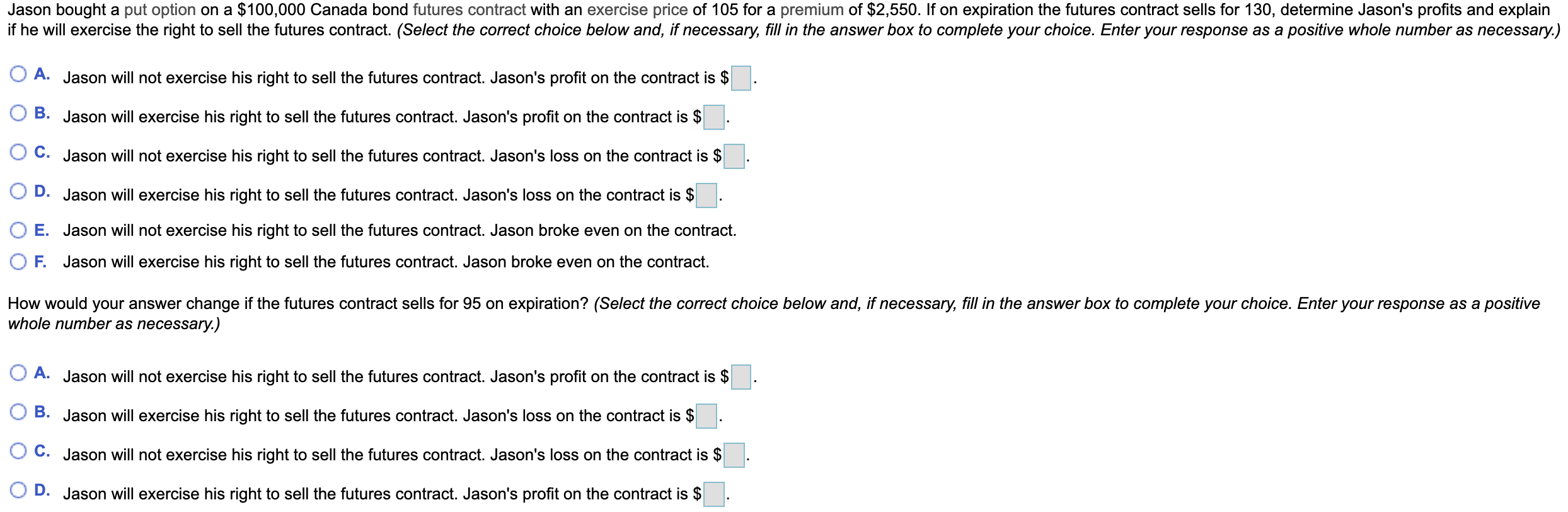

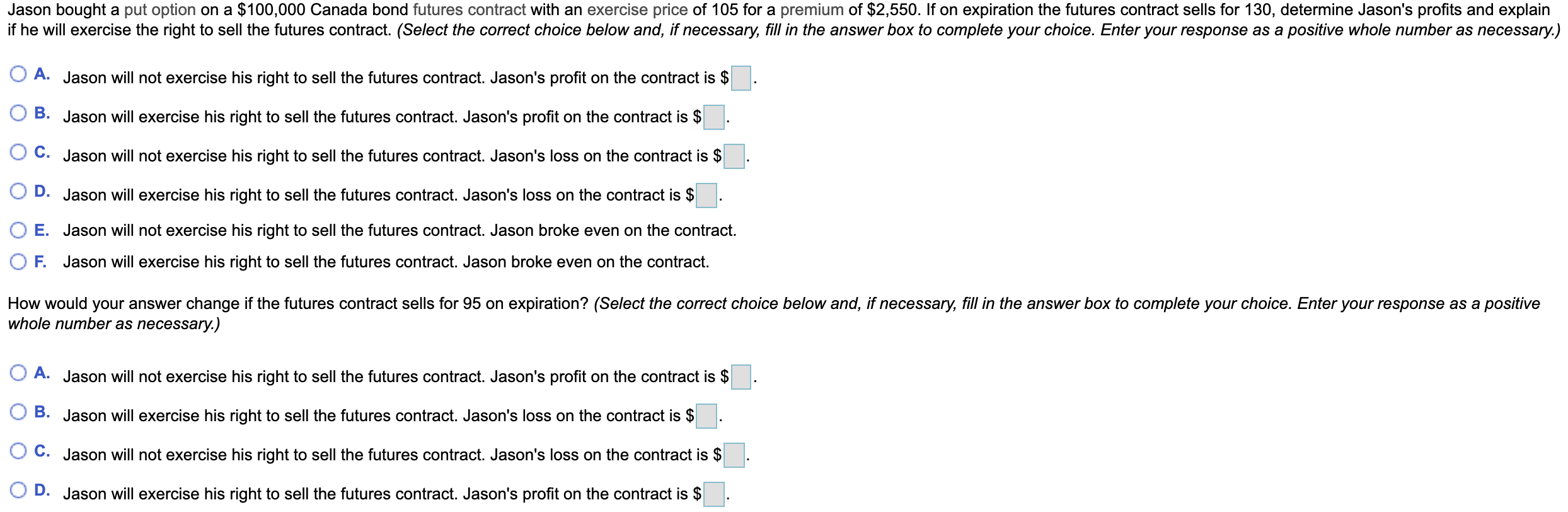

Jason bought a put option on a $100,000 Canada bond futures contract with an exercise price of 105 for a premium of $2,550. If on expiration the futures contract sells for 130, determine Jason's profits and explain if he will exercise the right to sell the futures contract. (Select the correct choice below and, if necessary, fill in the answer box to complete your choice. Enter your response as a positive whole number as necessary.) O A. Jason will not exercise his right to sell the futures contract. Jason's profit on the contract is $ B. Jason will exercise his right to sell the futures contract. Jason's profit on the contract is $ C. Jason will not exercise his right to sell the futures contract. Jason's loss on the contract is $ OD. Jason will exercise his right to sell the futures contract. Jason's loss on the contract is $ O E. Jason will not exercise his right to sell the futures contract. Jason broke even on the contract. OF. Jason will exercise his right to sell the futures contract. Jason broke even on the contract. How would your answer change if the futures contract sells for 95 on expiration? (Select the correct choice below and, if necessary, fill in the answer box to complete your choice. Enter your response as a positive whole number as necessary.) A. Jason will not exercise his right to sell the futures contract. Jason's profit on the contract is $ B. Jason will exercise his right to sell the futures contract. Jason's loss on the contract is $ OC. Jason will not exercise his right to sell the futures contract. Jason's loss on the contract is $ OD. Jason will exercise his right to sell the futures contract. Jason's profit on the contract is $ O E. Jason will not exercise his right to sell the futures contract. Jason broke even on the contract. OF. Jason will exercise his right to sell the futures