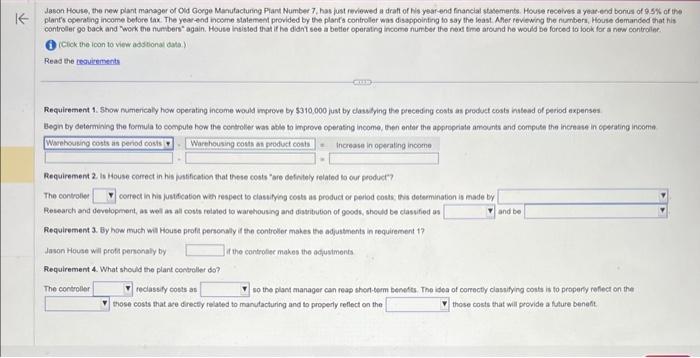

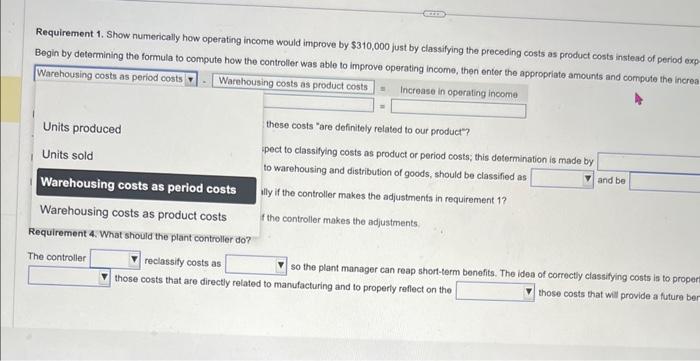

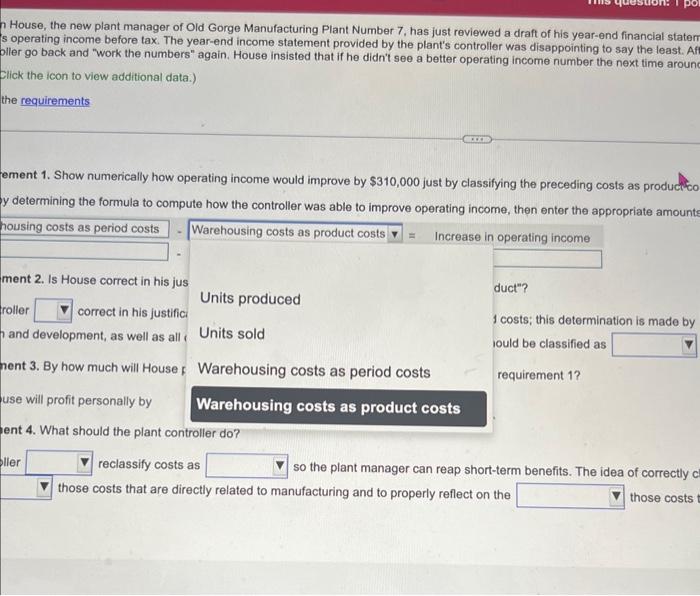

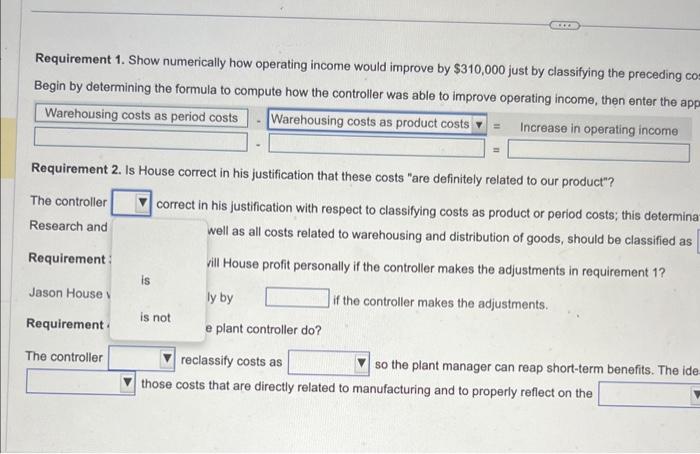

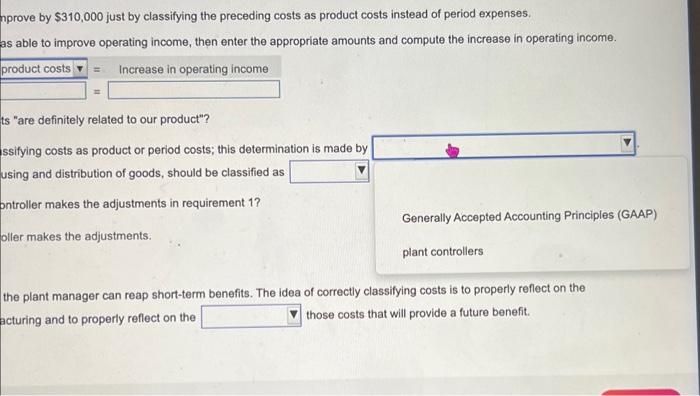

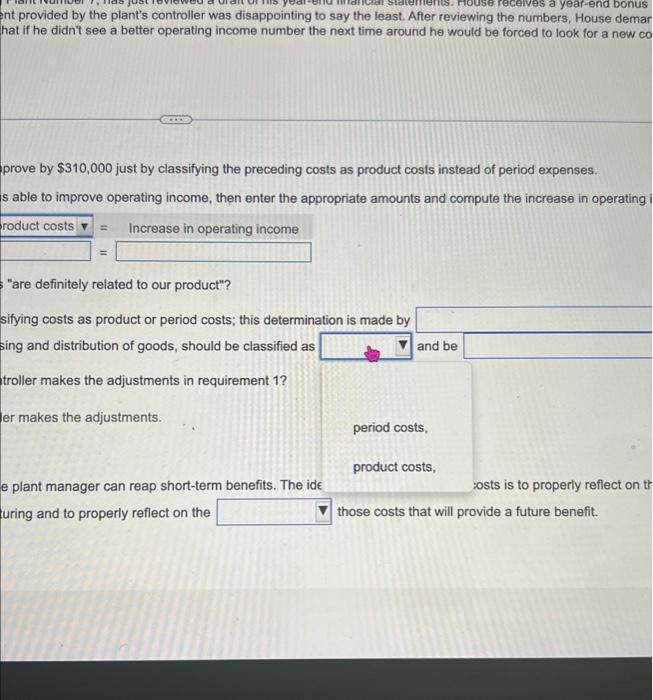

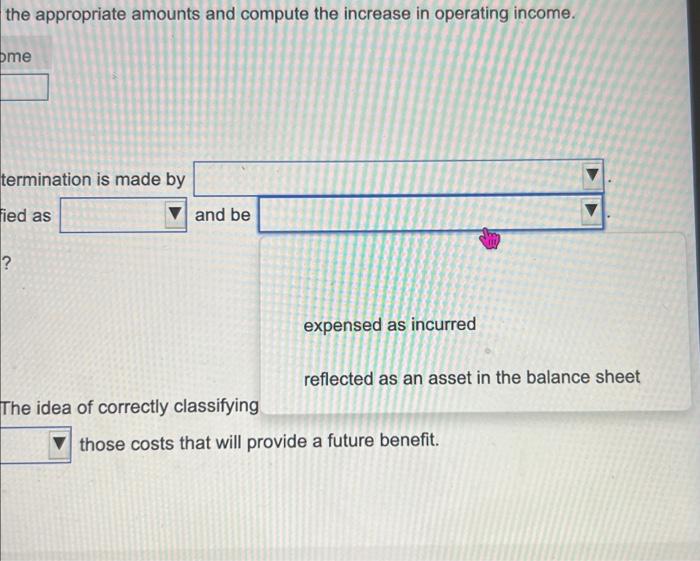

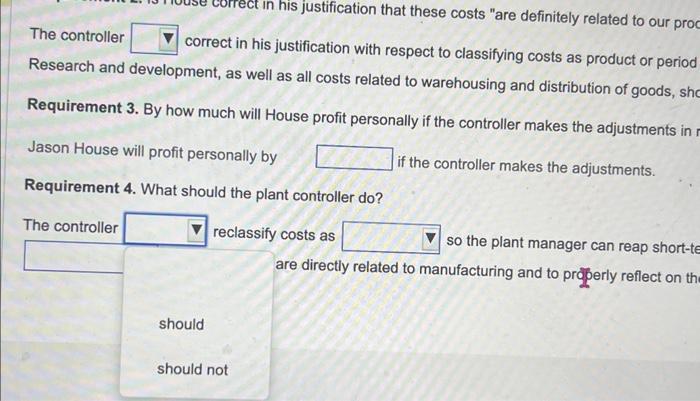

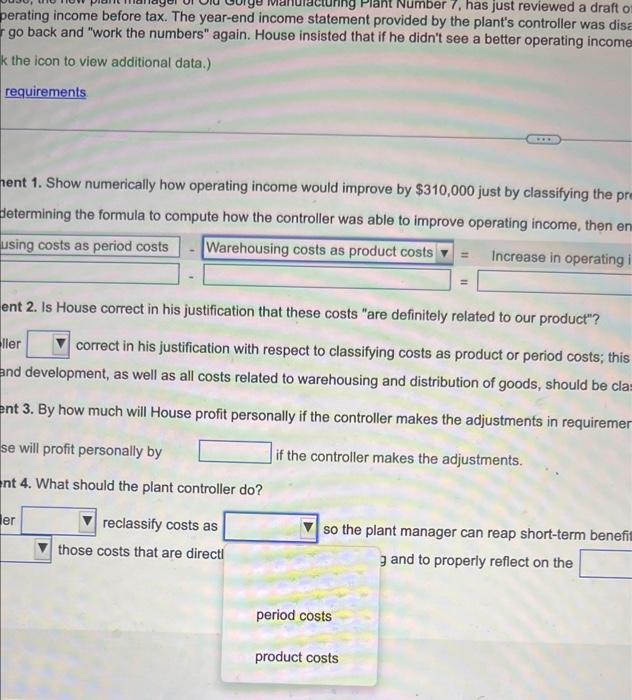

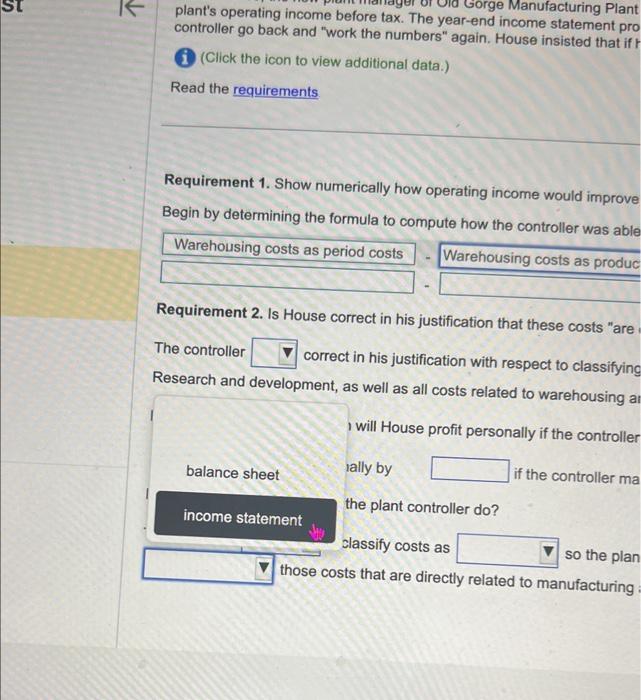

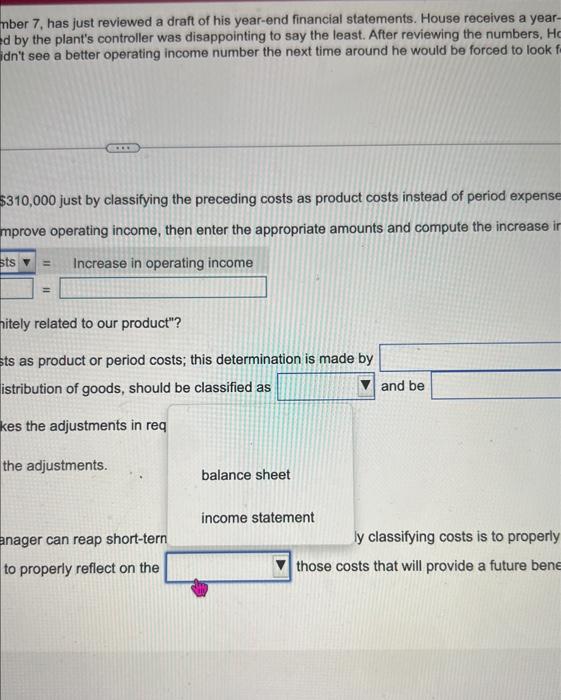

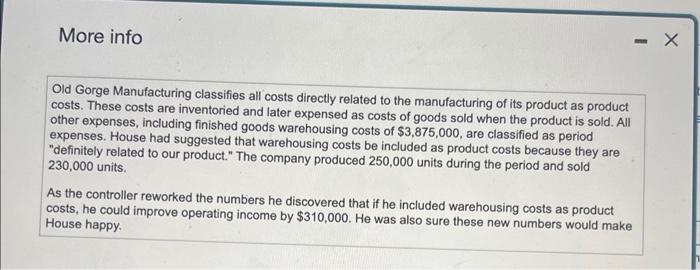

Jason House, the new plant managor or Cid Gorge Maculacturing Plant Number 7, has just reviewed a draft of Nis year-end financial stasements. House recelves a yeac-ead bonus of 9.5% of the plantc coperating income belore tax. The yearend income stalement provided by the plants controler was disappointing to say the least. Aher revicwing the numbers, House demanded that his contreler go back and work the numbers" again. House insisted that if he didnt see a beller operating income number the noat tmo around he wotid be forced to look for a new controler. icick the ioon to view adsional dala.) Read the reguirements Requirement 1. 5how fumencaly how operating income would mprove by 5310.000 just by dasitying the preceding costs as product costs intead of period axpenses Begn by determining the formula to eompute how the contoller was able to improve coerating income, then entar the approprate amounts and compute the incrase in opwating income 1=increaseinoperatingincome= Requirement 2 . Is house corect in his pustificaion that these costs "are defintely related lo our product"? The controler conect in his jusification weh respect to clasuifying costs as product or period cosks, this determination is made by Research and development, as wel as all cosh relaled to warehousing and distitubion of goods, sheuld be clasufied as Requirement 3. By how much wil Fouse profa personaly if the controller makes the adjustenents in requirement 1 ? Jason House will proft penenaly by. If the econtrofec makes the odysiments Requirement 4. What should the plant controller do? The controller teclassify costs an so the plant manager can reap shon-term benetts. The isea of correcty classifying conts is to propery reflect on the those costs that are drecty related to manutacturing and to propedy reflect on the