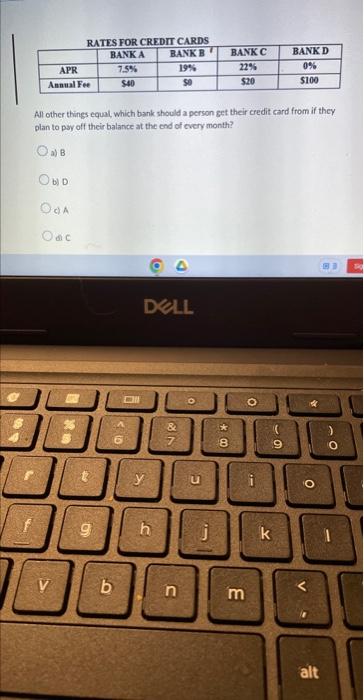

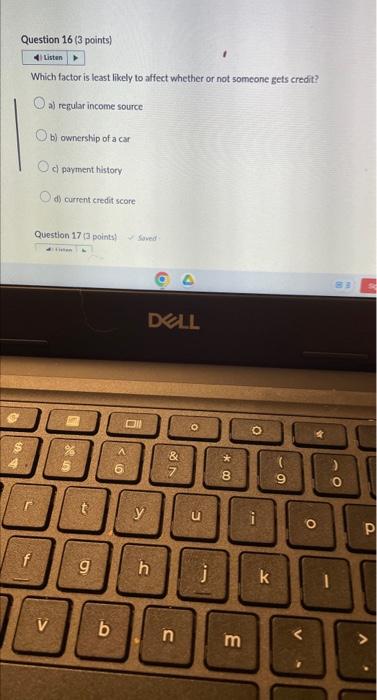

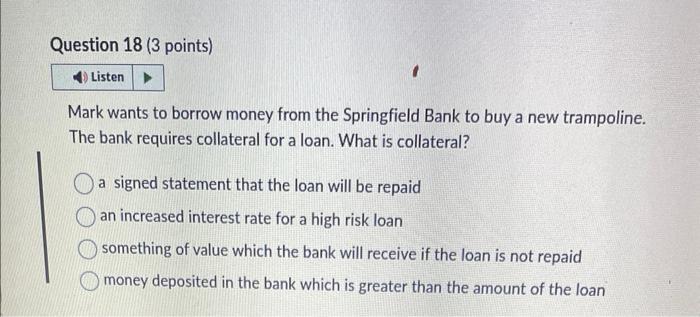

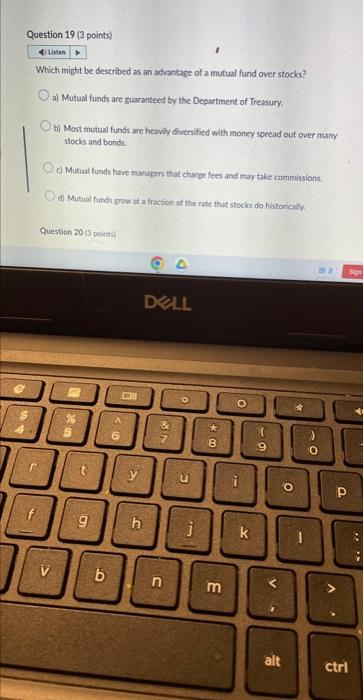

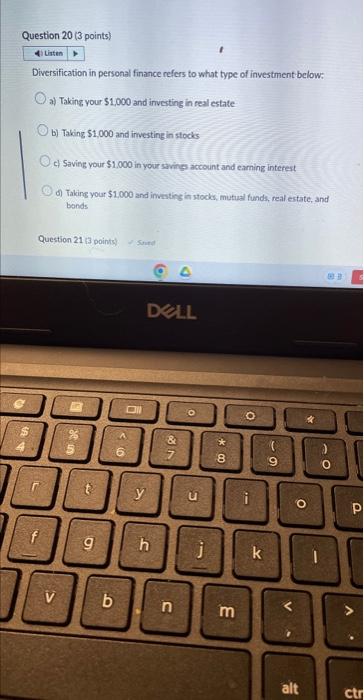

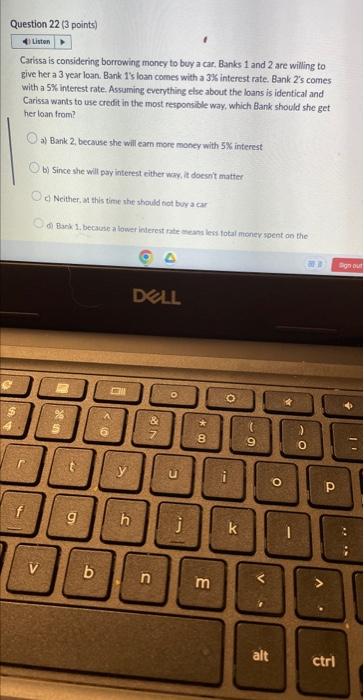

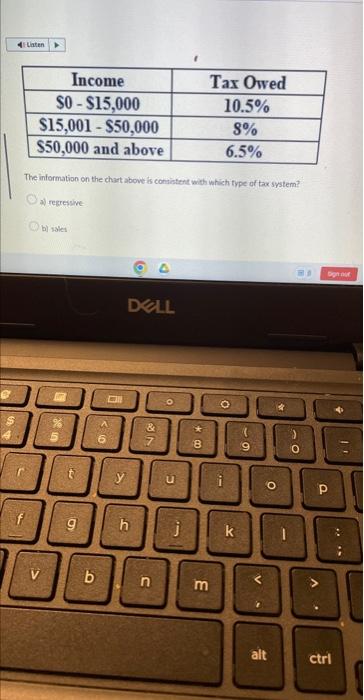

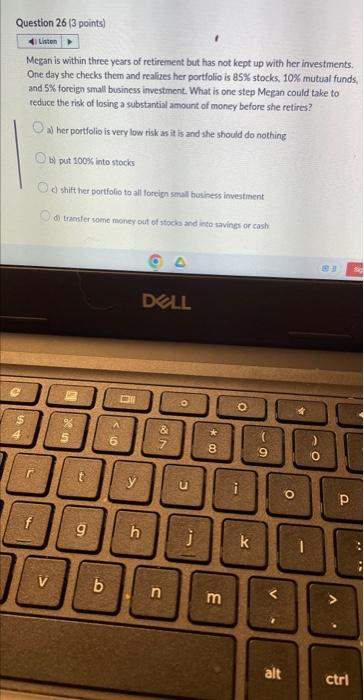

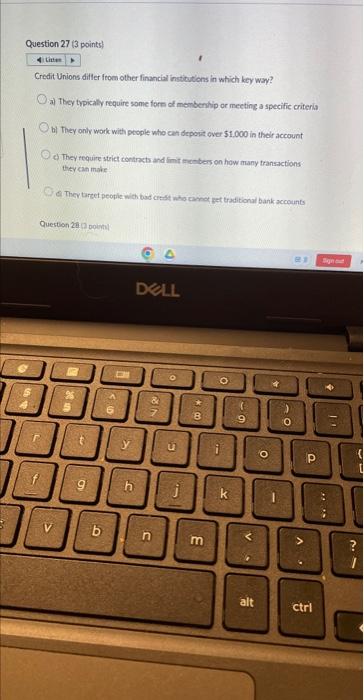

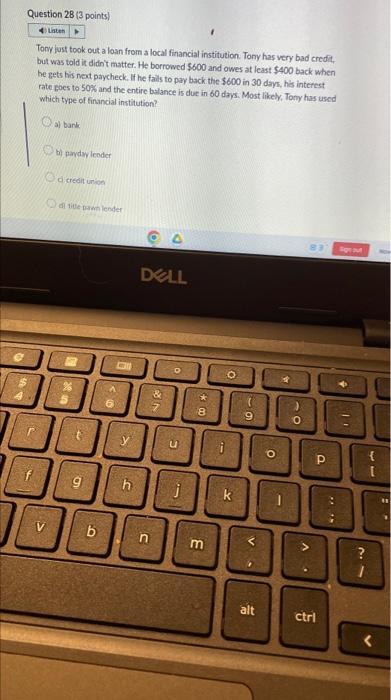

Jason gets excited when he reccives a credit ard offer in the mail. The offer reads ' $10,000 credit limit, 4.5% interest'" He goes to tell his wife that they have access to $10.000 and can carn 4.5% interest on it. Which statement is true regarding this situation? a) Jason is incorrect and will be charged 4.5% interest if he uses the card b) Jason is incorrect, only be can earn interest on the credit card c) Jason is correct and should use the credit card d) Joson is partially correct, but will only earn the interert it he uses att of the money Laura wishes to take a vacation in a few months that costs more than her monthly paycheck will allow. What would be the safest way to get the money for her trip? a) charse the trip on her credit eard and then pay it back over the next several years b) take more money out of her check and have it directly deposited into a 401K c) invest a large amount of moner in young companies on the stock market d) start immediately putting a portion of the money in an interest eaming sovings account Al other things equal, which bank should a person set their credit ard from if they plan to pay off their balance at the end of every month? a) B b) D c) A d C A regressive income tax would tax people at a rate as their income Which two words complete