Answered step by step

Verified Expert Solution

Question

1 Approved Answer

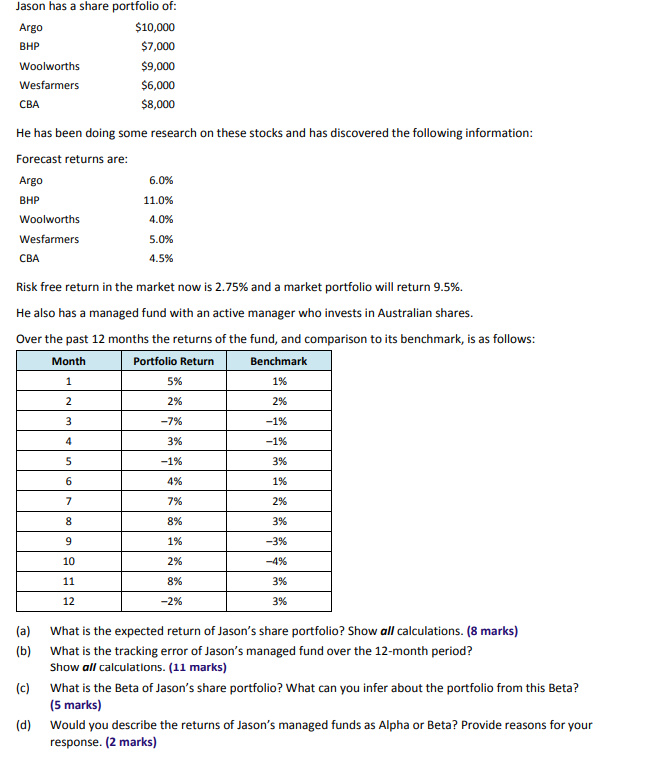

Jason has a share portfolio of: Argo BHP Woolworths Wesfarmers CBA He has been doing some research on these stocks and has discovered the

Jason has a share portfolio of: Argo BHP Woolworths Wesfarmers CBA He has been doing some research on these stocks and has discovered the following information: Forecast returns are: Argo BHP (a) (b) $10,000 $7,000 (c) Woolworths Wesfarmers CBA Risk free return in the market now is 2.75% and a market portfolio will return 9.5%. He also has a managed fund with an active manager who invests in Australian shares. Over the past 12 months the returns of the fund, and comparison to its benchmark, is as follows: Month Portfolio Return 1 2 3 4 5 6 7 8 9 10 11 12 $9,000 $6,000 $8,000 6.0% 11.0% 4.0% 5.0% 4.5% 5% 2% -7% 3% -1% 4% 7% 8% 1% 2% 8% -2% Benchmark 1% 2% -1% -1% 3% 1% 2% 3% -3% -4% 3% 3% What is the expected return of Jason's share portfolio? Show all calculations. (8 marks) What is the tracking error of Jason's managed fund over the 12-month period? Show all calculations. (11 marks) What is the Beta of Jason's share portfolio? What can you infer about the portfolio from this Beta? (5 marks) (d) Would you describe the returns of Jason's managed funds as Alpha or Beta? Provide reasons for your response. (2 marks)

Step by Step Solution

★★★★★

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the expected return of Jasons share portfolio we need to weigh the forecast returns of each stock by their respective portfolio weights The portfolio weight is calculated by dividing th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started