those costs that will pronde a fulure beneft. Requirement 1. Show numerically how operating income would improve by $310,000 just by classifying the preceding costs as product costs instead of period exp Begin by determining the formula to compute how the controller was able to improve operating income, then enter the appropriate amounts and compute the increa = Increase in oporating income Units produced these costs "are definitely related to our product"? Units sold "pect to classifying costs as product or period costs; this dotermination is made by to warehousing and distribution of goods, should be classified as and be Illy if the controller makes the adjustments in requirement 1 ? Warehousing costs as product costs f the controller makes the adjustments. Requirement 4. What should the plant controller do? The controller reclassity costs as so the plant manager can reap shor-term benefits. The iden of corrocty classifying costs is to proper those costs that are directly related to manulacturing and to properly reflect on the those costs that will provide a future ber House, the new plant manager of Old Gorge Manufacturing Plant Number 7, has just reviewed a draft of his year-end financial stater 5 operating income before tax. The year-end income statement provided by the plant's controller was disappointing to say the least. Aft piler go back and "work the numbers" again. House insisted that if he didn't see a better operating income number the next time around Click the icon to view additional data.) the requirements ement 1. Show numerically how operating income would improve by $310,000 just by classifying the preceding costs as producifco y determining the formula to compute how the controller was able to improve operating income, then enter the appropriate amounts = Increase in operating income ment 2. Is House correct in his jus Units produced duct"? correct in his justifici 1 costs; this determination is made by and development, as well as all, Units sold lould be classified as 3. By how much will House f Warehousing costs as period costs requirement 1 ? use will profit personally by 4. What should the plant controller do? reclassify costs as so the plant manager can reap short-term benefits. The idea of correctly c those costs that are directly related to manufacturing