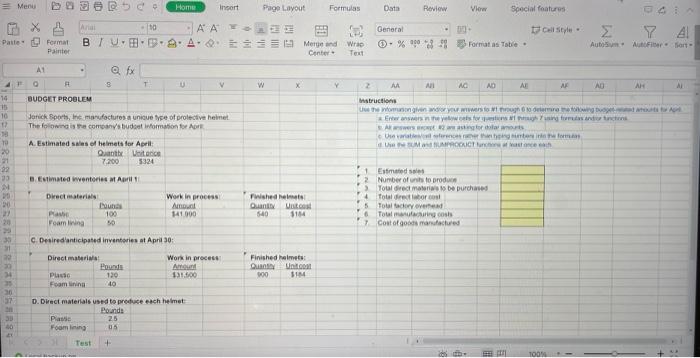

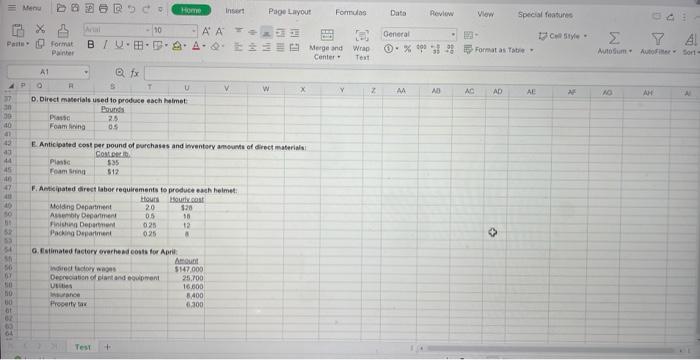

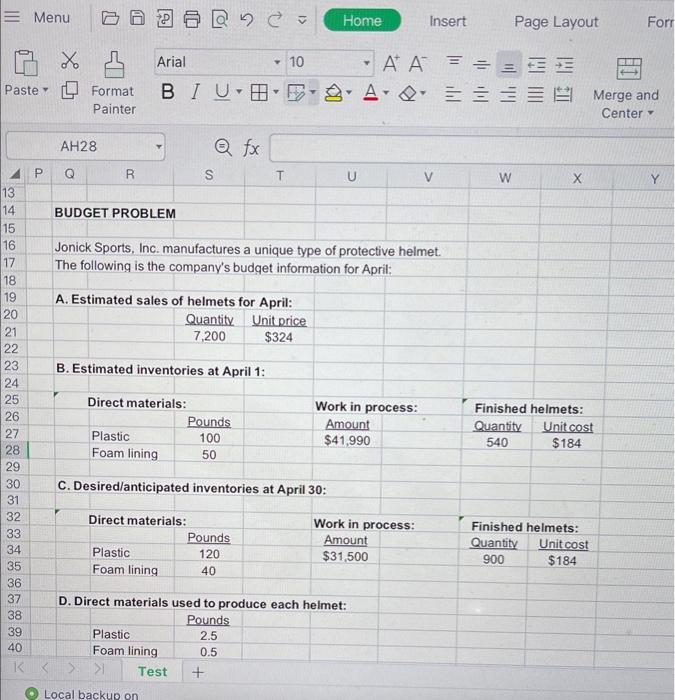

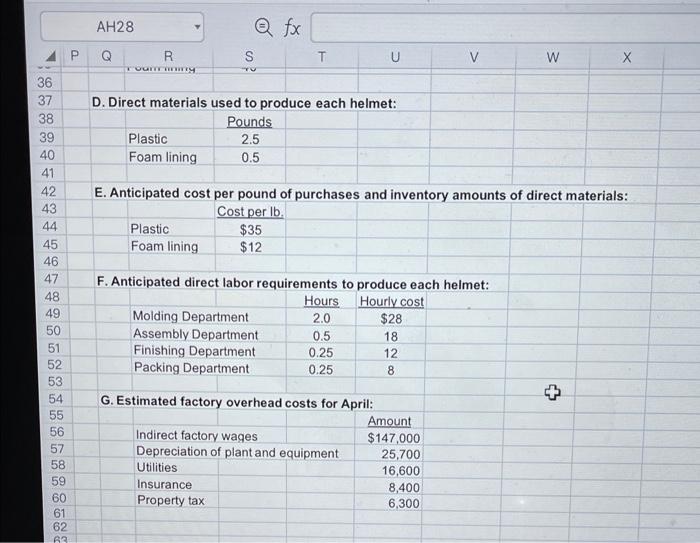

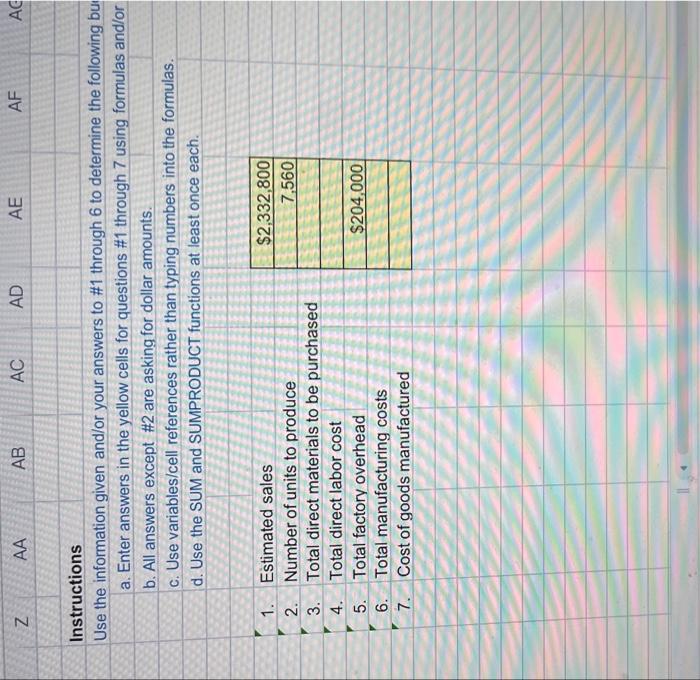

Jarick Spoth, the minrifactures a unicue tice of prolective helnet. The folidwing is the combanyes budset intomasion for Act A. Estimated saies of heimets for Asell: B. E.timated iwenteries at Aquil 1 1 Estmond seies 2. Number of unh to oroduch 3. Toul drest maserises be burchased 4 Total derect lator casi 5 Folal tacticy overemed 6. Total matularauire cosh f. Cost orgocete marifactures C. Desiredianticipated inventories at April 30: D. Direct materlals used to preduce each heimet D. Direct maserials used to produce each haimet E Anticiaated cost pee pound of purchases and iwentery anserme of drect materiali! F. Amicinated difect labor requirements to produce each helmet: Q. fistimated factery treehend costs for Apri: Jonick Sports, Inc. manufactures a unique type of protective helmet. The following is the company's budget information for April: A. Estimated sales of helmets for April: B. Estimated inventories at April 1: \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{2}{l|}{ Direct materials: } & Work in process: & \multicolumn{2}{l|}{ Finished helmets: } \\ \hline & Pounds & Amount & 540Quantity & $184Unitcost \\ \hline Plastic & 100 & $41,990 & & \\ \hline Foam lining & 50 & & \end{tabular} C. Desired/anticipated inventories at April 30: D. Direct materials used to produce each helmet: \begin{tabular}{|l|c|} \hline & Pounds \\ \hline Plastic & 2.5 \\ \hline Foam lining & 0.5 \\ \hline \multicolumn{1}{|c|}{ Test } & + \\ \hline \end{tabular} D. Direct materials used to produce each helmet: \begin{tabular}{|l|c} \hline & Pounds \\ \hline Plastic & 2.5 \\ \hline Foam lining & 0.5 \\ \hline \end{tabular} F. Anticipated direct labor requirements to broduce each halmat: G. Estimated factory overhead costs for April: Instructions Use the information given and/or your answers to \#1 through 6 to determine the following bu a. Enter answers in the yellow cells for questions \#1 through 7 using formulas and/or b. All answers except \#2 are asking for dollar amounts. c. Use variables/cell references rather than typing numbers into the formulas. d. Use the SUM and SUMPRODUCT functions at least once each. 1. Estimated sales 2. Number of units to produce 3. Total direct materials to be purchased 4. Total direct labor cost 5. Total factory overhead 6. Total manufacturing costs 7. Cost of goods manufactured \begin{tabular}{|r|} \hline$2,332,800 \\ \hline 7,560 \\ \hline \\ \hline$204,000 \\ \hline \\ \hline \\ \hline \end{tabular}