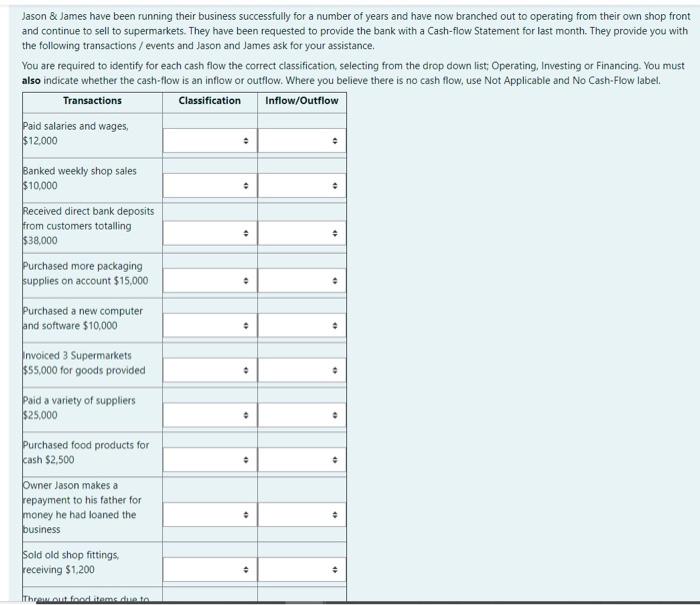

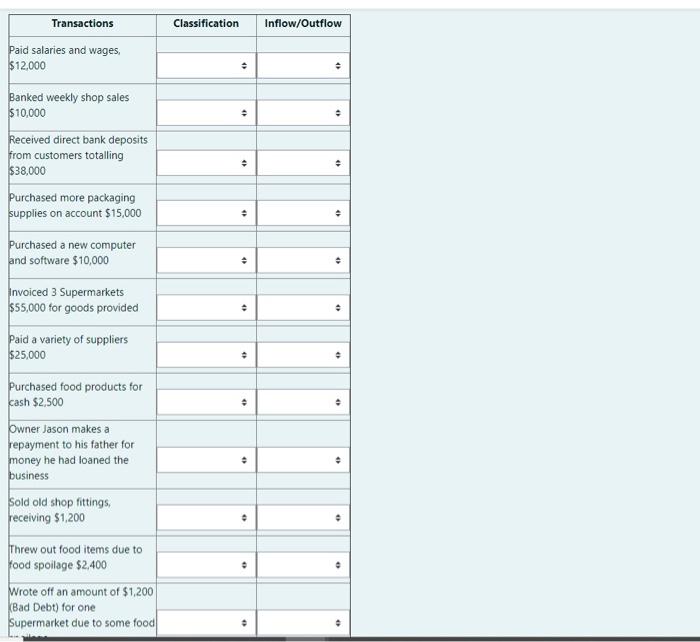

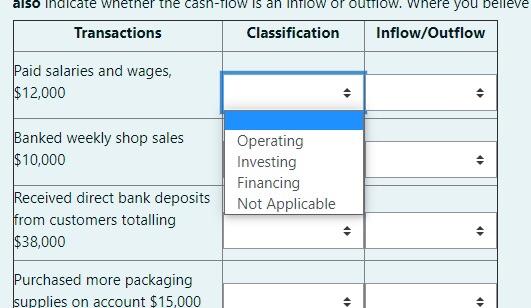

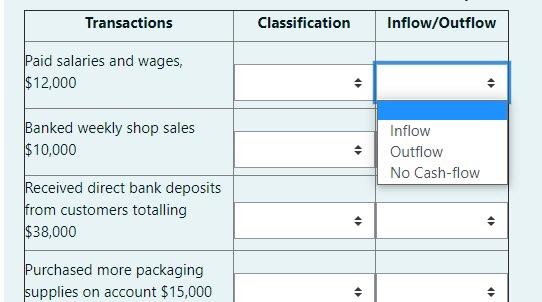

Jason & James have been running their business successfully for a number of years and have now branched out to operating from their own shop front and continue to sell to supermarkets. They have been requested to provide the bank with a Cash-flow Statement for last month. They provide you with the following transactions / events and Jason and James ask for your assistance. You are required to identify for each cash flow the correct classification, selecting from the drop down list: Operating, Investing or Financing. You must also indicate whether the cash-flow is an inflow or outflow. Where you believe there is no cash flow, use Not Applicable and No Cash-Flow label. Transactions Classification Inflow/Outflow Paid salaries and wages, $12,000 . Banked weekly shop sales $10,000 Received direct bank deposits from customers totalling $38,000 Purchased more packaging supplies on account $15,000 Purchased a new computer and software $10,000 nvoiced 3 Supermarkets $55,000 for goods provided . : 1) . paid a variety of suppliers $25,000 . . . Purchased food products for cash $2,500 Owner Jason makes a repayment to his father for money he had loaned the business . Sold old shop fittings receiving $1,200 Ithout foodtrome dhe te $25,000 . Purchased food products for cash $2,500 Owner Jason makes a repayment to his father for money he had loaned the business Sold old shop fittings receiving $1,200 . . . . + Threw out food items due to food spoilage $2,400 Wrote off an amount of $1,200 (Bad Debt) for one Supermarket due to some food spoilage Received $20,000 from Josie to join the business as another owner Paid for electricity, gas and water $1,500 owing from last month Grocery and Packaging supplies used for the period $48,000 . 4 . Shop sales banked $18,000 : Paid yearly insurance S4,480 . Recorded depreciation of $6,000 on shop fittings and cooking equipment > also indicate whether the cash-TIOW is an Intiow or OutTIOW. Wn re you believe Transactions Classification Inflow/Outflow Paid salaries and wages, $12,000 Banked weekly shop sales $10,000 Operating Investing Financing Not Applicable Received direct bank deposits from customers totalling $38,000 Purchased more packaging supplies on account $15,000 . Transactions Classification Inflow/Outflow Paid salaries and wages, $12,000 Banked weekly shop sales $10,000 > Inflow Outflow No Cash-flow Received direct bank deposits from customers totalling $38,000 1 Purchased more packaging supplies on account $15,000 >