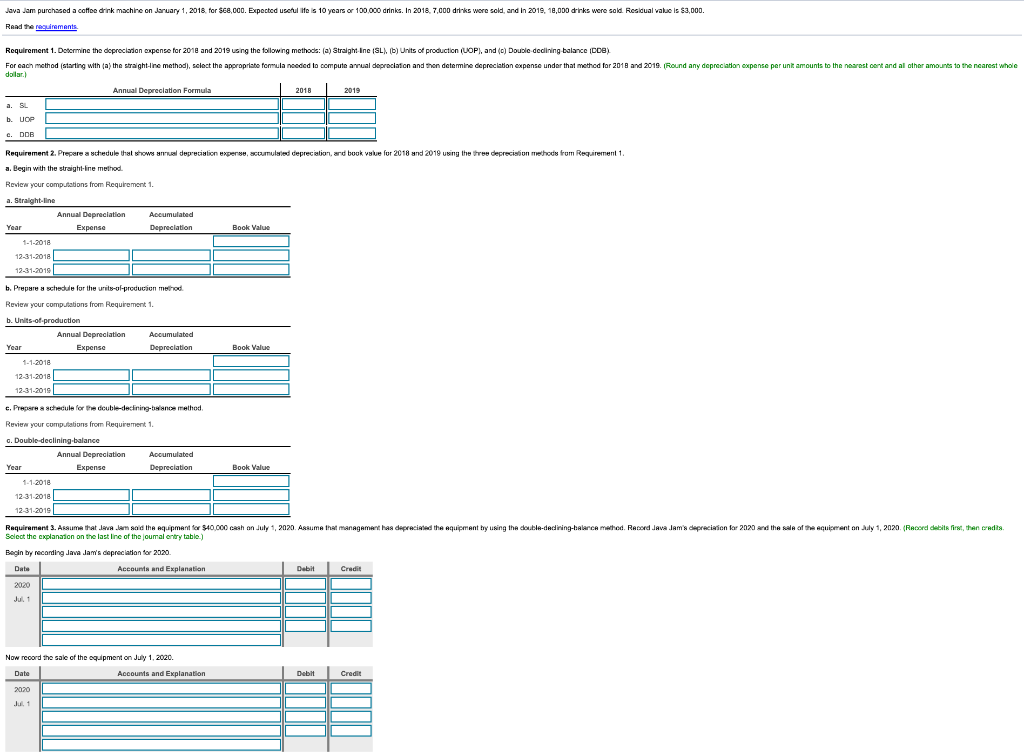

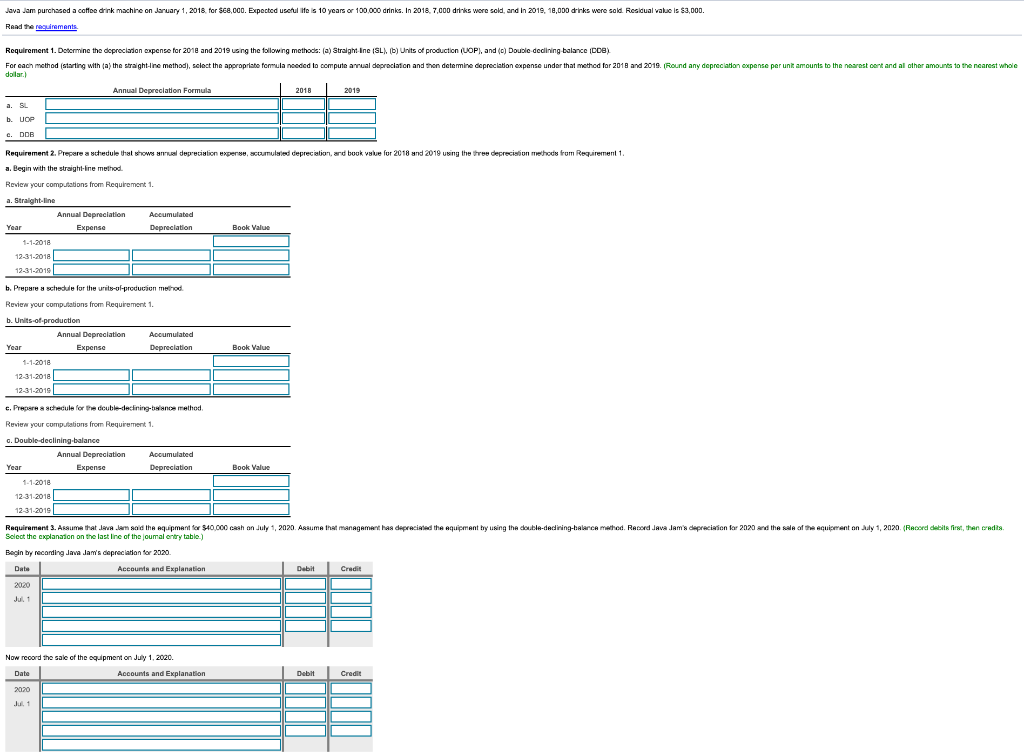

Java Jam purchased a coffee drink machine on January 1, 2018 for $68,000. Expected useful life is 10 years or 100.000 drinks. In 2018, 7,000 drinks were sold, and in 2019, 18,000 drinks were sold Residual value is $3,000. Read the resinaments Requirement 1. Determine the depreciation capense for 2018 and 2019 using the following methods: (a) Straight Ine ISL) (b) Units of production (UOP)and (c) Double-declining balance DDB) For each method (starting with (a) the straight-line method), select the appropriate formula nooded to compute anual depreciation and then determine depreciation expense under that method for 2018 and 2019. (Round any depreciation expense per unit amounts to the nearest cent and all other amounts to the nearest whole dollar) Annual Depreciation Formula 2018 2019 a. SL b. Do e DDR Requirement 2. Prepare a schedule that shows anual depreciation expense, sumulated depreciation, and book value for 2018 and 2019 using the tree deprecision methods from Requirement 1. a. Begin with the straight-line method. Review your computations from Requirement 1. a. Straight-line Annual Depreciation Accumulated Year Expense Depreciation Book Value 1-1-2018 12-31-2018 12-31-2018 b. Prepare a schedule for the units-of-production method Review your computations from Requirement 1. b. Units of production Annual Depreciation Year Expense 1-1-2018 Accumulated Depreciation Book Value 12-31-2018 12-31-2010 c. Prepare a schedule for the double-declining-sance method Review your computations from Requirement 1. G. Double-declining balance Annual Depreciation Accumulated Year Expense Depreciation 1-1-2018 12-31-2018 Book Value 12-31-2019 Requirement 3. Assume that love.am said the equipment for $40.000 cash on July 1, 2020. Assume that management has depreciated the equipment by using the double-dedining-balance method. Record Javalams depreciation for 2020 and the sale of the Aquirant en Adly 1, 2020. (Racord debits first, then credits 1dawa , than . Select the explanation on the last line of the oumal entry table.) Begin by recording Java Jan's depreciation for 2020 Accounts and explanation Debilt Credit 2020 Jul 1 Now record the sale of the equipment on July 1, 2020 Date Accounts and Explanation Debilt Credit 2020 J1