Question

Jarmuz Management Services began business on January 1, 2015, with a capital investment of $96,129. The company manages condominiums for owners (service revenue) and rents

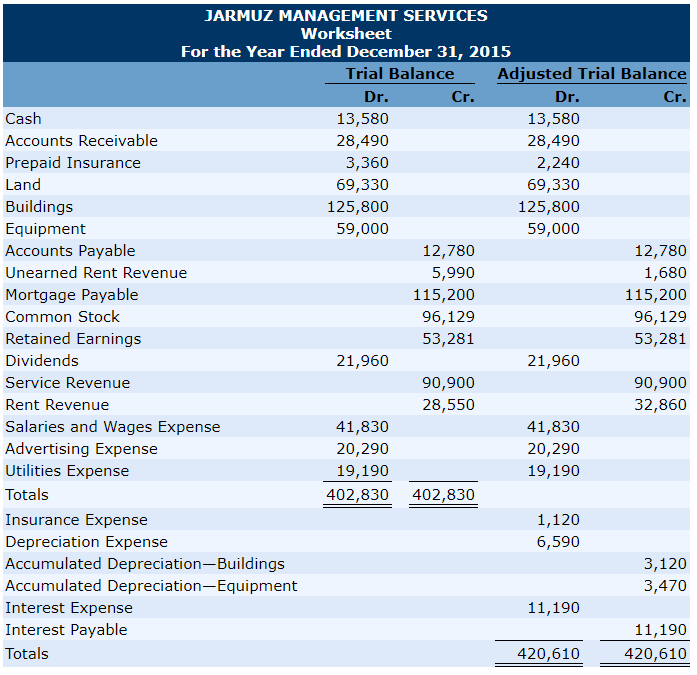

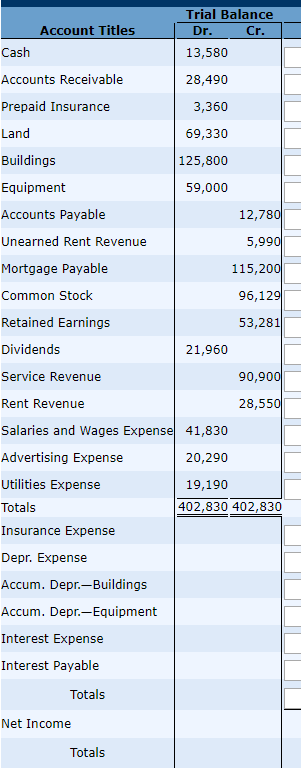

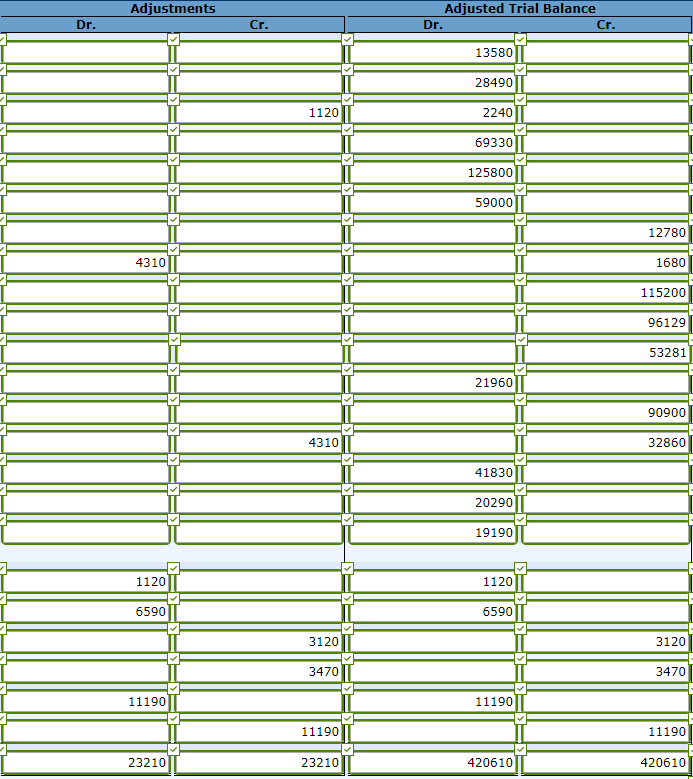

Jarmuz Management Services began business on January 1, 2015, with a capital investment of $96,129. The company manages condominiums for owners (service revenue) and rents space in its own office building (rent revenue). The trial balance and adjusted trial balance columns of the worksheet at the end of 2015 are as follows.

b) Prepare a classified balance sheet. (Note: $36,600 of the mortgage note payable is due for payment next year.) (List current assets in order of liquidity. List Property, Plant and Equipment in order of Land, Buildings and Equipment.)

c) journalize the adjusting entries

Dr. Cr. Cr. JARMUZ MANAGEMENT SERVICES Worksheet For the Year Ended December 31, 2015 Trial Balance Adjusted Trial Balance Dr. Cash 13,580 13,580 Accounts Receivable 28,490 28,490 Prepaid Insurance 3,360 2,240 Land 69,330 69,330 Buildings 125,800 125,800 Equipment 59,000 59,000 Accounts Payable 12,780 12,780 Unearned Rent Revenue 5,990 1,680 Mortgage Payable 115,200 115,200 Common Stock 96,129 96,129 Retained Earnings 53,281 53,281 Dividends 21,960 21,960 Service Revenue 90,900 90,900 Rent Revenue 28,550 32,860 Salaries and Wages Expense 41,830 41,830 Advertising Expense 20,290 20,290 Utilities Expense 19,190 19,190 Totals 402,830 402,830 Insurance Expense 1,120 Depreciation Expense 6,590 Accumulated Depreciation-Buildings 3,120 Accumulated Depreciation Equipment 3,470 Interest Expense 11,190 Interest Payable 11,190 Totals 420,610 420,610 Trial Balance Cr. 13,580 Dr. Account Titles Cash Accounts Receivable Prepaid Insurance 28,490 3,360 Land 69,330 Buildings 125,800 59,000 12,780 Equipment Accounts Payable Unearned Rent Revenue Mortgage Payable Common Stock 5,990 115,200 96,129 53,281 21,960 90,900 Retained Earnings Dividends Service Revenue Rent Revenue 28,550 Salaries and Wages Expense 41,830 Advertising Expense 20,290 Utilities Expense 19,190 Totals 402,830 402,830 Insurance Expense Depr. Expense Accum. Depr.Buildings Accum. Depr.-Equipment Interest Expense Interest Payable Totals Net Income Totals 23210|| 1119011 659 DELEM =o=0=0=0=0=0=0=0=i=i=0=0=0=0= = = Adjustments 23210 11190 34701 3120 4310 T O =O=O=O=O=*=*=*=*=*=*=*=*=O=O= = 420610 1119011 6590| 110211 19190 202907 41830T 125800 69330T 2240|| 28490|| 13580 | = = = = = = = = = = = Adjusted Trial Balance 420610 11190 3470 3120 32860 90900 53281 96129 115200 1680 12780Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started