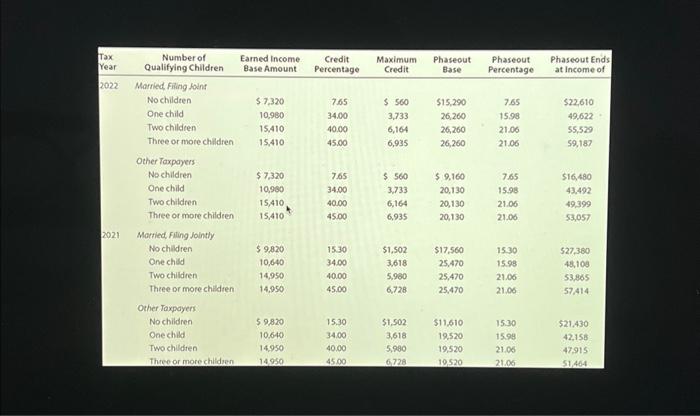

Jason, a single parent, lives in an apartment with his three minor children, whom he supports. Jason earned $27,400 during 2022 and uses the standard deduction. Click here to access Earned Income Credit and Phaseout Percentages Table. Round all computations to the nearest dollar. Calculate the amount, if any, of Jason's earned income credit. x Feedebck T Check My Work The earned income credit, which has been a part of the law for many years, consistently has been justified as a means of providing tax equity to the working poor. In addition, the credit has been designed to help offset regressive taxes that are a part of our tax system, as the gasoline tax. Further, the credit is intended to encourage economically disadvantaged individuals to become contributing membe the workforce, \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline TaxYear & NumberofQualifyingChildren & EarnedIncomeBaseAmount & CreditPercentage & MaximumCredit & PhaseoutBase & PhaseoutPercentage & PhaseoutEndsatincomeof \\ \hline \multirow[t]{10}{*}{2022} & Married Filing toins & & & & & & \\ \hline & No childten & $7,320 & 7.65 & $s00 & $15,290 & 7.55 & $22,610 \\ \hline & One child & 10,980 & 34.00 & 3,733 & 26,260 & 15.98 & 49,622 \\ \hline & Two childien & 15,410 & 40.00 & 6,164 & 26,260 & 21.06 & 55,520 \\ \hline & Three or more children & 15,410 & 45.00 & 6,935 & 26,260 & 21.06 & 59,187 \\ \hline & Other Taxpayers & & & = & & & \\ \hline & Nochildren & $7,320 & 7.65 & $560 & $9,160 & 7.65 & $16,480 \\ \hline & One child & 10,980 & 34.00 & 3,733 & 20,130 & 15.98 & 43,492 \\ \hline & Two children & 15,410 & 4000 & 6,164 & 20,130 & 21.06 & 49,399 \\ \hline & Three or more childeen & 15,4104 & 4500 & 6,935 & 20,130 & 21.06 & 53,057 \\ \hline \multirow[t]{10}{*}{2021} & Morried, Filling Jointly & & & & & & \\ \hline & No chlidren & $9820 & 1530 & 51,502 & $17,560 & 15,30 & 527,380 \\ \hline & One child & 10,640 & 34.00 & 3,618 & 25,470 & 15.98 & 48,108 \\ \hline & Two childiren & 14,950 & 40.00 & 5,960 & 25,470 & 21.06 & 53,805 \\ \hline & Three or more children & 14,950 & 45.00 & 6,728 & 25,470 & 21.06 & 57.414 \\ \hline & Other Taxpayens & & & & & & \\ \hline & No children & 59820 & 15.30 & $1,502 & $11,810 & 15.30 & $21,430 \\ \hline & Onechild & 10.640 & 34.00 & 3,618 & 19,520 & 15.98 & 42,158 \\ \hline & Two children & 14.950 & 40.00 & 5,990 & 19,520 & 21.06 & 47,915 \\ \hline & Thee or more chilideen & 14.950 & 45.00 & 6.728 & 10,520 & 21.06 & 51,464 \\ \hline \end{tabular}