and to properly reflect on the those costs Requirement 1. Show numerically how operating income would improve by $310,000 just by classifying the preceding co Begin by determining the formula to compute how the controller was able to improve operating income, then enter the app Requirement 2. Is House correct in his justification that these costs "are definitely related to our product"? The controller correct in his justification with respect to classifying costs as product or period costs; this determina Research and Nell as all costs related to warehousing and distribution of goods, should be classified as Requirement : fill House profit personally if the controller makes the adjustments in requirement 1? Jason House y by if the controller makes the adjustments. Requirement . plant controller do? The controller reclassify costs as so the plant manager can reap short-term benefits. The ide those costs that are directly related to manufacturing and to properly reflect on the aprove by $310,000 just by classifying the preceding costs as product costs instead of period expenses. as able to improve operating income, then enter the appropriate amounts and compute the increase in operating income. ts "are definitely related to our product"? ssifying costs as product or period costs; this determination is made by using and distribution of goods, should be classified as ontroller makes the adjustments in requirement 1 ? oller makes the adjustments. Generally Accepted Accounting Principles (GAAP) piant controllers the plant manager can reap short-term benefits. The idea of correctly classifying costs is to properly reflect on the acturing and to properly reflect on the those costs that will provide a future benefit. nt provided by the plant's controller was disappointing to say the least. After reviewing the numbers, House demar hat if he didn't see a better operating income number the next time around he would be forced to look for a new co prove by $310,000 just by classifying the preceding costs as product costs instead of period expenses. s able to improve operating income, then enter the appropriate amounts and compute the increase in operating =Increaseinoperatingincome= "are definitely related to our product"? sifying costs as product or period costs; this determination is