this sentence in order? a) higher, increased b) lower, increased c) lower, decreased d) constant, decreased Which factor is least likely to affect whether or not someone gets credit? a) regular income source b) ownership of a car c) payment history d) current credit score Mark wants to borrow money from the Springfield Bank to buy a new trampoline. The bank requires collateral for a loan. What is collateral? a signed statement that the loan will be repaid an increased interest rate for a high risk loan something of value which the bank will receive if the loan is not repaid money deposited in the bank which is greater than the amount of the loan Which might be deseribed as an acvantage of a mutual fund over stocks? a) Mutual funds are guaranteed by the Department of Treasury. b) Most mutual funds are heavily diversified with money spread out over many stocks and bonds. c) Mutul funds have manaeen that charge fees and may take commissions. d) Mutiai funds grow at a traction of the rate thut stocks do histonically. Question 20.3 points: Diversification in personal finance refers to what type of investment below: a) Taking your $1,000 and investing in real estate b) Taking $1,000 and investing in stocks ct Saving your $1,000 in your sevings account and eaming intefest d) Taking your $1.000 and imesting it stock, mutual funds, real estate, and bands Carissa is considering borrowing moncy to bey a car, Banks 1 and 2 are willing to give her a 3 year loan. Bank 1 's loan comes with a 3\% interest rate. Bank 2's comes with a 5% interest rate. Assuming everything else about the loans is identical and Carissa wants to use credit in the most responsible way, which Bank should she get her loan from? a) Bank 