Answered step by step

Verified Expert Solution

Question

1 Approved Answer

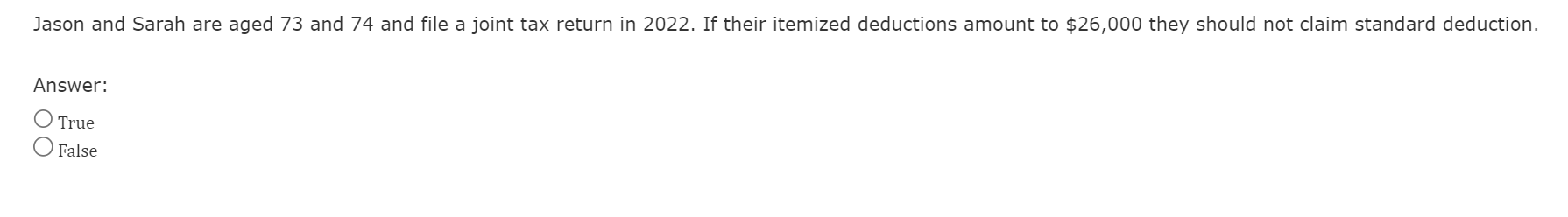

Jason and Sarah are aged 73 and 74 and file a joint tax return in 2022. If their itemized deductions amount to ( $ 26,000