made by sing and distribution of goods, should be classified as and be troller makes the adjustments in requirement 1 ? er makes the adjustments. period costs, product costs, e plant manager can reap short-term benefits. The ide oosts is to properly reflect on turing and to properly reflect on the those costs that will provide a future benefit. the appropriate amounts and compute the increase in operating income. ermination is made by and be expensed as incurred reflected as an asset in the balance sheet The idea of correctly classifying those costs that will provide a future benefit. The controller correct in his justification with respect to classifying costs as product or period Research and development, as well as all costs related to warehousing and distribution of goods, sh Requirement 3. By how much will House profit personally if the controller makes the adjustments in Jason House will profit personally by if the controller makes the adjustments. Requirement 4. What should the plant controller do? The controller reclassify costs as so the plant manager can reap short-te are directly related to manufacturing and to properly reflect on th should should not berating income before tax. The year-end income statement provided by the plant's controller was dis: go back and "work the numbers" again. House insisted that if he didn't see a better operating income the icon to view additional data.) requirements ient 1. Show numerically how operating income would improve by $310,000 just by classifying the pr determining the formula to compute how the controller was able to improve operating income, then er =Increaseinoperating=1 2. Is House correct in his justification that these costs "are definitely related to our product"? correct in his justification with respect to classifying costs as product or period costs; this development, as well as all costs related to warehousing and distribution of goods, should be cla 3. By how much will House profit personally if the controller makes the adjustments in requireme se will profit personally by if the controller makes the adjustments. nt 4. What should the plant controller do? reclassify costs as so the plant manager can reap short-term benefi those costs that are directl and to properly reflect on the period costs product costs plant's