Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jason, a single parent, lives in an apartment with his three minor children, whom he supports. Jason earned $28,400 during 2023 and uses the standard

Jason, a single parent, lives in an apartment with his three minor children, whom he supports. Jason earned $28,400 during 2023 and uses the standard deduction.

Round all computations to the nearest dollar.

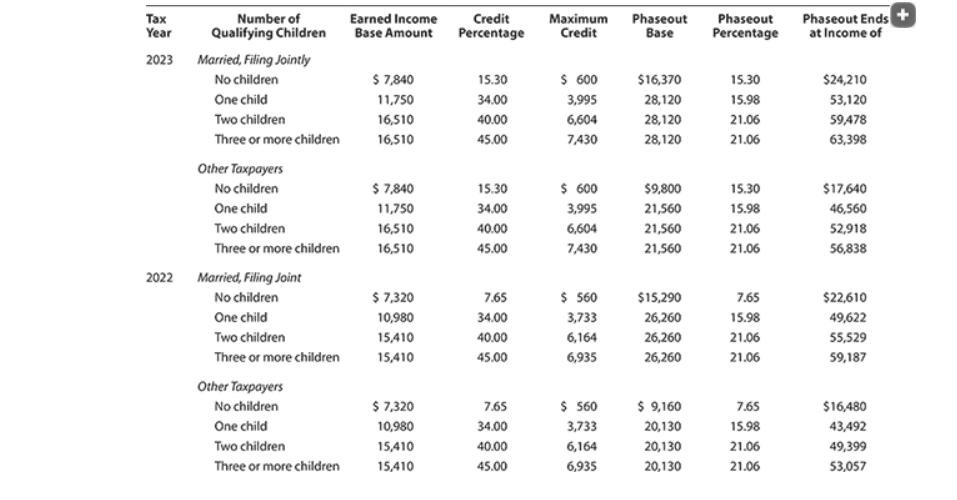

Calculate the amount, if any, of Jason's earned income credit

Tax Year 2023 Number of Qualifying Children Married, Filing Jointly No children One child Two children Three or more children Other Taxpayers No children One child Two children Three or more children 2022 Married, Filing Joint No children One child Two children Three or more children Other Taxpayers No children One child Two children Three or more children Earned Income Base Amount $ 7,840 11,750 16,510 16,510 $ 7,840 11,750 16,510 16,510 $ 7,320 10,980 15,410 15,410 $ 7,320 10,980 15,410 15,410 Credit Percentage 15.30 34.00 40.00 45.00 15.30 34.00 40.00 45.00 7.65 34.00 40.00 45.00 7.65 34.00 40.00 45.00 Maximum Phaseout Phaseout Credit Base Percentage $ 600 3,995 6,604 7,430 $ 600 3,995 6,604 7,430 $ 560 3,733 6,164 6,935 $ 560 3,733 6,164 6,935 $16,370 28,120 28,120 28,120 $9,800 21,560 21,560 21,560 $15,290 26,260 26,260 26,260 $ 9,160 20,130 20,130 20,130 15.30 15.98 21.06 21.06 15.30 15.98 21.06 21.06 7.65 15.98 21.06 21.06 7.65 15.98 21.06 21.06 Phaseout Ends + at Income of $24,210 53,120 59,478 63,398 $17,640 46,560 52,918 56,838 $22,610 49,622 55,529 59,187 $16,480 43,492 49,399 53,057

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of Jasons Caused in come pia Jasons Inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started