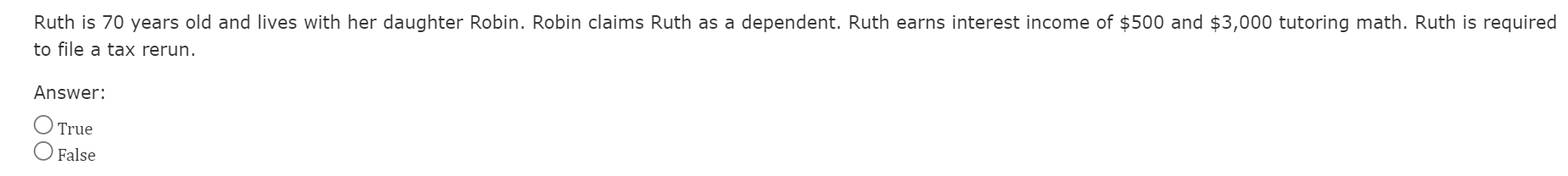

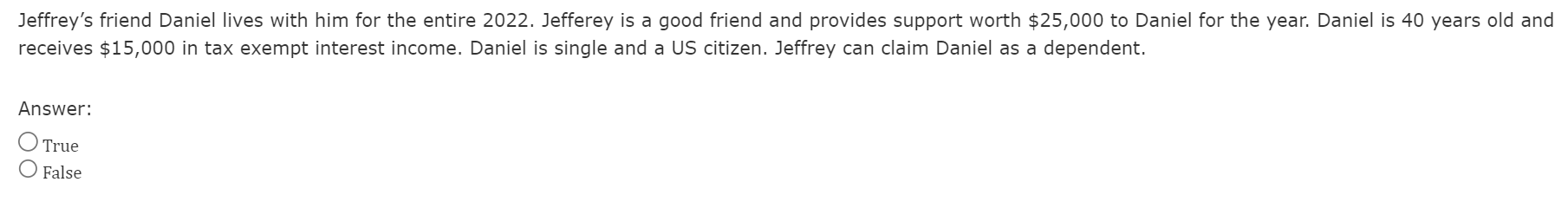

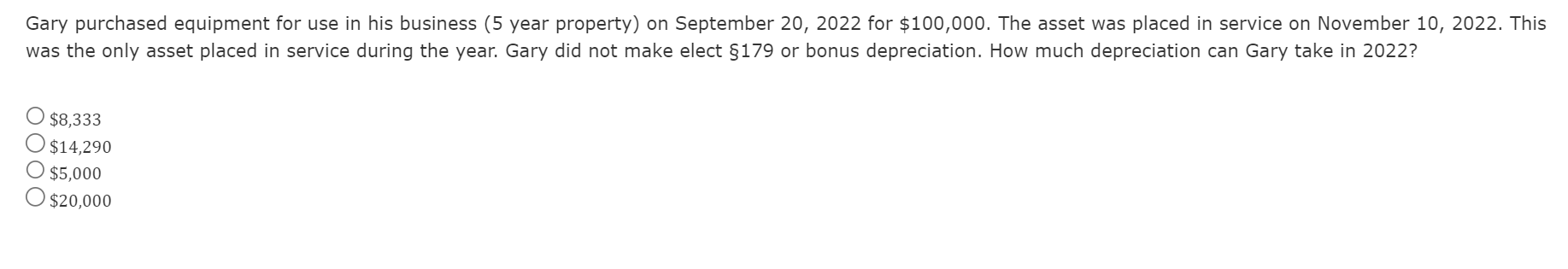

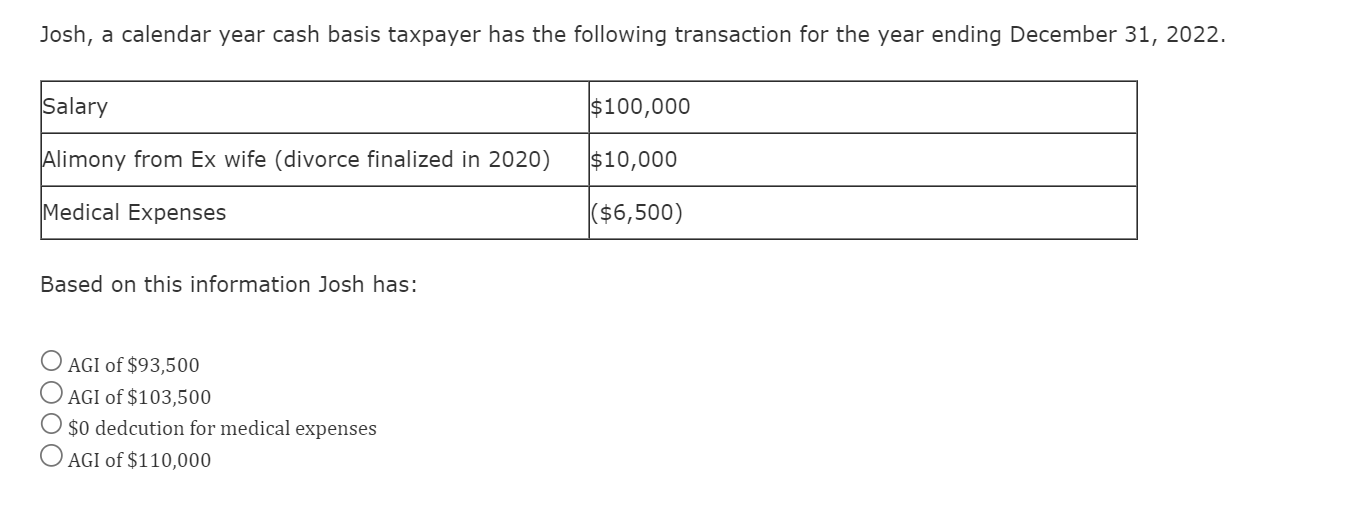

Jason and Sarah are aged 73 and 74 and file a joint tax return in 2022. If their itemized deductions amount to \\( \\$ 26,000 \\) they should not claim standard deduction. Answer: True False Gary purchased equipment for use in his business ( 5 year property) on September 20,2022 for \\( \\$ 100,000 \\). The asset was placed in service on November 10 , 2022 . This was the only asset placed in service during the year. Gary did not make elect \\( \\S 179 \\) or bonus depreciation. How much depreciation can Gary take in 2022 ? \\[ \\begin{array}{l} \\$ 8,333 \\\\ \\$ 14,290 \\\\ \\$ 5,000 \\\\ \\$ 20,000 \\end{array} \\] Josh, a calendar year cash basis taxpayer has the following transaction for the year ending December \\( 31,2022 \\). Based on this information Josh has: AGI of \\( \\$ 93,500 \\) AGI of \\( \\$ 103,500 \\) \\( \\$ 0 \\) dedcution for medical expenses AGI of \\( \\$ 110,000 \\) Jeffrey's friend Daniel lives with him for the entire 2022 . Jefferey is a good friend and provides support worth \\( \\$ 25,000 \\) to Daniel for the year. Daniel is 40 years old and receives \\( \\$ 15,000 \\) in tax exempt interest income. Daniel is single and a US citizen. Jeffrey can claim Daniel as a dependent. Answer: True False Ruth is 70 years old and lives with her daughter Robin. Robin claims Ruth as a dependent. Ruth earns interest income of \\( \\$ 500 \\) and \\( \\$ 3,000 \\) tutoring math. Ruth is required to file a tax rerun. Answer: True False

Jason and Sarah are aged 73 and 74 and file a joint tax return in 2022. If their itemized deductions amount to \\( \\$ 26,000 \\) they should not claim standard deduction. Answer: True False Gary purchased equipment for use in his business ( 5 year property) on September 20,2022 for \\( \\$ 100,000 \\). The asset was placed in service on November 10 , 2022 . This was the only asset placed in service during the year. Gary did not make elect \\( \\S 179 \\) or bonus depreciation. How much depreciation can Gary take in 2022 ? \\[ \\begin{array}{l} \\$ 8,333 \\\\ \\$ 14,290 \\\\ \\$ 5,000 \\\\ \\$ 20,000 \\end{array} \\] Josh, a calendar year cash basis taxpayer has the following transaction for the year ending December \\( 31,2022 \\). Based on this information Josh has: AGI of \\( \\$ 93,500 \\) AGI of \\( \\$ 103,500 \\) \\( \\$ 0 \\) dedcution for medical expenses AGI of \\( \\$ 110,000 \\) Jeffrey's friend Daniel lives with him for the entire 2022 . Jefferey is a good friend and provides support worth \\( \\$ 25,000 \\) to Daniel for the year. Daniel is 40 years old and receives \\( \\$ 15,000 \\) in tax exempt interest income. Daniel is single and a US citizen. Jeffrey can claim Daniel as a dependent. Answer: True False Ruth is 70 years old and lives with her daughter Robin. Robin claims Ruth as a dependent. Ruth earns interest income of \\( \\$ 500 \\) and \\( \\$ 3,000 \\) tutoring math. Ruth is required to file a tax rerun. Answer: True False Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started