operating income before tax. The year-end income statement pro controller go back and "work the numbers" again. House insisted that if r (Click the icon to view additional data.) Read the requirements. Requirement 1. Show numerically how operating income would improve Begin by determining the formula to compute how the controllar was ali- Requirement 2. Is House correct in his justification that these costs "are The controller correct in his justification with respect to classifying Research and development, as well as all costs related to warehousing a will House profit personally if the controller rally by if the controller ma the plant controller do? classify costs as so the plan those costs that are directly related to manufacturing mber 7, has just reviewed a draft of his year-end financial statements. House receives a year d by the plant's controller was disappointing to say the least. After reviewing the numbers, H dn't see a better operating income number the next time around he would be forced to look $310,000 just by classifying the preceding costs as product costs instead of period expense mprove operating income, then enter the appropriate amounts and compute the increase = Increase in operating income = hitely related to our product"? sts as product or period costs; this determination is made by istribution of goods, should be classified as and be kes the adjustments in req the adjustments. balance sheet income statement ly classifying costs is to properly to properly reflect on the those costs that will provide a future bene More info Old Gorge Manufacturing classifies all costs directly related to the manufacturing of its product as product costs. These costs are inventoried and later expensed as costs of goods sold when the product is sold. All other expenses, including finished goods warehousing costs of $3,875,000, are classified as period expenses. House had suggested that warehousing costs be included as product costs because they are "definitely related to our product." The company produced 250,000 units during the period and sold 230,000 units. As the controller reworked the numbers he discovered that if he included warehousing costs as product costs, he could improve operating income by $310,000. He was also sure these new numbers would make House happy