2, because she will earn more money with 5% interest b) Since she will pay interest either way, it doesst matter c) Neither, a this time the should not bur a car di Dank 1, because a fower insterest nte teand less fotal monev spent on the The information on the chart above is contistent with which type of tax system? a) regressive. b) 1skes Megan is within three years of retirement but has not kept up with her investments. One day she checks them and realizes her portfolio is 85% stocks, 10% mutual funds, and 5% forcign small business investment. What is one step Mepan could take to reduce the risk of losing a substantial amount of money before she retires? a) her pontfolio is very low risk as it is and she should do nothing b) put 100% intostocks c) shift her portfolio to all foreien small business investment di) trassfer roent money out of stochs and irto aviner or cash Credit Unions differ from other financial institutions in which bey way? a) They typically require some fore of memberhip or meeting a specific criteris bi They only work with pesple who can depoiz over $1.000 in their account d. They require striet controct and limit menters on how many transactions they can make Ther tareet peotile with bad crast who careo zet traditional bank accounts Tony just took out a loan from a local financial institution. Tony has very bad credi, but was told it didn't matter. He borrowed $600 and owes at least $400 back when he gets his next paycheck. If he fails to pay back the $600 in 30 dayn, his interest rate foes to 50% and the entire bulance is duc in 60 days. Most likely, Tomy has used which type of finsincial institution? 3) bant b) parity leoder di creait uniod di tite pasmiender