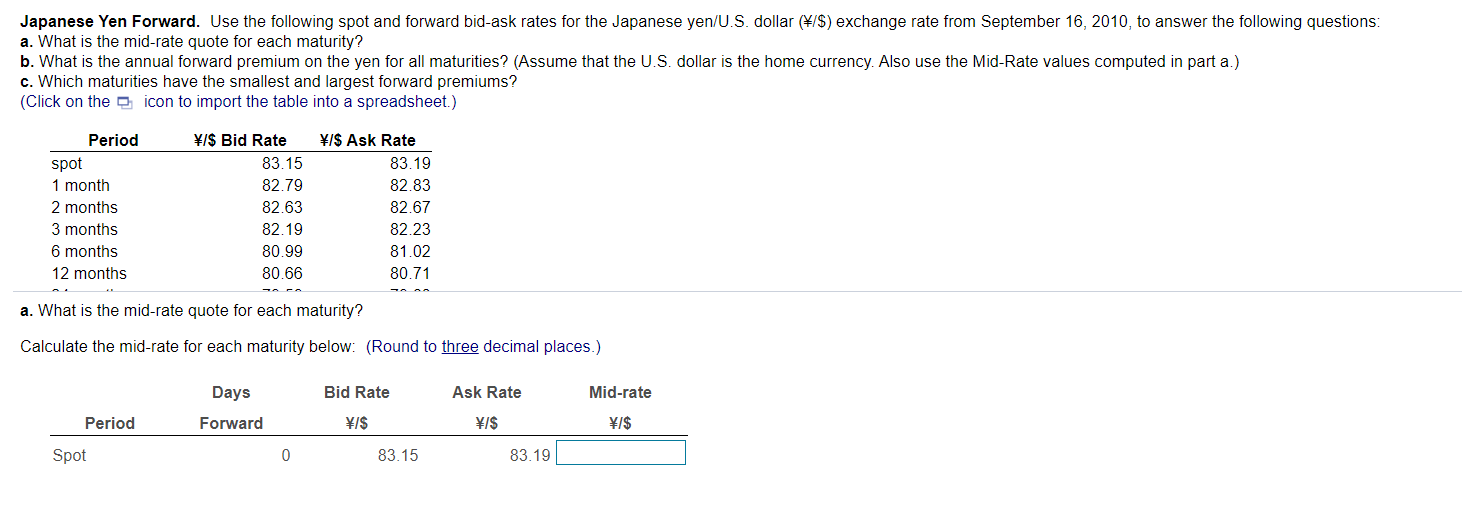

Japanese Yen Forward. Use the following spot and forward bid-ask rates for the Japanese yen/U.S. dollar (/$) exchange rate from September 16, 2010, to answer the following questions: a. What is the mid-rate quote for each maturity? b. What is the annual forward premium on the yen for all maturities? (Assume that the U.S. dollar is the home currency. Also use the Mid-Rate values computed in part a.) c. Which maturities have the smallest and largest forward premiums? (Click on the icon to import the table into a spreadsheet.) Period spot 1 month 2 months 3 months 6 months 12 months \/$ Bid Rate 83.15 82.79 82.63 82.19 80.99 80.66 \/$ Ask Rate 83.19 82.83 82.67 82.23 81.02 80.71 a. What is the mid-rate quote for each maturity? Calculate the mid-rate for each maturity below: (Round to three decimal places.) Days Bid Rate Ask Rate Mid-rate Period Forward \/$ 1$ \/$ Spot 0 83.15 83.19

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started