contract. Jason broke even on the contract. Jason bought a put option on a $100,000 Canada bond futures contract with an exercise price of 105 for a premium of $2,550. If on expiration the futures contract sells for 130, determine Jason's profits and explain if he will exercise the right to sell the futures contract. (Select the correct choice below and, if necessary, fill in the answer box to complete your choice. Enter your response as a positive whole number as necessary.) O A. Jason will not exercise his right to sell the futures contract. Jason's profit on the contract is $ B. Jason will exercise his right to sell the futures contract. Jason's profit on the contract is $ C. Jason will not exercise his right to sell the futures contract. Jason's loss on the contract is $ OD. Jason will exercise his right to sell the futures contract. Jason's loss on the contract is $ O E. Jason will not exercise his right to sell the futures contract. Jason broke even on the contract. OF. Jason will exercise his right to sell the futures contract. Jason broke even on the contract. How would your answer change if the futures contract sells for 95 on expiration? (Select the correct choice below and, if necessary, fill in the answer box to complete your choice. Enter your response as a positive whole number as necessary.) A. Jason will not exercise his right to sell the futures contract. Jason's profit on the contract is $ B. Jason will exercise his right to sell the futures contract. Jason's loss on the contract is $ OC. Jason will not exercise his right to sell the futures contract. Jason's loss on the contract is $ OD. Jason will exercise his right to sell the futures contract. Jason's profit on the contract is $ O E. Jason will not exercise his right to sell the futures contract. Jason broke even on the contract. OF. Jason will exercise his right to sell the futures contract. Jason broke even on the contract