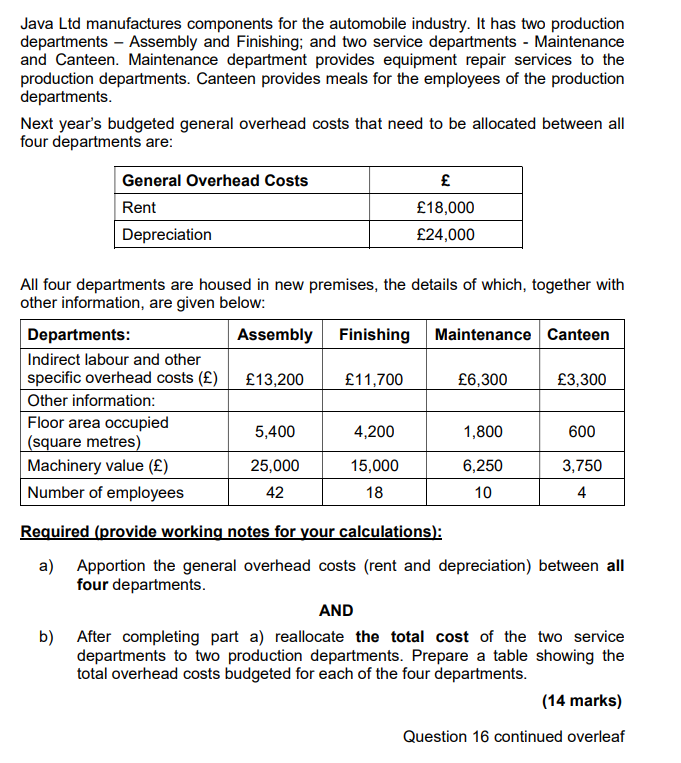

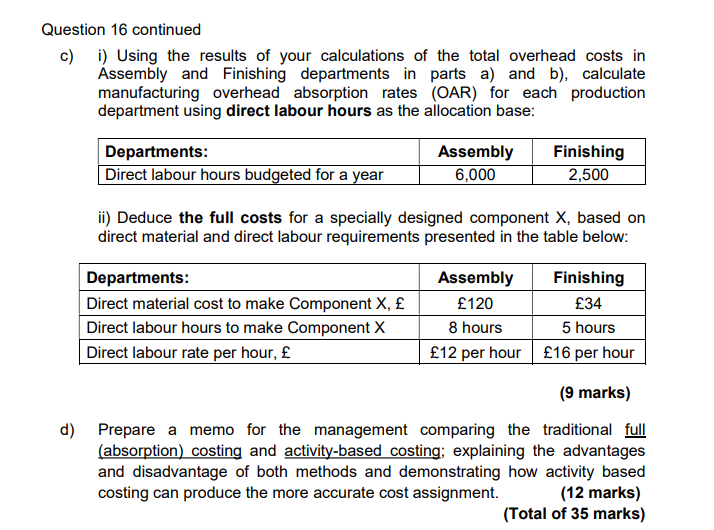

Java Lid manufactures components for the automobile industry. It has two production departments - Assembly and Finishing; and two service departments - Maintenance and Canteen. Maintenance department provides equipment repair services to the production departments. Canteen provides meals for the employees of the production departments. Next year's budgeted general overhead costs that need to be allocated between all four departments are: General Overhead Costs E Rent E18,000 Depreciation E24,000 All four departments are housed in new premises, the details of which, together with other information, are given below: Departments: Assembly Finishing Maintenance Canteen Indirect labour and other specific overhead costs (E) E13,200 E11,700 E6,300 E3,300 Other information: Floor area occupied 5,400 4,200 1,800 600 (square metres Machinery value (E) 25,000 15,000 6,250 3,750 Number of employees 42 18 10 4 Required (provide working notes for your calculations): a) Apportion the general overhead costs (rent and depreciation) between all four departments. AND b) After completing part a) reallocate the total cost of the two service departments to two production departments. Prepare a table showing the total overhead costs budgeted for each of the four departments. (14 marks) Question 16 continued overleafQuestion 16 continued c) i) Using the results of your calculations of the total overhead costs in Assembly and Finishing departments in parts a) and b), calculate manufacturing overhead absorption rates (OAR) for each production department using direct labour hours as the allocation base: Departments: Assembly Finishing Direct labour hours budgeted for a year 6,000 2,500 i) Deduce the full costs for a specially designed component X, based on direct material and direct labour requirements presented in the table below: Departments: Assembly Finishing Direct material cost to make Component X, E E120 E34 Direct labour hours to make Component X 8 hours 5 hours Direct labour rate per hour, f E12 per hour f16 per hour (9 marks) d) Prepare a memo for the management comparing the traditional full (absorption)_costing and activity-based costing; explaining the advantages and disadvantage of both methods and demonstrating how activity based costing can produce the more accurate cost assignment. (12 marks) (Total of 35 marks)